Euro Under Fresh Pressure after Russia Turns off the Gas Taps, Raising EU Recession Risks

- Written by: Gary Howes

- EU gas supplies squeezed further

- Puts EUR under pressure

- As economists warn of Eurozone stagflation

- And potential for economic recession

Image © Adobe Images

The Pound to Euro exchange rate has firmed as investors flip economic concerns from the UK to the Eurozone following a cut in supplies of Russian gas to the bloc and amidst fears of further restrictions to supplies.

The Euro fell new five-year lows versus the U.S. dollar and reversed recent gains against Pound Sterling "after Russia used Poland and Bulgaria as guinea pigs in its threat to cut off supplies of natural gas," says John Hardy, Head of FX Strategy at Saxo Bank.

Russia said the action was a result of the refusal of the two countries to pay for gas in Rubles and that similar measures would be taken against other countries that do the same.

The move signals Russia's willingness to weaponise gas supplies and economists see a growing tail risk that Russia retaliates to future Western actions by fully blocking supplies.

"Germany is the chief focus as a full shutdown would crater German economic growth on the need to ration supplies," says Hardy.

The Euro plumbed its lowest levels in five years at 1.0514 in the wake of the news while giving back gains made against Sterling on the previous two days to go back to 0.8422.

This gave a Pound to Euro exchange rate of 1.1900 by Thursday trade. (Set your FX rate alert here).

Image courtesy of Eurostat.

Russia typically supplies 40% of EU natural gas imports, but with winter over in Europe households now need less energy to heat their homes.

This is why the surge in gas prices following the Poland / Bulgaria switch-off did not push prices to February peaks.

Research from Berenberg Bank also shows Europe has steadily increased its storage of natural gas during recent weeks to some 36% above minimum levels.

"Even in the event of an immediate Russian embargo, imposed by either the EU or Russia, Europe would likely make it until late autumn without a shortage of gas," says Kallum Pickering, Senior Economist at Berenberg Bank.

But Pascal Blanqué, Chairman at Amundi Institute, warns "gas storage levels in Europe are only enough to cover near-term demand and a more coordinated European effort is needed to wean the region off Russian dependence in the long term."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Berenberg Bank tell clients Europe's economy faces serious near-term headwinds which include supply disruptions, the surge in energy and food prices and increased consumer caution.

"Since November 2021, the Eurozone seems to have been mired in stagflation with very little growth at high inflation. The current headwinds will likely keep the Eurozone in stagflation in Q2," says Pickering.

"A sudden stop of Russian gas supplies to Europe could push Europe into a recession," he adds.

The Pound was hammered last Friday on a bevvy of data that showed the UK economy was slowing, but investors' slowdown fears appear to now have turned to the Euro midweek.

"The EUR remains under intense downward pressure, with the latest catalyst for weakness the news that Russia says it will curb gas supplies to parts of Eastern Europe," says Dominic Bunning, Head of European FX Research, HSBC Bank plc.

Bunning says this is putting further upward pressure on gas prices in the region and exacerbates the worrying growth-inflation mix that has been deteriorating rapidly since the start of this year.

Image courtesy of Amundi Asset Management Institute.

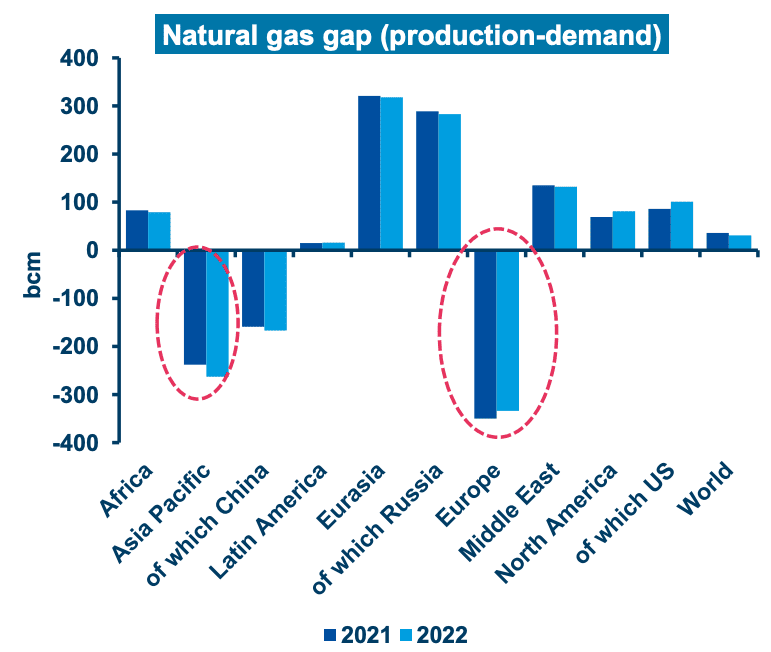

Amundi's Blanqué says the supply/demand mismatch in natural gas was already acute in Asia Pacific and Europe before the war.

"Given Russia’s role in supply, the geopolitical ramifications of the war are tremendous, including higher prices and a potential threat to supply, both of which feed into the inflation narrative," he says.

Jeremy Stretch, an analyst at CIBC Capital Markets, says ongoing question marks over gas supplies into the east of the EU risk further threatening an already fragile macro outlook.

The Euro will likely remain fragile with further gas payment deadlines fall due, leaving investors watchful of more supply shutdowns.

Threats to gas supply prompted a near 15% jump in the European benchmark gas prices yesterday.

"Should that move extend... expect this to further depress the recovery narrative, testing EUR resilience," says Stretch.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Concerns for the Eurozone economic outlook are being reflected by a key barometer of Eurozone health: the difference in the yield paid on German and Italian bonds.

"The spread between the Italian and German 10-year widening by the most since June 2020, says Fawad Razaqzada, Market Analyst at City Index and Forex.com.

He adds incoming European macro data has not been great either. Today saw the German Gfk Consumer Climate read at -26.5, which is below analyst expectations for -16.1.

France's consumer confidence reading from INSEE meanwhile read at 88, down from 90.

But readers should be aware the Euro is looking heavily sold against the Dollar right now and some technical relief buying and profit taking must be expected at some point in the near-term.

But this is not necessarily going to drive GBP/EUR lower as GBP/USD is also looking oversold and in need of a correction higher.

Over coming weeks analysts are nevertheless wary of the Euro's prospects given its sensitivities to the war and Russia's belligerence.