Pound / Euro Week Ahead Forecast: Could Steady Above 1.1910 but Upside Limited

- Written by: James Skinner

- GBP/EUR looks to hold 1.19, with upside limited

- After G7 fires monster sanctions salvo at Russia

- With hopes of swift end to Ukraine conflict rising

- As Russian army flounders in assault on Ukraine

Above: Central Bank of Russia. Image © Adobe Stock

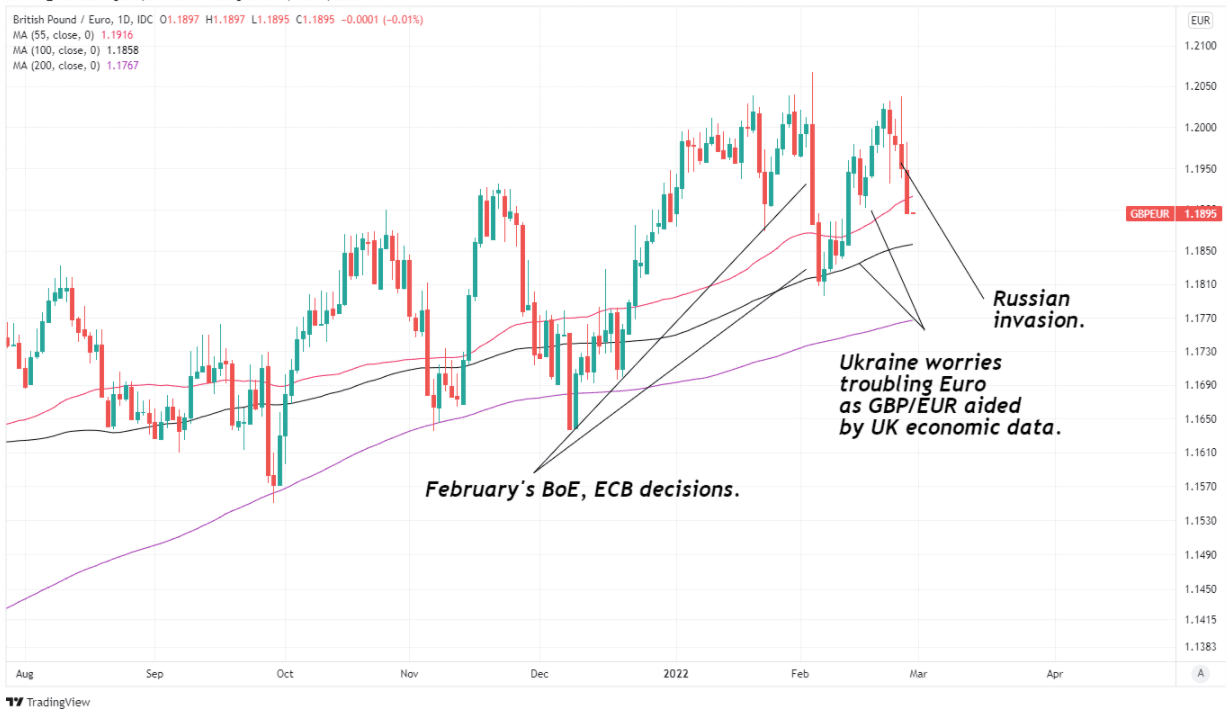

The Pound to Euro rate has held near the 1.19 handle and may attempt to hold above here over the coming days, although price action is likely to be interspersed with irregular trading activity, which could lead to periodic bouts of volatility in both directions.

Pound Sterling was slower to recover its footing than the Euro during Friday’s global market rebound, which had led GBP/EUR to extend its earlier decline all the way into the weekend, although this week the Pound might be likely to show greater resilience than the single currency during any possible further bouts of market volatility.

This would be due in part to the Euro’s more widespread use as an official reserve asset including by the Central Bank of Russia, which was targeted by G7 countries with something like the ‘the mother of all sanctions packages’ on Saturday in response to Moscow’s attempted conquest of Ukraine.

“We commit to imposing restrictive measures that will prevent the Russian Central Bank from deploying its international reserves in ways that undermine the impact of our sanctions,” leaders of G7 countries said in a bombshell announcement on Saturday.

Not without good reason, sanctions such as the proposed asset freeze are highly likely to require legislation to be enacted, which creates uncertainty over when they’ll go into effect and could leave scope for some potentially wild price action in the interim.

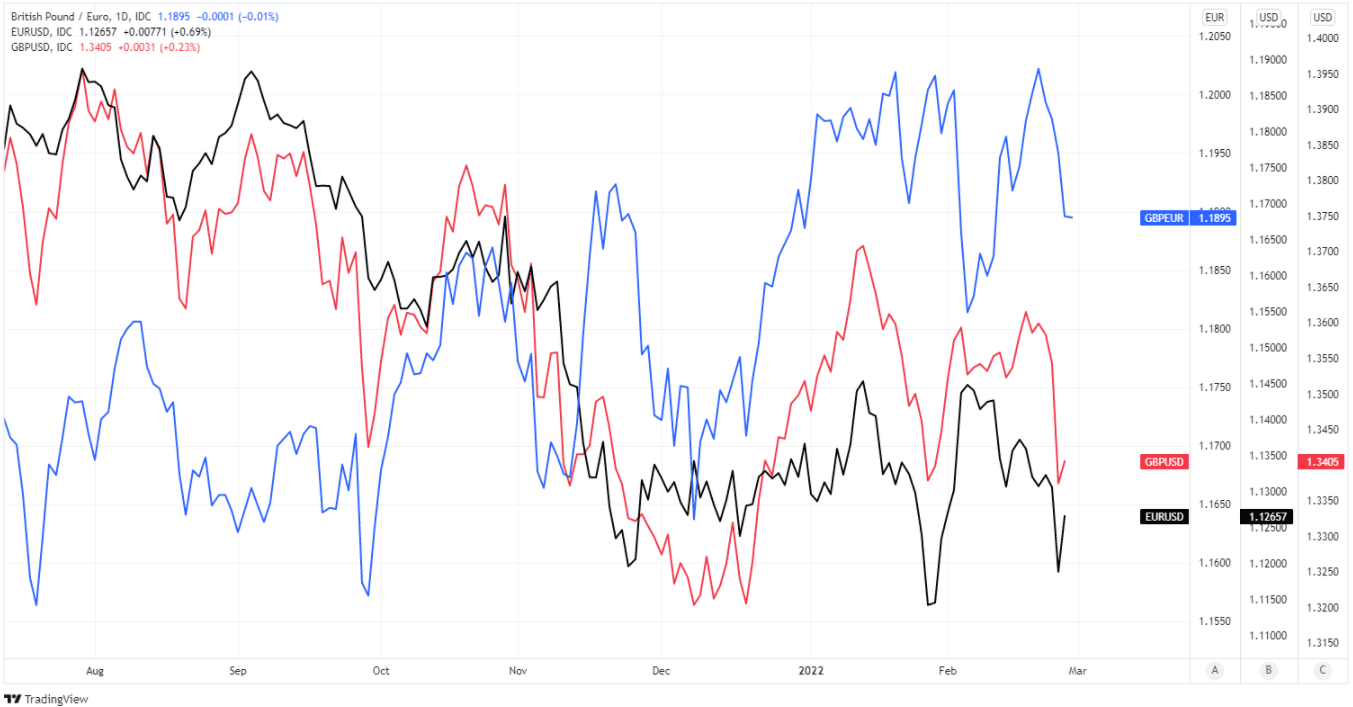

Above: Pound to Euro exchange rate shown at daily intervals alongside GBP/USD and EUR/USD.

- Reference rates at publication:

GBP to EUR: 1.1984 - High street bank rates (indicative): 1.1665 - 1.1758

- Payment specialist rates (indicative): 1.1876- 1.1924

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

“The 600-billion-plus war chest of Russia’s foreign reserves is only powerful if Putin can use it and without being able to buy the Ruble from Western financial institutions, for example, Putin’s Central Bank will lose the ability to offset the impact of our sanctions. The Ruble will fall even further, inflation will spike, and the Central Bank will be left defenseless," the White House explained in a weekend teleconference.

While the G7 decision to demand the eviction of numerous Russian banks from The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a significant curveball thrown at the Russian economy and so has garnered much of the attention among commentators, the decision to freeze the official reserve assets of the Central Bank of Russia is by far the more significant development for financial markets.

“Russia’s macro and policy buffers against external shocks are sizeable. If additional sanctions were introduced, the country’s twin surpluses, high FX reserves and low debt, could act as important shock absorbers,,” Melis Metiner, an economist at HSBC, said in a research briefing last week.

The asset freeze has numerous potential implications, some of which could be very far reaching, and in the absence of any immediate asset freeze these could potentially place Sterling, the Euro, U.S. Dollar, Japanese Yen and Canadian Dollar directly in the firing line during the week ahead.

Source: Central Bank of Russia.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

All of these currencies are held as part of the CBR’s official reserves and would be inaccessible to it after any assets freeze goes into effect, although with the Euro being by far the largest holding this could actually be a somewhat supportive development for the GBP/EUR exchange rate in the event of any attempted fire sale by the Central Bank of Russia over the coming days.

While this is potentially supportive of GBP/EUR, the upside for Sterling is likely limited by a combination of the Eurozone’s closer proximity to the conflict in Ukraine and the reported - yet still tentative - successes of the country’s military and civilian population in their efforts to halt the invading army.

“Any dreams Putin had of imposing a puppet regime, or of carving up and holding Ukraine, have been shattered by cries of “Slava Ukraini!” (Glory to Ukraine!),” says Michael Every, a global macro strategist at Rabobank.

“Overall, the Russian military is performing extremely poorly: they still don’t have air superiority due to Ukraine moving its air defences around, and Russian missile strikes having only hit old, static targets. Russia’s attempts to rapidly seize Kyiv while minimising losses to Ukrainian civilians and its infrastructure are resulting in massive losses on their side,” Every also said on Monday.

Above: Pound to Euro rate shown at daily intervals.

Ukrainian resistance had left Russian forces floundering at the time of writing without them having secured any of their stated objectives and, when combined with the mounting pile of international sanctions, was threatening to leave Moscow with a complete and unabridged calamity on its hands.

This gives rise to the prospect of Russian forces being overcome by their Ukrainian counterparts, or otherwise compelled to withdraw in failure, and either outcome would be enough to avert any protracted conflict that would inevitably come with plentiful scope for further escalation. The shorter-lived affair would be a more favourable outcome for the Euro.

“As it stands at the moment, we don’t think that the Russia/Ukraine conflict will delay or derail the Bank of England’s plans to raise interest rates further. That’s because the Bank will probably be a bit more alert to the resulting risk of higher inflation than weaker economic activity,” says Paul Dales, chief UK economist at Capital Economics.

Developments in and of relevance to Ukraine are likely to be the dominant considerations for financial markets in the week ahead, although there’s no less than three members of the Bank of England (BoE) Monetary Policy Committee who’re scheduled to speak publicly over the coming days.

Sterling would be likely to listen closely to those addresses for clues on the extent to which the tragedy in Ukraine is likely to impact monetary policy.