July ECB Decision Preview

- Written by: Gary Howes

- 50bp ECB rate hike likely

- 25bp hike could spark EUR selloff

- Details of anti-fragmentation tool expected

- This could be the day's most important development

Above: File image of ECB President Christine Lagarde. Image: © European Union, reproduced under CC licensing.

UPDATE: ECB hikes 50bp and announces a new stability mechanism that appears to have been broadly welcomed by the market. The Euro is higher as a result, full coverage here.

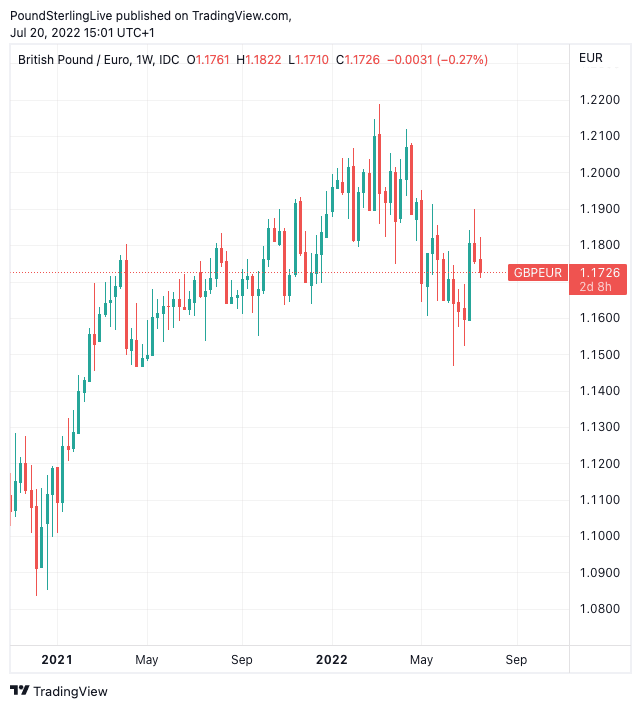

The Pound to Euro exchange rate has retreated over the course of the past week but Thursday's crucial European Central Bank policy decision on interest rates could allow for a recovery.

Heading into the watermark decision, that should bring an end to negative interest rates in the Eurozone, the Euro is up 0.80% against the Pound and 1.75% against the U.S. Dollar over the course of the past week.

Gains were largely the result of easing fears of a complete shut off in Russian gas supplies and a report out earlier in the week that the European Central Bank could go with a 50 basis point rate hike this Thursday.

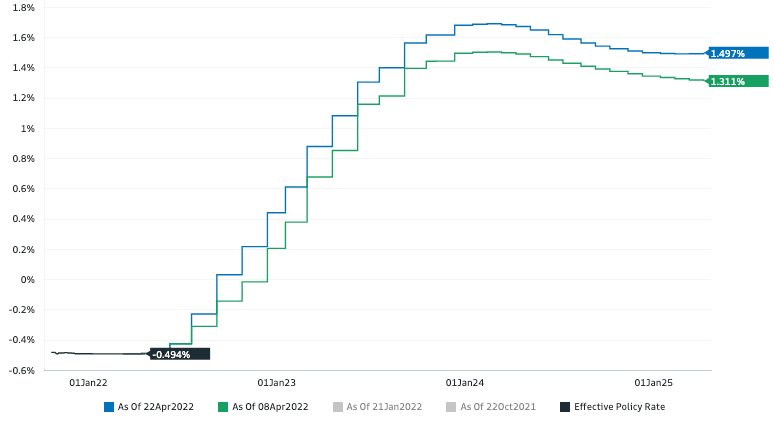

A 50bp hike would now be an unsurprising decision for investors and will therefore have limited impact on the single currency. Therefore the initial risk to Euro exchange rates is that the anonymous reports hinting at a 50bp hike are false and this week's gains are ultimately returned.

"Some disappointment will likely emerge if the ECB hikes by only 25bp, which remains our expectation," says Roberto Mialich, FX Strategist at UniCredit Bank.

Ahead of the decision the Pound to Euro exchange rate is quoted at 1.1726, with bank accounts quoting levels at around 1.1490 for euro payments and FX specialists quoting 1.1690.

Above: GBP/EUR at weekly intervals showing trade since 2021.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Volatility might not result from the interest rate decision that has been signalled well in advance, instead it is the details of the ECB's anti-fragmentation tool that will really matter.

"Pre-announced ECB rate hike itself is unlikely to support the EUR, with focus instead on anti-fragmentation tool details," says Marek Raczko, an analyst at Barclays.

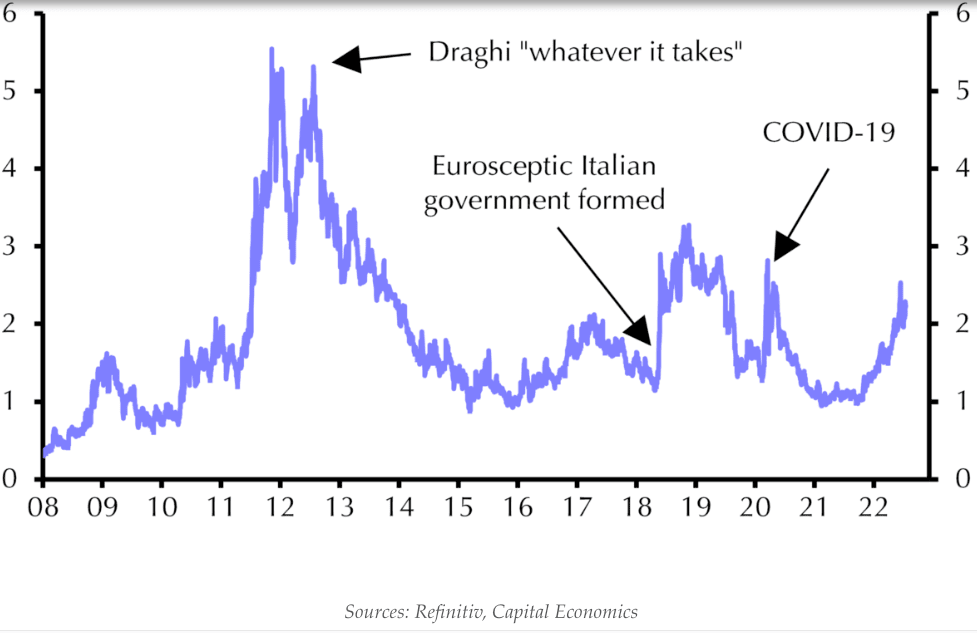

The tool is the ECB's attempt to ensure the cost of servicing debt in some EU countries - most notably Italy - do not rise too rapidly.

There is a concern that by raising interest rates the cost of debt paid by various Eurozone countries will start to rise.

But higher debt repayments could mean some of the weaker Eurozone countries run into trouble, causing a fragmentation of the Eurozone which is ultimately a threat to the single currency itself.

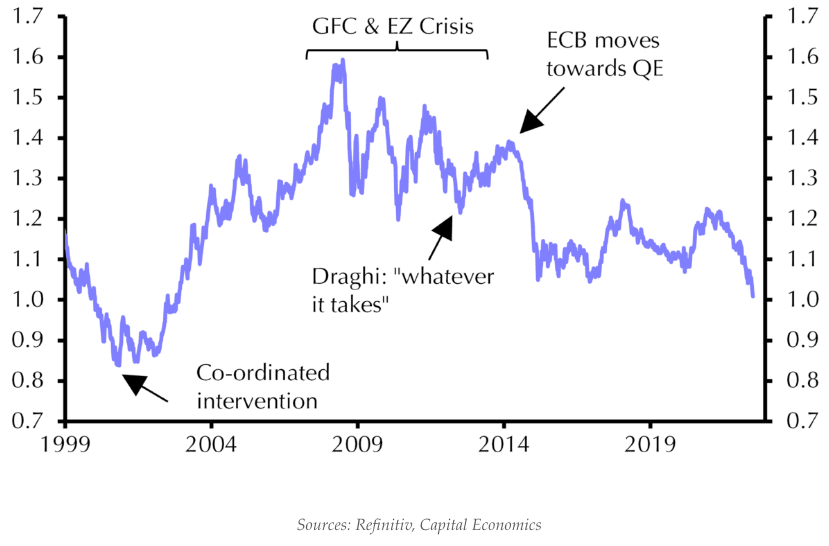

"Ten years after Draghi’s pledge to do whatever it takes, Christine Lagarde risks repeating history. She must avoid drifting into another crisis that would ultimately require her to make a similar pledge to her predecessor," says Neil Shearing, Group Chief Economist, Capital Economics.

Above: ECB Deposit Rate expectations. Image courtesy of Goldman Sachs.

The broad expectation is that the ECB will simply buy the debt (sovereign bonds) of distressed countries, thereby capping their yield and ensuring costs remain contained.

But this form of quantitative easing is at odds with the ECB's desire to end quantitative easing altogether and raise interest rates in order to ensure inflation starts coming down.

The answer therefore would to be to buy specific bonds but suck liquidity out of the system elsewhere in a 'sterilisation' operation: this is the tricky bit and where nuances lie.

"We think the ECB will be deliberately vague by avoiding specific targets for yields or spreads," says Stephen Gallo, European Head of FX Strategy, BMO Capital, a lack of detail could still be interpreted negatively by the FX market."

The risk for the Euro is that any vagueness is interpreted by investors as a sign the ECB has failed to reach a credible solution.

"The recent decline in the euro has not been driven by existential concerns about its future. But the complexity of the ECB’s unique challenge was laid bare last week when political ructions in Italy triggered fresh selling in the bond market," says Shearing.

Shearing says if the ECB fails to put sufficient "meat on the bones of its anti-fragmentation plans then it runs the risk of an even greater negative reaction from the market".

He suggests that should investors sense the ECB is dragging its feet, or that the final outcome won’t be effective enough, "will see fragmentation concerns rush back onto the agenda, fanning the flames of an altogether more worrying fall in the euro".

"The ECB has to develop a credible tool to prevent a blowout in peripheral bond spreads as policy is tightened. The widening of peripheral spreads earlier this year – and the subsequent failure to adequately address the issue at June’s scheduled policy meeting – led to a hastily-arranged emergency meeting of the Governing Council which agreed to develop a new programme to contain spreads. Since then, we’ve heard relatively little about what has been named the Transmission Protection Mechanism," says Shearing.

Jussi Hiljanen, Chief Strategist for USD & EUR rates at SEB says the new anti-fragmentation programme will likely be flexible, ex-ante unlimited and sterilised, "but also controversial".

"While the GC members widely share a need to counteract fragmentation, reaching a consensus on the scale and scope of the new programme and its practical implementation is a challenge," says Hiljanen.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes