Pound Sterling vs. Euro Forecast: Finding Support; Outlook Still Tentative with Political Heat Expected to Start Building Once More

Above: Prime Minister Theresa May. UK politics will start to matter for Sterling once more. File photo. Image © Number 10 Downing Street

- GBP/EUR still languishing below 1.1600

- Could be forming bearish topping pattern

- May to be told she must exit office within weeks

- Euro to be driven by sentiment data

The Pound-to-Euro exchange rate is trading at 1.1558 at the start of the new week with holiday-thinned trading conditions ensuring volatility across global currency markets is low.

Most currencies saw limited movement in the run up to Easter as many traders closed out their positions ahead of the break.

The Pound rose, however, after the release of strong wage and retail sales data; the Euro too seemed to gain a boost from positive Chinese data - all in all gains for each cancelled each other out.

From a technical perspective, the forecast for GBP/EUR is little changed from the previous week when it crossed an important boundary after breaking below the key 1.1600 range highs. This changed our technical outlook from bullish to neutral.

The last week was marginally stronger but before then we had four down weeks in a row, which is not a particularly positive sign for the pair.

Downside momentum as measured by RSI is not particularly strong, suggesting the move lower in April may simply be nothing more than a pull-back rather than a reversal.

Overall we are neutral until a substantial directional move evolves in either direction clarifying the trend.

The break below the long-term range highs at 1.1600 and the move back inside the range would normally be an outright bearish sign, however, in this case the sluggish nature of the selloff as well as the probable fundamental reason underlying it suggest caution before adopting an outright bearish position.

The Pound’s decline seems illogical.

If anything it should have strengthened after the announcement of a delay in Brexit, give it is possible to argue risks have probably marginally eased. UK data has been stronger on balance than in the Eurozone.

These factors should have resulted in a stronger, not weaker Pound. The current pull-back seems, therefore, to lack fundamental ballast, and is probably more as a result of profit-taking due to Brexit being kicked down the road, rather than economic drivers. It is likely to thus be short lived.

One bearish factor, however, which cannot be ignored is the pattern - quite probably a ‘topping’ pattern, which has formed at the highs on the daily chart.

The pattern looks like a bearish double top or a fulcrum. For confirmation of more downside we would like to see a break below the neckline or 1.1463 March 21 lows. Such a break would probably usher in a deep decline to the next major target at 1.1345 where the 50-week MA is situated and likely to provide support. This could happen in the next 1-3 weeks.

A break above the 1.1802 highs, on the other hand, would suggest the pattern was actually just a consolidation in a short-term uptrend. Such a move would probably confirm a continuation up to a target at 1.1930, at the 200-week MA. This could well happen over a 1-5 month time horizon.

The 4hr chart shows the most recent decline in finer detail. It suggests a short-term downtrend may have started, with a bias to continuing lower. The sequence of peaks and troughs has turned lower and the pair has completed more than two lower lows and lower highs, which is an indication the trend may be bearish.

Ideally we would still like to see a break below the very important March 21 lows for confirmation, however, if pushed there is a marginal bias to more downside from the current level to those lows too. A break below last weeks 1.1515 lows could very well open the gates to a continuation down to 1.1465, although we stress this is not a conviction call. The timeframe would be within the first few days of next week.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Pound: What to Watch this Week

Politics is back on the agenda for Sterling as UK parliamentarians return to their desks.

A top member of Prime Minister Theresa May's Conservative Party will tell her in the coming week that she must step down by the end of June or her lawmakers will try again to depose her, the Sunday Times reported, without citing sources.

The pressure on May comes amidst a precipitous drop in support for the Conservative party after a lengthy Brexit delay was announced, with voters apparently flocking to the newly-formed Brexit Party of Nigel Farage. We see the implications of the sudden shift in domestic politics as posing downside risks to Sterling with a 'Brexit at all costs' likely to come on October 31.

The Conservatives, under May or a new leader, know further delays will only deeply damage the party's standing with the public.

A change in leader of the Conservatives could mean the UK could be under the leadership of a 'Brexiteer' Prime Minister by late summer, we believe this creates the kind of uncertainty that would weigh on Sterling over coming weeks and months.

According to the report, the Conservative Party could go as far as changing party rules on leadership change.

May survived a vote of no confidence in December with current party rules stating parliamentarians cannot challenge her again until a year has passed. Graham Brady - who oversees party rules - will tell May the rules will be changed unless she quits, the Sunday Times reports.

There is also the chance of a vote being held on whether the UK should remain in a customs union, which could cause a surge higher for Sterling if affirmative.

It is a thin week for UK data with the most important releases being the UK public borrowing data and figures from the Consortium of British Industry (CBI), which is often a useful leading indicator for the broader economy.

UK public borrowing basically measures how much the government needs to borrow to meet its outgoings in the month in question. The data on Tuesday is forecast to show a relatively small £50m (£0.05bn) sum was required to cover the shortfall.

The chart below shows how over time the government has reduced the amount it has needed to borrow to cover its outgoings. This is obviously a positive sign for the economy, both because it reduces the country’s reliance on outside lenders which can leave its currency more vulnerable, and also because it suggests the economy is generating more tax revenue, which is a sign of increased activity.

Public sector borrowing is not likely to move Sterling unless it surprises grossly higher or lower. Nevertheless, it provides useful background information. It is released at 9.30 BST.

The other key releases for the Pound are the CBI distributive trades and CBI industrial trends orders reports.

The former is a gauge of the “wellbeing of the retail sector” based on a survey of 150 retailers; the latter is a survey of manufacturers.

Both are considered important leading indicators and can impact on the Pound if the actual result differs substantially from the expected.

There is no official forecast for the retail survey which came out at -18 in March, but there is an official forecast for the manufacturing one, which is forecast to rise marginally to a balance of 2 from 1 in the previous month of March. The balance reflects the difference between positive and negative responses.

The Euro: What to Watch this Week

The Ifo German business sentiment index for April is a key release in the week ahead for the single currency.

It is scheduled for Wednesday at 9.00 BST when the Business Climate Index is forecast to rise to 99.9 from 99.6 previously. Current Conditions are forecast to rise to 108.7 from 103.8. Expectations are expected to fall to 94.7 from 95.6.

The Ifo is often viewed as a leading index for the wider economy so if it rises strongly it will often be taken as a positive sign for the Euro and can lead to gains for the currency.

Another key sentiment gauge for the Eurozone is official Eurozone consumer confidence in April, released on Monday at 15.00. This is forecast to show a balance of -7 from -7.2 previously. The balance reflects the balance of positive to negative survey responses. It can sometimes impact on the Euro if it varies from expectations dramatically. It is often a fairly accurate leading indicator of economic growth.

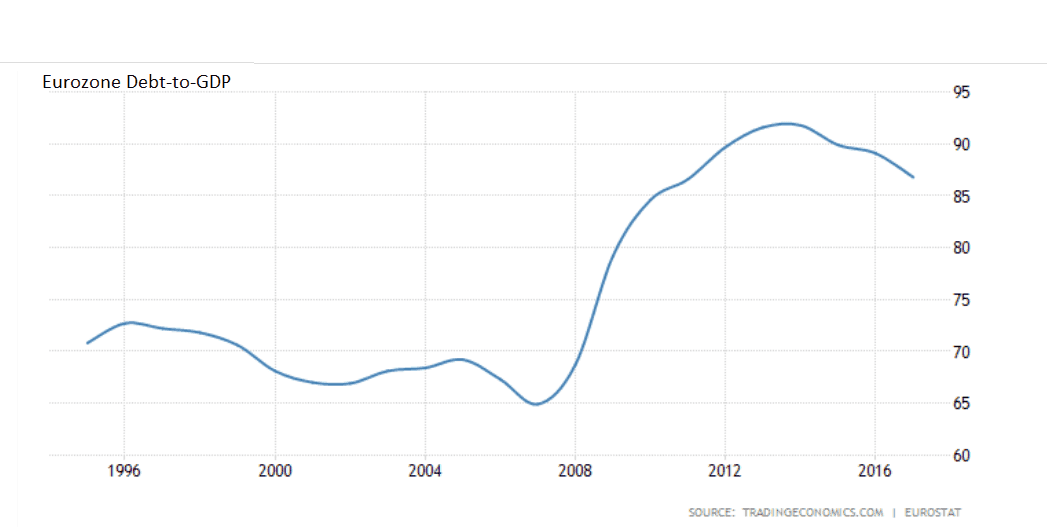

The overall average EU and Euro-area government debt to GDP stands at 86.8% and data out on Monday morning at 10.00 will provide an update of that figure. Debt remains a serious problem, especially for some members of the periphery. It can be a serious drag on growth since government’s have to allocate a greater and greater portion of their revenue to servicing their debt rather than infrastructure, welfare or other more growth-producing activities.

The gauge seldom impacts directly on the Euro but it can influence it over time.

Reduced growth potential weighs on the currency as it makes the region a less attractive place for international investors to invest, and this reduced demand for the currency.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement