Pound Sterling a ‘Sell On Rallies’ Says Credit Suisse FX Trader

- Written by: James Skinner

- GBP facing an uphill struggle to recover from losses

- Risks drawing in sellers on recoveries in short-term

- As market yet to grasp BoE message on Bank Rate

- Surging costs of imported essentials drives inflation

- Cannibalises economy & keeps lid on interest rates

Image © Adobe Images

Pound Sterling took a pummeling this week but its rollercoaster ride is a long way from over and this means the British currency is still best off being sold in the event of any rallies, according to one trader at Credit Suisse.

Sterling built further on already large year-to-date losses as the market responded to Thursday’s Monetary Policy Report from the Bank of England (BoE) and its possible implications for interest rates in the near future.

“The outlook from the BOE meeting yesterday was pretty bleak but I do appreciate Governor Bailey’s honesty about the state of the economy and what tackling inflation will mean for growth. I liked the way he described the different scenarios currently facing the EU and US and that the UK was currently somewhere in the middle,” says Jonathan Pierce, an FX trader at Credit Suisse.

“The UK sits between the two as it has a similar shortage of key imports to the EU but also has a tight labour market like the US. Bailey noted the difficult path they have to tread. This set up outlined by Bailey is what keeps USD so bid relative to the rest of G10. The UK stagflation scenario looks more clear than ever so expect rallies in GBP to be sold,” Pierce also said on Friday.

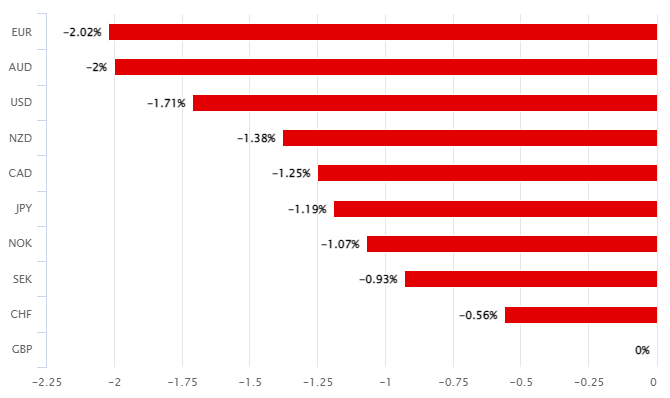

Above: Pound Sterling relative to G10 counterparts this week. Source: Pound Sterling Live.

The BoE took another step on Thursday in a process intended to withdraw the monetary stimulus provided to the economy during the pandemic and in the period leading up to it, and as part of its effort to rein in an inflation rate that is now expected to reach a double-digit percentage this year.

But this did no favours for Sterling exchange rates at the time or afterward and in part because of what the new forecasts contained in the May Monetary Policy report imply about the outlook for interest rates in the near future.

“Its latest economic forecasts strongly suggest that it still envisages increasing Bank Rate by considerably less than markets think,” explains Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“Although investors tempered their expectations for further rate hikes yesterday, they have not gone far enough,” Tombs also said on Thursday.

Above: Pound to Dollar rate shown at hourly intervals alongside GBP/EUR.

Above: Pound to Dollar rate shown at hourly intervals alongside GBP/EUR.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The forecasts suggested the BoE would effectively write off the UK economy if it indulged market expectations for Bank Rate, which envisage the benchmark rising from 1% this May to around 2.5% by the early months of 2023.

They are collectively a subtle but clear enough hint that the BoE is unlikely to raise rates as far as financial markets assume would be necessary in order for inflation to be brought down to the targeted 2% level in the coming years.

“The governor gave a figure for the estimated or predicted increase in the OFGEM energy cap this year, an estimate based on where the forward market is at the moment, of around £1500 per household on top of what we’re seeing, something like a £250 or £300 rise, for the last year,” says Ben Broadbent, the BoE’s Deputy Governor for Monetary Policy, in Thursday’s press conference.

“If you include the rises driven by the mixture of the pandemic and the Russian invasion, in prices of other imported goods and traded goods, you will probably more than double that increase in energy over that two year period. So we’re talking about a very significant hit to incomes. The rise in mortgage costs as a result of rising interest rates is a fraction of that number,” Broadbent added.

Above: Pound to Dollar rate shown at daily intervals alongside GBP/EUR.

Above: Pound to Dollar rate shown at daily intervals alongside GBP/EUR.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

This in turn implies not only that further increases in inflation are just around the corner, but also that further disappointment for financial markets and additional losses for Pound Sterling exchange rates are likely too.

At the heart of this reality is the nature of the inflation currently seen in the UK, which is substantially the result of surging prices for the energy and manufactured goods consumed in the UK, much of which is imported rather than being produced domestically.

This is driving the “very significant hit to incomes” described by BoE Deputy Governor Broadbent and imperiling the economic outlook by leading spending on imported goods to cannibalise the other parts of households’ incomes that would otherwise be spent within the UK economy.

But this scenario is not in any way, shape or form unique to the UK; the UK is simply among the first to be navigating through it after the BoE became one of the first major central banks to begin confronting the inflation driving the oft-referenced ‘cost of living crisis’ back in December.

The related decision to begin raising interest rates in December placed the BoE near the vanguard of a trend that could eventually impose a burden on many other central banks, with implications for all of their associated currencies too.

Above: Pound to Dollar rate shown at weekly intervals alongside GBP/EUR.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks