Euro Under Pressure again on Faded Ukraine Peace Hopes

- Written by: Gary Howes

Image: Photographer: Lukasz Kobus, European Union, 2022, Copyright. Source: EC - Audiovisual Service.

Prospects for a peace settlement in Ukraine have slipped notably this week and will likely keep the Euro under pressure over the near-term, say analysts.

After two weeks of negotiations and positive signals Russia appears to be pushing back on the prospects for any breakthrough in talks over coming days, with Russia's presidential press secretary Dmitry Peskov saying the two sides were still far apart.

"The degree of progress in the negotiations perhaps is not what would be desirable and not what the development of the situation for the Ukrainian side would call for," said Peskov in a regular briefing to media.

Following talks between the two sides there were hopes enough progress had been made for a meeting between Ukrainian President Volodymyr Zelensky and Russian President Vladimir Putin.

"To begin speaking about a meeting between the two presidents, the homework should be done first, namely negotiations should be held and their results agreed upon," said Peskov.

"No significant progress has been ensured thus far. They (Putin and Zelensky) would simply have nothing to formalise, there are no agreements that they could formalise," he added.

The Euro had recover against the Dollar and British Pound through the course of the past week alongside global stock markets on hopes for a negotiated settlement to the conflict.

Any fading of such hopes would therefore impact negatively on Euro exchange rates.

"We fear the hope of peace may now be a little excessively priced which could see European currencies turn weaker versus USD once again," says Derek Halpenny, Head of Research, Global Markets EMEA at MUFG.

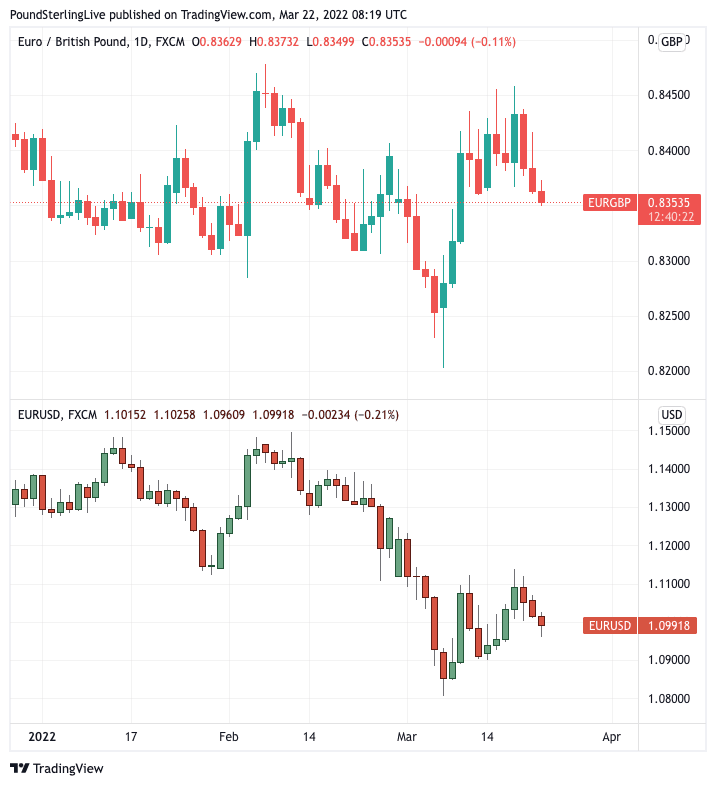

The Euro to Pound exchange rate, the Euro to Dollar exchange rate has retreated from highs at 0.8458 to trade back at 0.8353, the Euro to Dollar rate has retreated from highs at 1.1137 back to 1.0992.

Above: EUR/GBP (top) and EUR/USD (bottom) at daily intervals.

- Reference rates at publication:

GBP to EUR: 1.1970 - High street bank rates (indicative): 1.1550 - 1.1630

- Payment specialist rates (indicative): 1.1860 - 1.1890

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

MUFG notes a further upturn in risk sentiment last week helped by the limited evidence of contagion from the Ukraine invasion and Russia sanctions.

"Based on the events unfolding and the immediate outlook ahead we see a greater risk of a renewed deterioration in market conditions with the US dollar set to advance versus European currencies," says Halpenny.

News reports indicate Belarus might be preparing to join the war in Ukraine on Russia's behalf, a development that would amount to an escalation in the geopolitical stakes.

Furthermore, it is reported Tuesday that President Joe Biden believes there are "clear signs" Russia is preparing to use chemical weapons as he becomes increasingly frustrated with the inability of Russian forces to deliver territory.

Such an outcome could prompt further tightening of sanctions from Western countries and pressure investor sentiment.

Another negative development for sentiment would be a greater involvement by China on the Russian side. Last week the U.S. warned China against supplying arms to Russia, a development they believed to be likely.

"If China was to indicate more explicitly its support for Russia as the US have indicated, a wider contagion in market pricing could well unfold. All of this coupled with a hawkish Fed communication points to renewed USD appreciation," says Halpenny.

"The evolution of the conflict in Ukraine still looks like the main driver in the FX market as for now," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.