Pound-Euro Week Ahead Forecast: Rescued by Dip Buyers

- Written by: James Skinner

- GBP/EUR draws bargain hunters at 1.16

- Gamechanging BoE stance aids GBP

- Dip buyers eye 1.1976 multi-month

Image © Adobe Images

- GBP/EUR reference rates at publication:

- Spot: 1.1614

- Bank transfers (indicative guide): 1.1308-1.1390

- Money transfer specialist rates (indicative): 1.1500-1.1556

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Euro rate drew bargain hunters when month-end market turbulence pushed it briefly below 1.16 last week, but over the coming days it could set the stage for new 2021 highs to be achieved toward year-end aided by Sterling's undervaluation and the increasingly supportive outlook for Bank of England interest rates.

Sterling suffered heavy losses against many currencies in the opening half of last week before staging a comeback into the weekend, which saw the Pound-to-Euro rate rebound from two-month lows of 1.1550 on the Wednesday to levels close to 1.17 on Friday.

Earlier losses came at the onset of a destabilising rally in all-important Dollar exchange rates but also amid a heightened focus in media and markets on the inflationary effects of recent increases in international natural gas prices, as well as an almost comical ‘fuel crisis’ in the UK.

There are no major economic figures in the calendar for either the UK or Europe although recent data and its implications for BoE policy remain supportive of the Pound, while other factors too could also help sustain its tentative rebound during the week ahead.

"We believe part of the price action in GBP is the narrative chasing the price action,” writes Mark McCormick, global FX strategy at TD Securities. “Yet, more important than the narrative is that this see-saw has produced a nice GBP [discount] on some of the key crosses.”

Above: TD Securities charts show an overbought EUR/GBP on the left, while GBP features on the right as the only G10 currency to have seen growth expectations rise in the recent six months and to still be undervalued. Click image for closer inspection.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Prior losses were steep but Sterling’s recovery was quick to draw endorsement from TD Securities who advocated that clients buy GBP/EUR around 1.1607, and in anticipation of a move up to 1.1976 over the next two months.

McCormick and colleagues cite an overbought EUR/GBP and an undervaluation of the Pound, which is the only G10 currency to remain undervalued despite having also recently seen market expectations for economic rise.

The latter point is poignant in light of last Thursday’s announcement from the Office for National Statistics, which upgraded its estimate of second quarter GDP growth from 4.8% to 5.4% in what is a significant development.

“When the facts change, we change our mind,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. “Accordingly, we now expect the Committee to hike Bank Rate to 0.25%, from 0.10%, in May, and then to wait a further 12 months before raising Bank Rate again.”

Above: Pound-to-Euro rate shown at daily intervals with major moving-averages indicating possible areas of support and resistance.

The upgrade means second quarter growth was even faster than already-bullish and yet earlier expectations of the BoE, which had anticipated a 5% increase but was left disappointed by the initial estimate released in August.

August's disappointment dampened appetite for Sterling at the time as it was seen in the market as likely to mean the BoE would be slower reversing its crisis-period interest rate cuts than otherwise, but last week's upgrade was a gamechanger for some forecasters as well as for the money markets.

Some money market prices have come to imply that as soon as the first quarter of next year the BoE could begin to reverse the interest rate cuts announced at the onset of the coronavirus crisis, starting with an increase in Bank Rate from 0.10% to 0.25%, and recent comments from the BoE itself have been encouraging of this view.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“All of us believe that there will need to be some modest tightening of policy to be consistent with meeting the inflation target sustainably over the medium-term. Recent evidence appears to have strengthened that case, but there remain substantial uncertainties and we are monitoring the situation closely,” BoE Governor Andrew Bailey told the Society of Professional Economists Annual Dinner last Monday.

Governor Bailey’s remarks and minutes of September's meeting suggest that all members of the Monetary Policy Committee (MPC) want clear evidence of employment and inactivity levels in the labour market continuing to normalise in the final quarter of the year before voting to take any action.

But they have also illustrated clear scope for the MPC to reach a majority in favour of gradually reversing earlier interest rate cuts as soon as the opening quarter of 2022, albeit subject to the employment, GDP and inflation figures released over the course of the final quarter of this year.

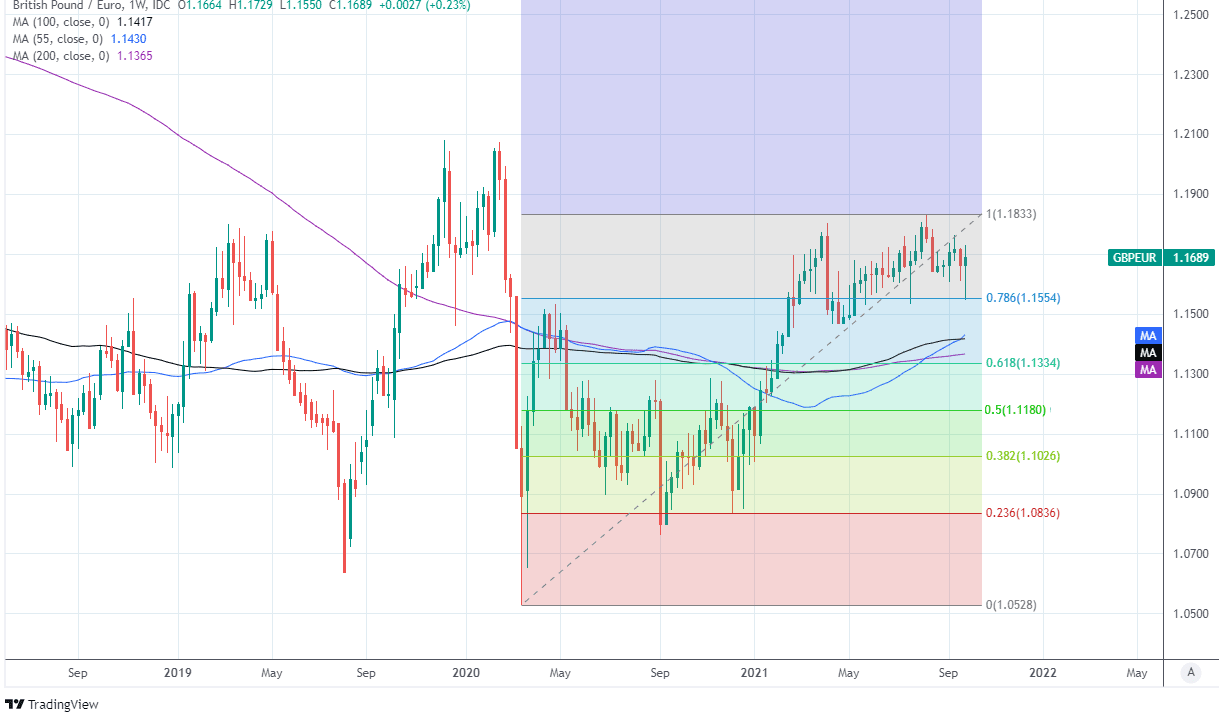

Above: Pound-to-Euro rate shown at weekly intervals with major moving-averages and Fibonacci retracements of March 2020 uptrend indicating possible areas of support.

“Some members put more emphasis on the continuing shortfall in the level of GDP relative to pre-Covid, while others emphasised the continuing direction of travel towards closing that gap and the evidence of cost pressures accompanying the closing. But all of this group were of the view that the stimulus to monetary policy enacted in response to Covid would need to start to unwind at some point,” Governor Bailey said last Monday.

Governor Bailey’s remarks echoed September’s meeting minutes while the two distinct positions described in them match those set out on September 08 when he told the Treasury Select Committee there had been around four members in each camp during August’s meeting, which was one where the nine seat committee had been operating with just eight voters.

While only time will tell what is in store for employment levels following September’s end of the furlough scheme, the growth upgrade announces last Thursday has left UK GDP 3.3% below its pre pandemic level while Governor Baileyhad told the audience at a European Central Bank conference previously on Wednesday that the earlier and even larger growth gap could be closed as soon as “the early part” of next year.

This means the market may be on the money looking for the BoE to normalise its policy early in 2022, which would be supportive of Sterling generally but especially against currencies like the Euro given that the European Central Bank (ECB) is not expected to change its policy for a number of years.

“We remain constructive on sterling’s prospects and view recent weakness as a function of short term disequilibria,” says Daniel Been, head of FX research at ANZ, who forecasts GBP/EUR to end the year around 1.1764.

“The EUR will be tested in the near term as growth and policy divergences weigh, while the GBP will appreciate as the Bank of England remains hawkish,” Been says.