GBP/EUR Week Ahead Forecast: Dip Buyers Drawn On Slippage Below 1.17

- Written by: James Skinner

- GBP/EUR finding support & drawing demand near 1.17

- But lacking impetus for any recovery much above 1.18

- 1.1695 to 1.1838 range possible with Europe CPI eyed

Image © Adobe Images

The Pound to Euro exchange rate has drawn interest from dip buyers upon slippage below the 1.17 handle but could struggle to extend its rebound by much above the 1.18 level in the week ahead, and will potentially spend its time trading within roughly a 1.1695 to 1.1838 range.

Pound Sterling rallied strongly against many currencies late last week and this outperformance coincided closely with speculation in advance of HM Treasury’s Thursday unveiling of a fiscal support package aimed at defending retired households, the unemployed and other welfare claimants from stratospherically elevated energy costs.

“This marks a notable shift in stance from the government, and on the margin should help ease the BoE’s dilemma. But, the macro impact is likely to be fairly small (our economists estimate a 0.1% boost to growth and a marginal boost to inflation) and arguably pales in comparison to the significant downside surprise in the UK services PMI, which was the biggest on record,” says Michael Cahill, a G10 FX strategist at Goldman Sachs.

“We think it is unlikely to significantly alter the BoE’s measured approach, which we have argued is de facto a low real rate, weaker currency policy. We therefore maintain our outlook for relative Sterling underperformance. However, we acknowledge that the balance of risks has shifted slightly, particularly if this week’s announcement snowballs into a bigger fiscal policy shift,” Cahill and colleagues said on Friday.

Above: GBP/EUR at hourly intervals alongside GBP/USD and EUR/USD. Includes model-derived estimate of probable weekly range.

Above: GBP/EUR at hourly intervals alongside GBP/USD and EUR/USD. Includes model-derived estimate of probable weekly range.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

HM Treasury rescued Sterling from another probe below 1.17 and positioned it to enter the new week closer to 1.18 but its intervention is no panacea for the perilous position of many low income workers (explained below) and there are other factors that could also limit GBP/EUR’s ability to rise this week.

The UK economic calendar for the week ahead is devoid of major appointments for Sterling and shortened at the latter end by two public holidays, although before then and on Tuesday Eurostat will release its estimate of Eurozone inflation in May, with possible implications for the Euro.

“There has been a cacophony of ECB voices in recent days commenting on what liftoff might look like, with some members talking openly about the possibility of a 50bp hike to begin the cycle,” says Jordan Rochester, an FX strategist at Nomura.

“The market credibly pricing in 50bp rate hikes for the euro area is a big risk for EUR shorts,” Rochester and Nomura European Economics colleague George Buckley wrote in a research briefing on Friday.

Rochester and Nomura colleagues doubt the ECB would actually lift Eurozone interest rates by a larger than usual increment of 0.5% in July, which would end the era of negative interest rates in Europe, but they’ve noted the risk of markets speculating in this direction over the coming weeks.

This kind of speculation is a risk for Sterling that could be felt further as soon as Tuesday if the May inflation figures surprise on the upside of a market consensus that is looking for the annual inflation rate to rise from 7.5% to 7.7%.

“The risk next week is that the May CPI data do just that, rising from 7.4% to 8.2% (our view) or higher,” Rochester and Buckley said on Friday.

Eurozone inflation and the ECB policy are key this week but the UK economy’s handling of the recent and upcoming inflation shocks is also an important factor, and whether the market has correctly inferred the implications for Bank of England (BoE) policy stemming from last week's intervention by HM Treasury.

"On balance, the case for the MPC to raise Bank Rate further has strengthened since it last met, nearly four weeks ago. We continue to think, however, that the Committee will not raise Bank Rate all the way to 2.00% by the end of this year and to 2.50% by mid-2023, as markets currently expect," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"The long lags between changes in monetary policy and their impact on the economy, however, mean the MPC feasibly can’t offset the near-term stimulus to activity and inflation. Note too that the boost to activity from the one-off grants will fade," Tombs said in review of the package last Friday.

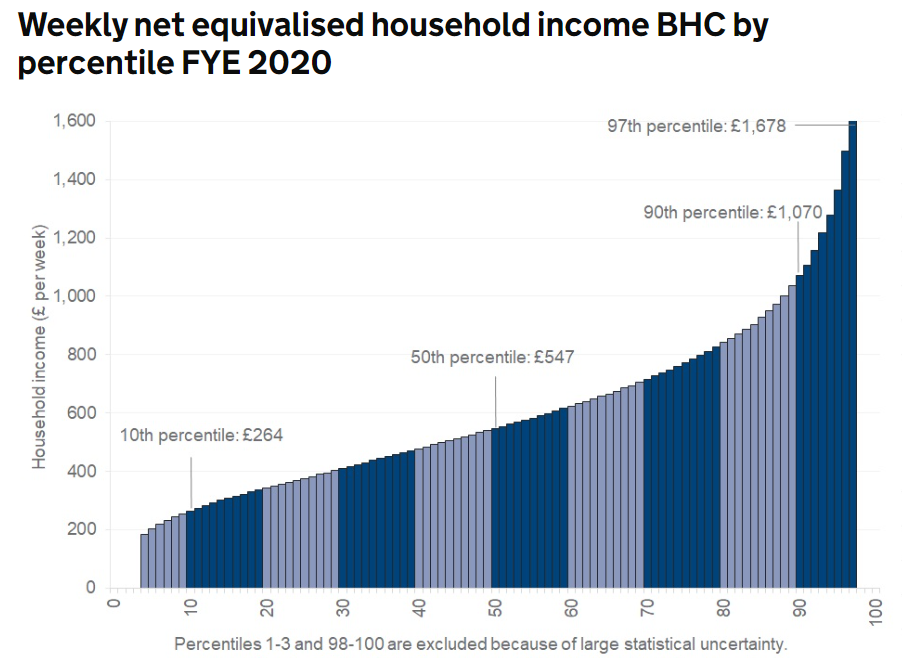

Above: United Kingdom average weekly incomes of the working population before housing costs in 2020. Source: Office for National Statistics.

Above: United Kingdom average weekly incomes of the working population before housing costs in 2020. Source: Office for National Statistics.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

HM Treasury’s latest efforts were significant but the potential rub for the economy is that this support was targeted mainly at welfare claimants and offers little to the lowest income workers who're not eligible for welfare, which is many of those who're employed on a full-time basis.

It’s possible that many of these workers will neither claim welfare nor be direct payers of energy bills themselves and so will not necessarily see any of the support announced last week. For instance, those who're employed on a full-time basis and reside in rented property that is of a shared or communal variety.

"Rents are climbing across the country and are already reaching record highs in the majority of towns and cities. That’s going to be incredibly unwelcome news for renters," says Matt Hutchinson, director of SpareRoom, the UK’s largest marketplace for communal accommodation.

"With a substantial proportion of flat sharers having bills included in their rents, this may just be the start. The effects of the price cap rising won’t have kicked in yet and, when the second phase comes into effect in the autumn, just as we’re heading into the colder months, we may well see more records broken," he added in summary of SpareRoom's first quarter Rental Price Index.

Record increases in rental costs are looming for all including those who may have been overlooked in last week's intervention, and some of this latter group will still also be at risk from stratospherically increased energy costs that are not normally itemised separately.

This potentially keeps alive the medium-term headwinds lurking on the path ahead of the UK economy and Pound Sterling.

Source: Spareroom.co.uk