Euro Powers Higher against Pound Sterling and Dollar

- Euro dominant in wake of EU rescue deal agreement

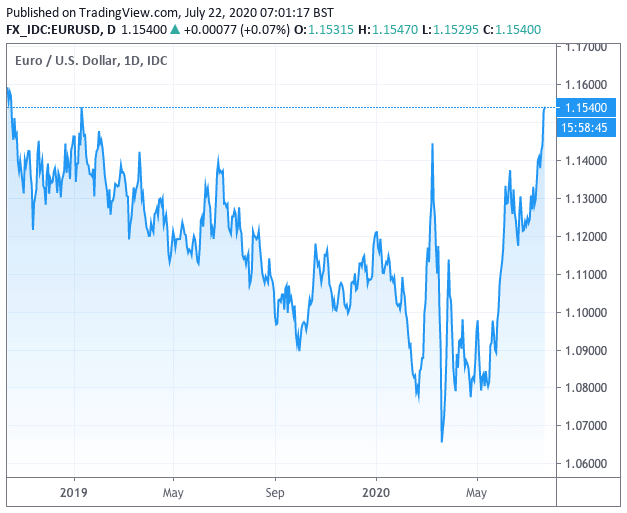

- EUR/USD at year-and-a-half highs

- GBP/EUR retreats once more

- GBP volatility to spike on Thursday and Friday

Image © Adobe Images

The British Pound and Dollar are both weaker against the Euro in mid-week trade with markets cheering the agreement of the EU's recovery deal and budget, which they say could result in further gains for the single currency over coming days and months.

The Euro was initially weaker after EU leaders agreed on Tuesday morning to pass a €750BN rescue package as well as a €1.074TN budget for the 2021-2027 period, but as we noted here, the losses were likely a 'buy the rumour, sell the fact' reaction by the marketplace and that ultimately the developments were supportive of the Euro on a fundamental basis.

This assessment is certainly the dominant one in the mid-week session with the Euro powering to a new multi-year high against the Dollar with the Euro-Dollar exchange rate hitting 1.1535, its highest level since January 2019.

It is important to note that when the Euro is powering ahead against the Dollar most Euro cross rates are likely to benefit from strength.

The British Pound is however looking more resistant to the Euro's advance, with the Euro-Pound exchange rate recovering back to 0.9071 which is where it as located on Monday. This gives a Pound-to-Euro exchange rate of 1.1022, which while still being higher than the week's open is nevertheless well below Tuesday's high 1.11097.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"In terms of being able to thrash out a compromise which is a small, but important step toward debt sharing, the European politicians may have this week heralded in significant change," says Jane Foley, Senior FX Strategist at Rabobank. "The EMU project may not be on the home straight yet, but since the spring the fundamentals behind the EUR have improved. While much of this is priced in, the EUR’s resilience vs. the USD has been provided with an additional boost."

EU leaders who agreed €1.8TN in spending, which includes a €750BN rescue fund to deal with the covid crisis, of which €390BN will be made in grants.

Of the €750bn recovery fund, €390BN will be paid as grants and €360BN as loans: France and Germany had been pushing for €500BN in grants to be made but some pushback from the 'frugal five' of Denmark, Netherlands, Austria, Sweden and Finland meant this amount was ultimately reduced.

"The emerging compromise is positive for the euro. We remain Bullish," says David Kohl Chief Currency Economist at Swiss private bank Julius Baer who have upgraded their Euro forecasts in light of the developments.

"The detailed outcome of the negotiation marathon is less important for our bullish view of the euro than the mere fact that the room for fiscal support has increased and that EU cohesion has been strengthened by the willingness to compromise," adds Kohl.

Kohl says fiscal policy support for the economy is increasingly relieving pressure from monetary policy to intensify its controversial measures, such as negative interest rates, which are a headwind for a currency.

Julius Baer have raised their three-month EUR/USD forecast from 1.14 to 1.16 and increase their forecast from 1.16 to 1.18 on a 12 month period.

They raise their EUR/GBP forecast slightly higher to 0.94 in three months and 0.92 in 12 months.

EUR/GBP at 0.94 gives a Pound-to-Euro exchange rate of 1.0638 while 0.92 translates into 1.0870.

Beware Pound Sterling Weakness Ahead

The British Pound is near its strongest level against the Dollar in over a month at 1.2768, and GBP/USD will be looking to take advantage of the EUR/USD strength to catapult it to fresh highs.

However, progress in GBP/USD will likely be slow given that the GBP/EUR cross is under pressure once more and we are wary of heightened volatility in Sterling on Thursday and Friday.

Indeed, the second half of the week will see the Pound come into focus with the conclusion of the latest round of Brexit trade negotiation talks due on Thursday, where markets will be looking for signs of progress.

Negotiators remain deadlocked on issues concerning fishing rights, level playing field provisions and the jurisdiction of EU courts in the UK in overseeing the future trading relationship and with October being the EU's favoured deadline for the process, we don't expect any major breakthroughs this week.

"The probability of a no-deal Brexit has increased significantly. For this reason we are forecasting a weak pound in the short term and only a very moderate recovery later in the year. In fact, there is a high risk that the pound will suffer much more severe setbacks in the meantime than our forecasts suggest due to rising Brexit risks," says Thu Lan Nguyen, FX & EM Analyst at Commerzbank.

UK data will also be in focus with flash PMIs out on Friday, this should give an early steer as to how the economy performed in July and any signs of an accelerating recovery could be met with Sterling strength.

Also keep an eye on UK retail sales data for June as this will give an indication of how the all-important UK consumer is holding up. Markets are expecting retail sales to have grown 8% in June and a beat on expectations would be positive for Sterling. However, a weaker number would signal to markets that the Bank of England will need to boost its quantitative easing programme once more which is an expectation that is likely to weigh on the Pound.

Foreign exchange analysts at Nomura - the Japan-based multi-national investment bank - say they have downgraded their forecasts for the British Pound, listing a litany of problems facing the UK economy and its currency.

These include low real yields on government bonds, mobility data that suggests consumers are yet to emerge from their lockdown hibernation in a similar way to that of mainland Europe.

"The UK’s fiscal and monetary response is not matching that of its European peers, with the furlough scheme ending in October and the BoE’s QE pace now half what it was. The UK has second-wave risks that may appear by end-Q3/Q4, with an underlying higher case count and less adoption of mask wearing than its DM peers. The UK starts from a position of weak credit conditions, with IVAs on the rise (pre-COVID-19) and substantial double deficits too," says Jordan Rochester, an analyst at Nomura in London.

Nomura downgrade their GBP forecasts saying GBP/EUR should trade around 1.0870 into year-end, or lower.