Pound Sterling's Rally vs. Euro Stalls as Markets Lock onto Relative Economic Performances

- GBP/EUR drops half % vs EUR

- EUR outperforms courtesy of strong economic recovery

- HSBC remain bearish GBP

- CIBC look to sell into any GBP strength vs. EUR

Image © Adobe Images

- GBP/EUR spot rate at time of writing: 1.1060

- Bank transfer rates (indicative guide): 1.0770-1.0850

- FX specialist provider rates (indicative guide): 1.0880-1.0960

- Learn more about market beating exchange rates, here

The British Pound fell sharply against the Euro over the course of the past 24 hours and looks set to endure further weakness unless the UK economy can start printing some impressive data and close its performance gap with the Eurozone.

While Sterling retains a broadly supported tone against the Dollar, and indeed the past month sees Sterling looking relatively robust against other major and minor currencies, against the Euro the broader trend still ultimately remains one of decline.

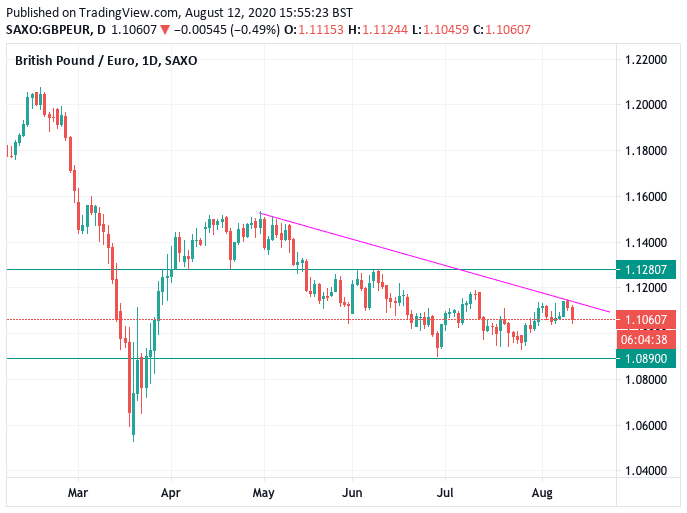

The daily chart below underscores this view; it shows that since late April the Pound has been trending lower, and while there has been some sideways action since mid-May there remains a decidedly heavy feel to Sterling's outlook:

The above should underscore one point to readers: the Pound is in no position to pose a concerted recovery against the Euro and if you want to lock in a rate we would suggest making contact with a provider that can offer various solutions to protect your purchasing power given existing uncertainties.

Importantly, the Euro is not just holding an advantage against the Pound as it does so against the U.S. Dollar too, largely thanks to global investors swivelling towards the Eurozone which they believe should outperform the UK and U.S. in the post-covid economic recovery stakes.

The key point here is expectations for economic outperformance matters for FX right now, and the Eurozone is on top.

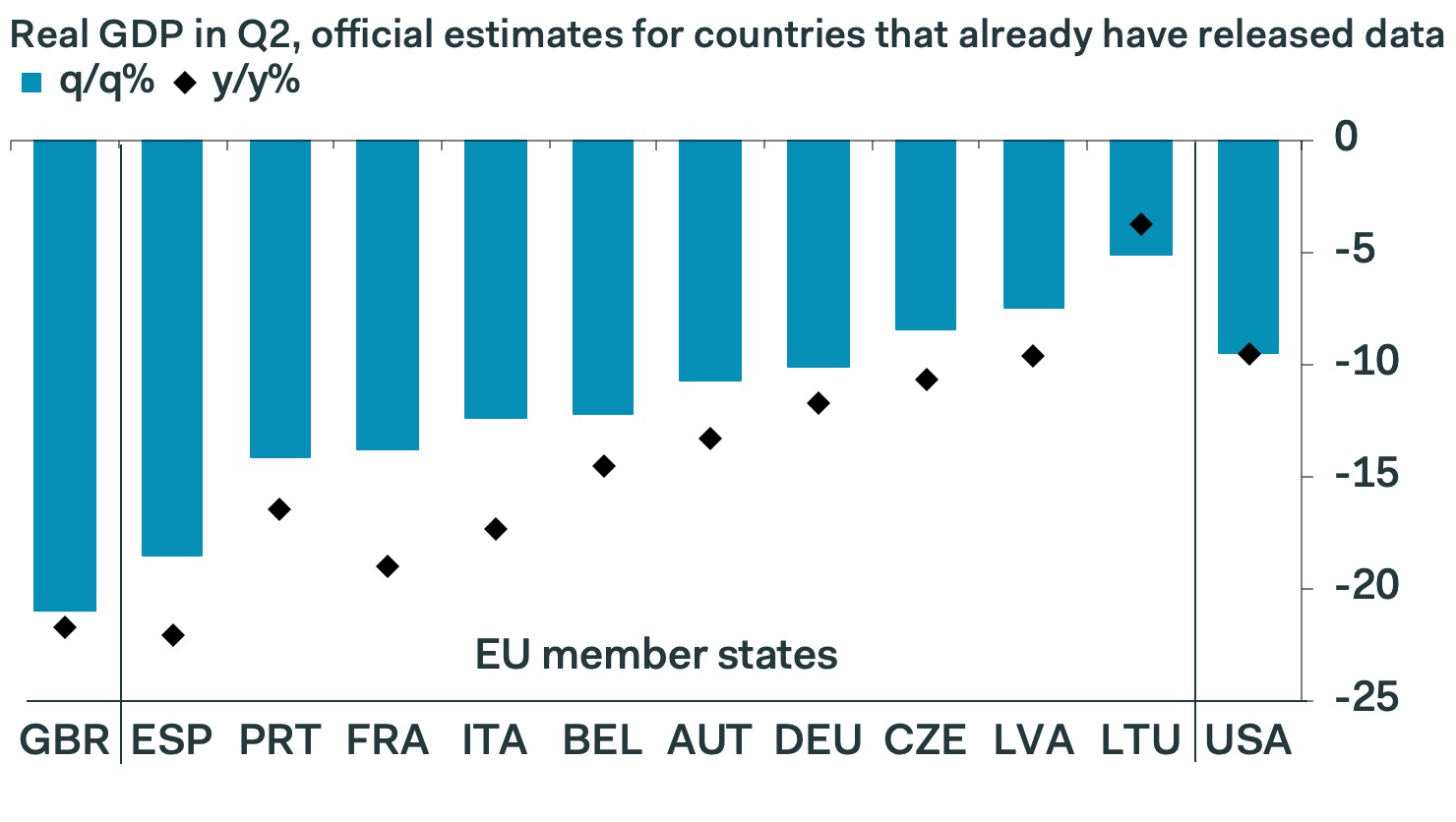

The challenge facing the UK economy was meanwhile laid bare on Wednesday after the ONS reported the UK had endured the deepest economic slump of all its European peers during the first half of the year, providing a fundamental reason to sell the Pound against the Euro over recent months.

"The U.K. economy has underperformed its peers to an extraordinary degree," says Samuel Tombs, UK Economist at Pantheon Macroeconomics. "The drop in GDP in Q2 was bigger than reported to date by any E.U. member state, and double the fall recorded in the United States."

But, markets are forward looking by nature and the Pound could resist the Euro's advances should the UK economy start to print some impressive official figures over coming weeks and months that suggest it is playing catch up with the Eurozone.

Indeed, a key driver of exchange rates over coming months will be how fast economies recover relative to others, with some analysts saying the UK will struggle.

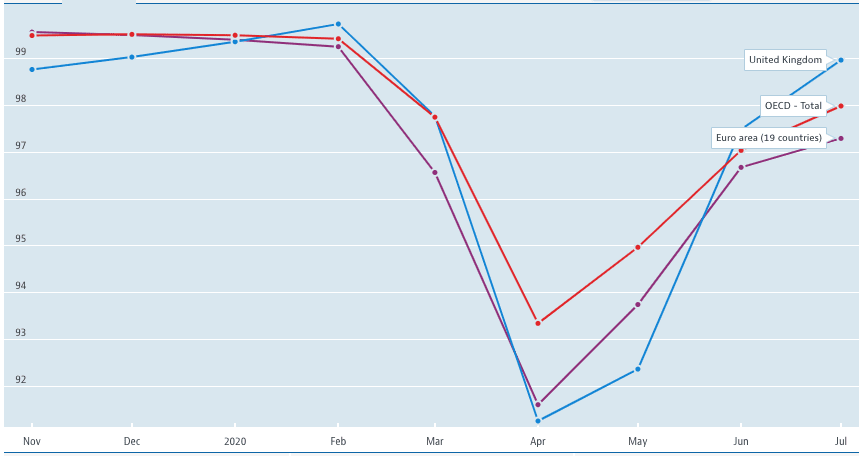

But one positive for those who would back the UK recovery, and by extension Sterling, is there are signs the UK is starting to outperform. The graph below is the Composite Leading Indicator from the OECD which is designed to provide early signals of turning points in business cycles. As can be seen below, the worst appears to be in the rear view mirror for the UK and official data could soon start outperforming that of the EU:

But, it will take more convincing data for markets to shift their viewpoint on the UK and we would imagine September's official from the ONS that captures what the leading indicator surveys are saying could have the potential to do this.

For now, sentiment remains pitted against Sterling.

"It’s a long climb out of that economic hole. We remain bearish on GBP given the economic challenges, the constrained fiscal firepower, and the still lingering additional headache of a “no trade deal” Brexit risk," says Daragh Maher, Head of Research, Americas at HSBC.

One reason for the UK's particularly deep recession is the significant share of the economy taken up by the services sector, which accounts for over 80% of UK economic activity. Shutting down pubs, restaurants, medical providers, schools, arts, entertainment and other contact-orientated service industries left the economy particularly prone.

"The underperformance can be attributed partly to the economy’s greater reliance on consumer services spending and the high level of labour market participation by working parents, many of whom have left work to look after children. These are structural disadvantages that likely will mean that the U.K. economy continues to lag behind in Q3 and Q4," says Tombs.

Nevertheless, the data shows the economy started to grow once more in May and June, but the unlocking of swatches of the services industry in early July should add fuel to the recovery.

But for some economists, there is not yet sufficient evidence that the recovery is gaining the kind of traction required to make the Pound an outperformed.

"The recovery in the UK has been underwhelming so far and the unwinding of the furlough scheme from August is likely to prompt a second wave of unemployment," says a client note from independent research house Capital Economics. "The additional uncertainty around Brexit will dampen business investment further, regardless of whether there is an eventual deal or not. As a result, the UK’s recovery from the coronavirus crisis will probably be slower than the recoveries in the U.S. and the euro-zone."

Capital Economics say the economy will ultimately disappoint on the recovery stakes, which will invoke further interventions from the Bank of England. "We suspect the Bank of England will expand its quantitative easing programme by a further £250bn over the next year and keep interest rates at or below 0.10% for five years," says Capital Economics.

The rule of thumb in foreign exchange markets is that when a central bank is cutting interest rates and boosting quantitative easing, faster than its peers, the currency it issues should depreciate in value. A timely example is that of the New Zealand Dollar which has fallen sharply in the wake of the Reserve Bank of New Zealand's boost to quantitative easing and warning it could soon cut interest rates to 0% or below.

"We expect fundamentals in the UK to lag European counterparts," says Bipan Rai, a foreign exchange strategist at

CIBC Capital Markets, who says his preferred strategist is to sell spikes in GBP/EUR in the 1.1150 area.

"There are plenty of headwinds for the GBP, which will likely fail to benefit further from the recovery of European currencies, explaining our Bearish short-term outlook," says David Alexander Meier, an economist with Julius Baer, the private Swiss bank.