Euro Records Sizeable Gains against the Pound and Dollar thanks to Promise of Sizeable Central Bank Response to Coronavirus Outbreak

- EUR finds it is win-win in coronavirus obsessed markets

- Surges on Monday as expectations for agressive Fed cuts spike

- Global recession increasingly likely

Image © Adobe Images

- Spot GBP/EUR at time of writing: 1.1480, -0.90%

- Bank transfer rates (indicative): 1.1178-1.1259

- FX specialist transfer rates (indicative): 1.1300-1.1377 >> More details

Foreign exchange markets are on the move, and the currency to watch is the Euro which is currently witnessing a sizeable spike in demand.

The single currency has proven to be a beneficiary of the eye-watering sell-off in global stock markets over the course of the past ten days, but looking at the markets on Monday, March 02 it is clear that demand for the Euro is maintained even as stock markets recover.

Global stock markets are currently attempting to reclaim some of last week's sizeable losses at the time of writing, but make no mistake, markets remain fragile and it will take subsequent days of recovery to convince that a bottom to the coronavirus sell-off has been achieved.

Driving the recovery in stocks is an expectation that the U.S. Federal Reserve is poised to slash interest rates - money markets are currently reflecting expectations for a whopping 100 basis points of cuts in 2020.

This is substantially more than the action that is expected at the European Central Bank (ECB), after all, it is arguable the ECB has run out of space to cut rate any further.

It is the relative expectation that the Fed will cut deeper and more aggressively than the ECB, that is currently driving demand for the Euro. And where the EUR/USD goes, other Euro-based exchange rates such as the EUR/GBP tend to follow.

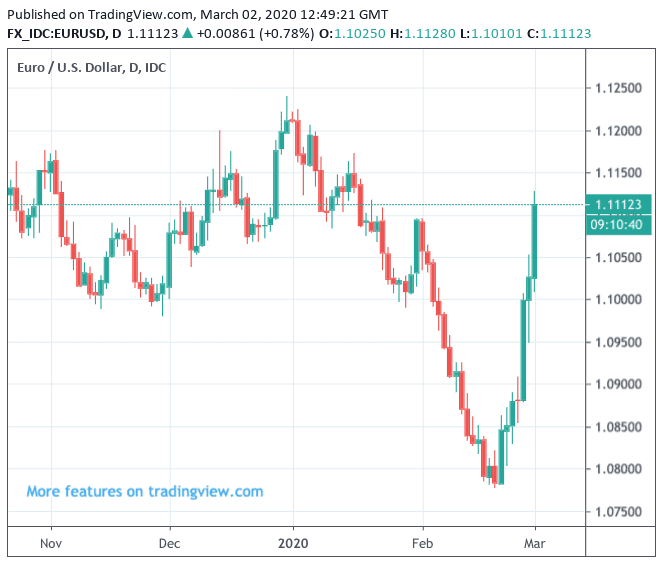

Above: The Euro pushes higher against the Dollar.

"We now look for the FOMC to cut rates 100 bps by the end of Q2-2020 due to the growth-slowing effects that the COVID-19 outbreak has imparted to the economy. However, the timing of the rate cuts is highly uncertain," says Jay H. Bryson, Acting Chief Economist at Wells Fargo.

We are finding economists are increasingly of the opinion that the Fed should act in a decisive manner to prevent the shock to confidence in global markets having a negative knock-on effect to the plumbing of the financial system.

"Not only has the stock market swooned, but corporate bond spreads have pushed wider. If the selloff in capital markets is sustained, banks could eventually tighten lending standards for businesses and households," says Bryson.

We also believe that a good portion of recent gains by the Euro are driven by a flow of investor capital from stocks into the Euro.

The Euro is known as a funding currency; Eurozone interest rates are at historical lows allowing investors to borrow in euros to spend on stocks. When markets are selling off there is a subsequent repatriation of euros, which in turn drives up its value.

So there are two factors at play here, making for a convincing rally in the single currency.

The Euro was up against all the majors apart from the traditional safe-haven Swiss Franc and Sweden's Krona as global investors further liquidated exposure to stocks, suggesting there is a sizeable flow out of stocks and into Euros.

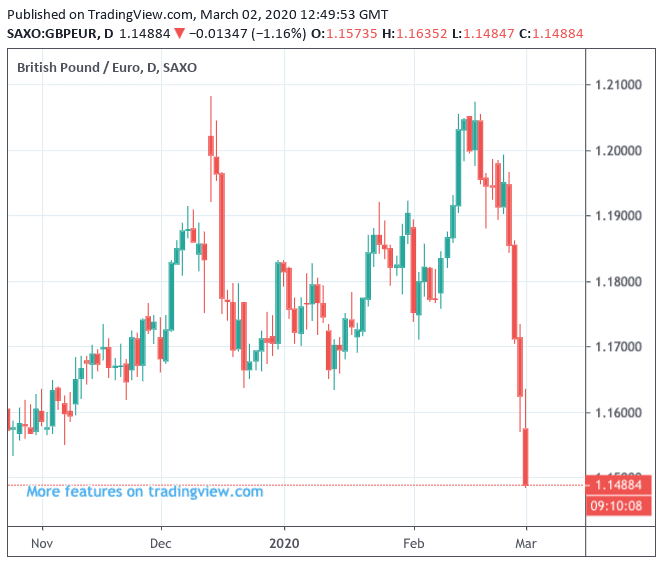

The Euro-Dollar exchange rate is up 0.60% on the day at 1.1116 while the Euro-Pound exchange rate is up a sizeable 0.90% at 0.8705. This gives a Pound-to-Euro exchange rate of 1.1488; this is the first time the Pound has bought less than 1.15 euros since October 15, 2019.

"Risk appetite continues to drive broader moves in G10 FX markets. This dynamic looks set to define trading for the foreseeable future," says Mark McCormick, Global Head of FX Strategy at TD Securities.

Global markets continue to reflect rising investor fears that the outbreak - and attempts to prevent the disease from spreading - will cause a substantial global economic slowdown.

China this weekend released data that showed containment measures enacted at the start of January had severely restricted economic activity. The Composite PMI - which gives a snapshot of economic activity for February - fell to a record low of 28.9, having been at 53.0 in January.

During the financial crisis of 2008 the activity indicator only went as low as 38.8.

Above: The Pound falls against a surging Euro

Asian stock markets opened higher at the start of the week, but at some point during the European session traders used any residual strength to shed further exposure to the markets.

"The markets are trying to stabilise after a week of almost unprecedented carnage for U.S. equities in particular, where market historians were pulling up data from nearly a century ago to find a point at which the market corrected so violently from a fresh all-time high. The chief culprit here was that this coronavirus outbreak struck as the market was pushing into extremely complacent territory in credit risk and volatility terms. Commodities did a far better jobs of immediately pointing to the fallout," says John J Hardy, Head of FX Strategy at Saxo Bank.

"From here, for markets to stabilise, the immediate key will be clear signs that the coronavirus breakout has properly turned the corner and that the number of new cases and pace of the spread is receding. Shortly put, we’re not there yet in a global sense," adds Hardy.

"The COVID-19 situation is evolving very rapidly," says Sharon Zollner, Chief Economist at ANZ. "A marked global slowdown is guaranteed, due to both demand and supply disruptions."