GBP/EUR Rate Tests 1.15, EU and UK Agree to Restart Northern Ireland Talks

- Written by: Gary Howes

Above: File image of James Cleverly, Picture by Simon Dawson / No 10 Downing Street.

The UK and EU have struck a notably more conciliatory tone over the issue of Northern Ireland in a development that analysts say improves the outlook for the British Pound, and the Pound to Euro exchange rate more specifically.

UK and EU officials have this week committed to resolve the impasse over the Northern Ireland Protocol, promising to remove a long-standing source of uncertainty in relations between the UK and its largest trading partner.

European Commission spokesman Daniel Ferrie said the two sides will meet this week for technical level talks, adding the EU will approach them "constructively" and it remains "committed to finding joint solutions".

The move comes after UK Foreign Secretary James Cleverly held talks with his EU counterpart Maroš Šefčovič on Friday afternoon.

It also follows a notably conciliatory shift in tone from the UK.

Steve Baker, an MP who has traditionally been 'hawkish' on Brexit, said he was sorry over behaviour towards Ireland during Brexit talks.

He said he and others on the UK side did not "always behave in a way which encouraged Ireland and the European Union to trust us to accept that they have legitimate interests".

"I am sorry about that," said Baker, who is now the Northern Ireland minister, adding, "relations with Ireland are not where they should be and we all need to work extremely hard to improve them".

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Questioned about the comments, Ferrie said, "we stand ready, we have been standing ready for a long time now to find those solutions, to negotiate, that's all I can say."

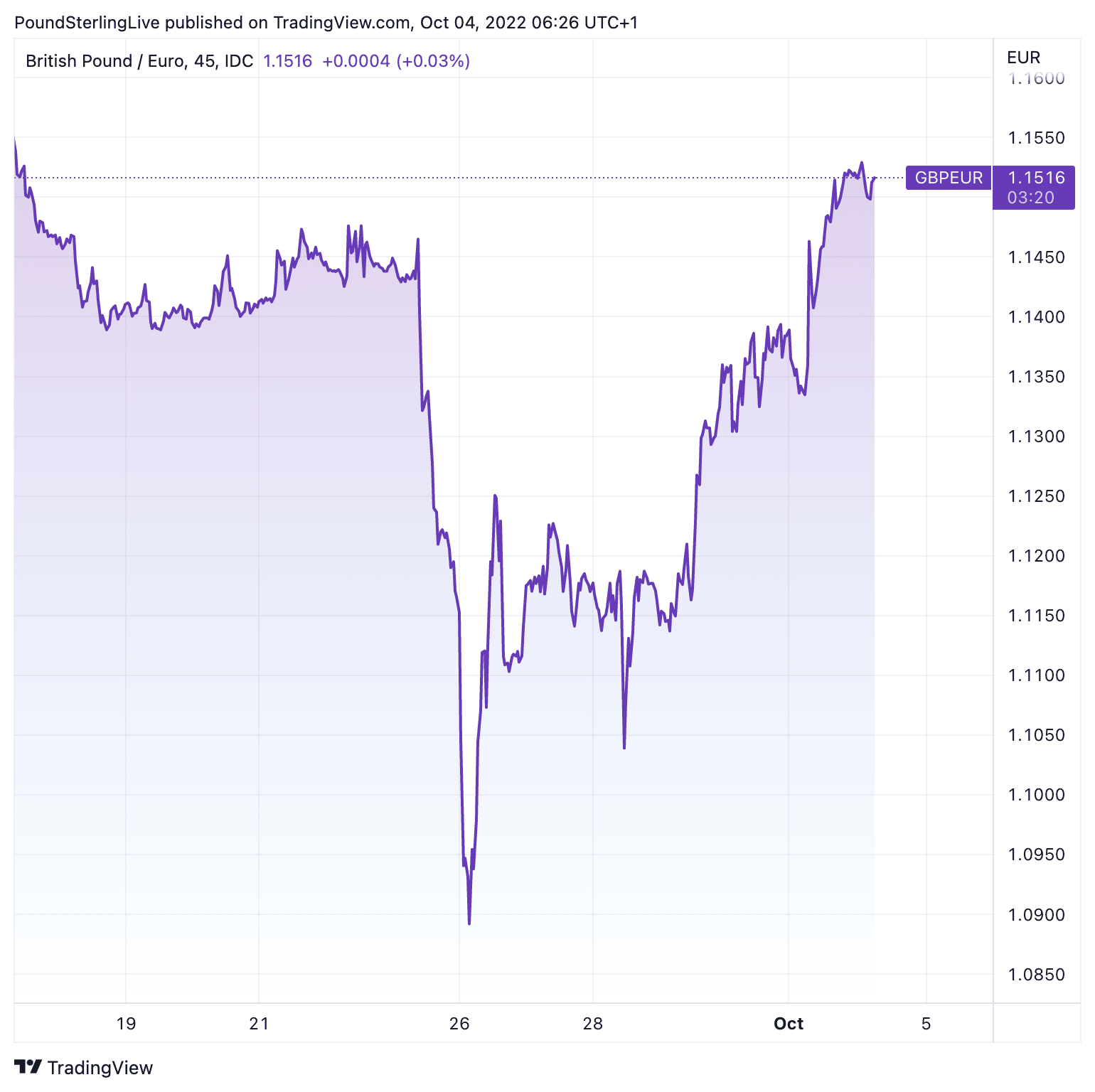

News of the restart of talks, and the more cordial atmosphere, helped a broader rebound in the Pound at the start of the week.

The Pound to Euro exchange rate was higher by a percent in hours following news talks would restarting, hitting its highest level in a week at 1.1480.

Above: GBP/EUR at 45 minute intervals. Set your free FX rate alert here.

Analysts have said uncertainty over the status of the Northern Ireland protocol has been a major lingering concern hanging over the British Pound's outlook.

"Until a solution is reached, there is very little likelihood of UK-EU trading relations improving from where they stand currently," says Jordan Rochester, a currency strategist with Nomura, who maintains a committed bearish stance on the Pound.

The UK and EU have been at odds over the full implementation of the NI protocol, with the UK saying it has effectively created a customs border between Northern Ireland and the rest of the UK, something which they said was never supposed to happen.

As a result, the UK said it would invoke Article 16 of the Northern Ireland protocol, allowing it to override aspects of the treaty to facilitate trade within the borders of the UK.

"To us, the real risk of an idiosyncratic GBP shock lies elsewhere. Although there are no early signals of this nature, the new administration’s stance on EU relationships carries the clear risk of a triggering of Article 16 of the Northern Ireland Protocol," says analyst Themistoklis Fiotakis at Barclays.

"The EU could, in this case, retaliate by imposing tariffs on UK imports or suspending the Trade and Cooperation Agreement. Falling back to WTO rules could mean a 4-5% GBP depreciation against the EUR," adds Fiotakis.

Further talks could result in necessary modifications to the protocol, or at least interpretations to the original text, that could ultimately settle the issue.

Kamal Sharma, another devout Sterling bear, is forecasting ongoing material weakness in the Pound, in part owing to Brexit and tensions between the EU and UK over Northern Ireland.

Writing in a recent note to clients Sharma says the Truss government is likely to engage an "increasingly confrontational approach to relations with the EU over the Northern Ireland Protocol and the fallout from Brexit".

"We continue to maintain a bearish view on GBP and look for GBP/USD to breach 1.10 and EUR/GBP through 0.90. In our view, the risks are rising for a more disorderly unravelling unless the market can be convinced that the UK has a credible plan to tackle the large structural imbalance," he says.

However, the charm offensive by Baker and Cleverly suggest the government is taking the opposite approach, recognising Brexit has fallen down the list of concerns of the British public and there is little positive political return from stoking further uncertainty.

Indeed, for a government that has put economic growth as its priority pragmatism would suggest the benefits of striking a deal with the EU are non neglible.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes