Euro Rebounds as Eurozone GDP Beats Expectations

- Written by: Gary Howes

Image © Adobe Stock

Euro exchange rates were higher on the final trading day of July, boosted by above-consensus inflation and GDP data.

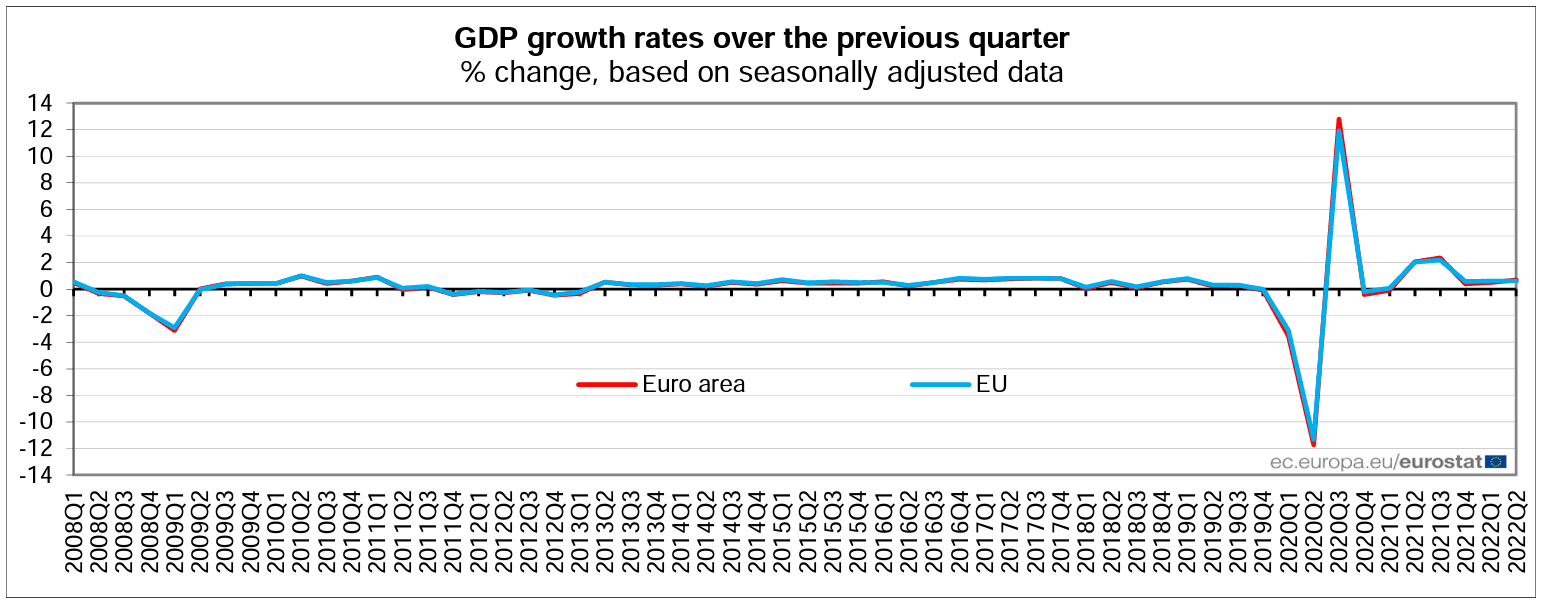

Data from Eurostat showed Eurozone GDP rose 0.7% quarter-on-quarter in the second quarter of 2022, beating the expectations for 0.2% and improving on the first quarter growth figure of 0.6%.

GDP grew GDP 4.0% in the year to the end of the second quarter, beating expectations for 3.4% and down on the first quarter's 5.4% annual growth.

"Italy, France and Spain grew sizeably thanks to tourism," says economist Ludovico Sapio at Barclays.

Eurozone CPI inflation meanwhile rose 0.1% month-on-month in July, beating expectations for a decline of -0.1%, which is a cooling from the previous month's 0.8% rise. The annual inflation rate stood at 8.9% in July, higher than expectations for 8.6%.

The data is consistent with the European Central Bank's desire to normalise interest rates and will keep alive expectations for a second consecutive 50 basis point hike in September.

The GDP data is particularly supportive of the Euro given the increase in negative sentiment towards the Eurozone and rising expectations for a recession owing to surging gas prices.

The Euro to Dollar exchange rate was seen higher by 0.35% ahead of the weekend at 1.0227 while the Euro to Pound exchange rate was higher by half a percent at 0.8409.

Looking at the GDP data, the upside surprises were driven by Spain (+1% quarter-on-quarter), Italy (+1%) and France (+0.5%).

Germany disappointed by registering no growth.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Paolo Pizzoli, Senior Economist for Italy and Greece says tourism and inventory accumulation was possibly at the heart of the upside surprise in the Italian figures, but looking forward he doesn't believe that the growth rate seen in the second quarter can be repeated in the third.

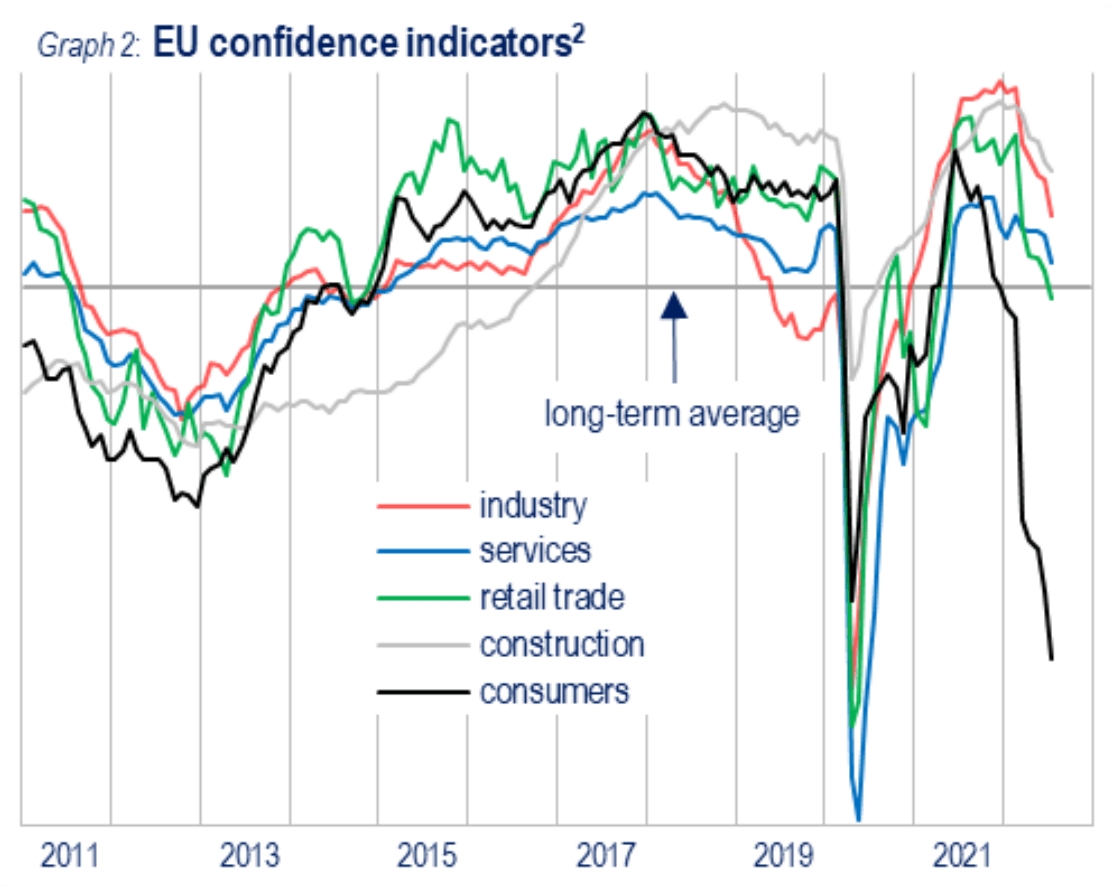

"Confidence indicators headed south in July, with exceptions only in the construction and retail sectors. The impact of inflation on disposable income will compound, with uncertainty originating from the government crisis possibly adding some prudence in consumption and investment behaviour," says Pizzoli.

Economists at Barclays are meanwhile predicting a soft third quarter for the broader Eurozone.

"Looking ahead, we forecast the euro area in recession by the turn of the year," says Sapio. "Soft indicators show recessionary momentum already at the start of Q3."

Above: EU confidence levels are crashing at the start of the third quarter. Image source: EU Commission.

He says July consumer surveys warn that the surge in the cost of living is denting their financial situations and curbing their spending decisions.

The GDP for the second quarter therefore offers Euro exchange rates a bout of relief and the opportunity for traders to book profits ahead of the new month.

But the sober outlook and ongoing gas supply issues will likely remain the overarching narrative undermining the Eurozone's single currency.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes