British Pound will Jump towards 1.17 vs. the Euro if May's Deal Passes (on a 2nd or 3rd Attempt): UniCredit

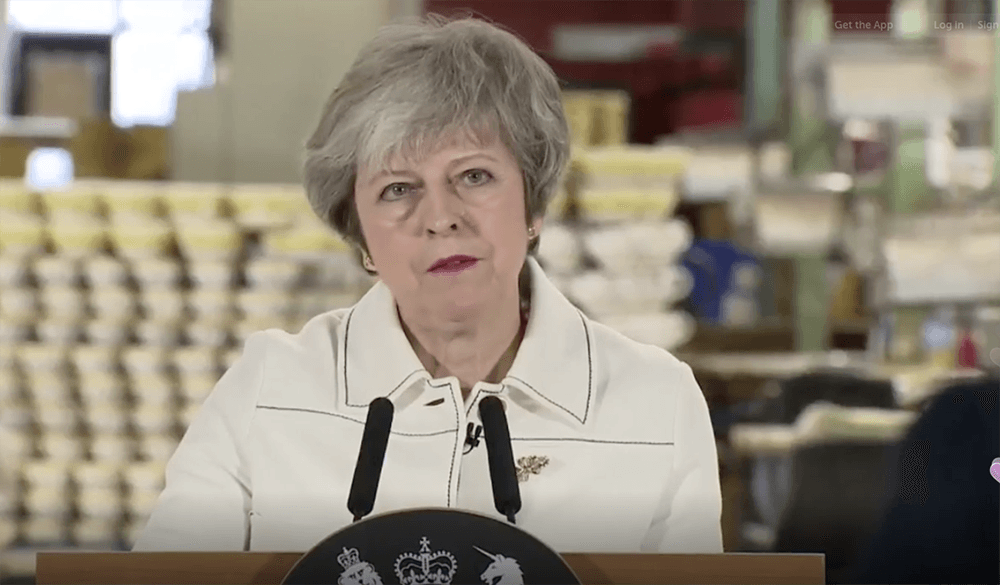

Above: Prime Minister Theresa May addresses reporters in Stoke-on-Trent a day before parliament's Brexit vote. Image © Pound Sterling Live.

- Brexit deal to be voted down by House of Commons on Tuesday

- But, we should expect up to three attempts by the Government to get deal passed

- Sterling is undervalued and will rally against the Euro on such an outcome say UniCredit

Foreign exchange strategists with UniCredit are expecting Theresa May's Brexit deal to succeed in parliament on a second or third attempt, and this should spark a strong rally in Sterling against the Euro.

Pound Sterling is trading firm as markets bet that defeat for the Brexit deal in parliament today does not spell the end for the deal, nor does it materially raise the chances of a 'no deal' Brexit transpiring. The Pound-toEuro exchange rate is quoted at 1.1232, but the pair had gone as high as 1.1265 on Monday, its best level since December 07.

Because the rejection of the deal is so well signposted most analysts are in agreement that the Pound's reaction to the result is unlikely to stir any major moves in Sterling. Rather, the scale of the loss could be important as a loss below 100 suggests that the Brexit deal might be able to pass on a second, or even third attempt.

Even if the government loses big on Tuesday, it is almost certain to bring the deal back to parliament for further votes, but some substantial changes to the legislation itself will be required to shift the dial in its favour.

We could see the government make changes to the legislation to win over Brexit supporting Labour MPs, and we could also yet see the EU come back with further concessions. While the EU have resisted making any big concessions as of yet, there is a chance they could act at 'zero hour', and we believe that time would be after the first vote has failed.

Foreign exchange strategists maintain a view that that movement will ultimately happen and the deal will pass, and this has positive implications for Sterling's outlook.

"Our base case remains that either the deal on the table or a slightly amended version of it will eventually pass in the Commons, at the second or third time of asking. We would expect sterling to rally across the board once it becomes clear that a deal will be found," says Katherin Goretzki, a foreign exchange strategist with UniCredit Bank.

Goretzki says should the deal pass the Pound-to-Euro exchange rate could rally and break through 1.1765.

A 'no deal' Brexit is meanwhile regarded as being "very unlikely" by UniCredit who note a majority of MPs have demonstrated their determination to prevent it.

"However, should the risk of a 'no deal' Brexit materialise, this would likely cause another period of sharp Sterling depreciation," warns Goretzki.

Under such an outcome, the strategist warns the Pound-to-Euro exchange rate could fall below to 1.0525, and potentially even lower.

UniCredit also see another referendum as being a potential way out of "the mire if there was still an impasse in the UK parliament at the eleventh hour," but a referendum is not yet regarded as a base-case scenario going forward.

The calling of a referendum would likely provide some initial relief to markets as it further cancels the prospect of a 'no deal' Brexit.

However, relief would be limited until the question itself is made clear (May's deal vs. no deal would probably be preferred to an option offering May's deal vs. Remain).

"At current levels of EUR/GBP, the market is pricing in a substantial Brexit risk premium, penalizing the GBP for the uncertainty surrounding a potential deal, but most importantly, for the risk of a 'no deal' Brexit. The medium-term direction of Sterling will therefore crucially depend on political developments in the coming weeks and months," says Goretzki.

UniCredit are one of the more optimistic institutions on Sterling, holding a mid-2019 forecast for GBP/EUR at 1.25, although they acknowledge downside risks to the call are growing on expectations of a broader rebound in the Euro. For GBP/USD, they expect a recovery to 1.35 by mid-2019.

Advertisement

Get up to 3-5% more foreign exchange by using a specialist provider than a bank. A specialist will get you closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here