The Pound Advances as "Probability of a No-Deal has Reduced"

Image © Melinda Nagy, Adobe Images

- Pound firm as clock counts down on Brexit vote

- Letter from EU confirms no new concessions before key vote

- But, EU said to be open to delaying Brexit date say reports

- Pound to surge if May's deal passes say UniCredit

The Pound has traded at fresh multi-week highs at start of what will be a momentus week in British politics. The Pound-to-Euro exchange rate quoted at 1.1212 on the interbank market but had been as high as 1.1228 earlier which represents Sterling's strongest level since December 07. The Pound-to-Dollar exchange rate quoted close to its November highs at 1.2869, its strongest level since November 26.

The gains in Sterling suggest to us that markets are increasingly confident that the chances of a 'no deal' Brexit have increased. "We had previously assigned the probability of 60:20:20 to an orderly Brexit, a no-deal Brexit, and no-Brexit, respectively, but revised this after the surprise ECJ ruling to 50:10:40," says a note to clients from investment bank JP Morgan, published Monday.

All eyes turn to Tuesday night's Brexit vote in the House of Commons which will allow markets to gauge the scale of opposition to the EU-UK Brexit deal. May will almost certainly lose the vote and this outcome alone won't bother the Pound. Rather, currency markets will be looking at 1) the scale of the loss and 2) indications of what the government's 'plan B' looks like.

Hopes for a decisive last-minute intervention by the EU to help increase support for the Brexit deal have been quashed as no big concession will come, at least before the first vote. The EU published a 'reassurance letter' at 11:00 AM on Monday which ultimately failed to offer Prime Minister Theresa May any legal assurances that the Irish backstop - if ever triggered - would be temporary. May requires such a legal guarantee to entice Brexiteer opponents in her own party, and Northern Ireland's DUP, to back the Brexit deal struck between the EU and UK back in November.

The letter from European Council President Donald Tusk and European Commission President Jean-Claude Juncker confirmed the EU prefers for any use of the backstop to be strictly time limited, and the EU would strive for its use to be avoided. The backstop is opposed by Brexiteers and the DUP as it would potentially tie the UK to EU trade laws indefinitely in the event of negotiators failing to find a solution that keeps the Irish border unhindered. The legal text in the Withdrawal Agreement says the backstop, if triggered, can only be exited if the subsequent trade agreements struck between the EU and UK guarantee no hard border will ever be required on the island of Ireland.

Juncker and Tusk assure May their pledge carries legal weight. While stressing that nothing in their letter could be seen as changing or being inconsistent with the draft treaty agreed with May last month, they said a commitment to speedy trade deal made by EU leaders had "legal value" which committed the Union "in the most solemn manner".

However, opponents of the Brexit deal have dismissed this reading, saying it is the Withdrawal Agreement alone that carries legal standing, therefore unless the Withdrawal Agreement reflects the temporary nature of the backstop, the potential for the backstop to run indefinitely remains real.

This means May heads into Tuesday's parliamentary vote on the EU-UK Brexit deal with no fresh leverage ensuring the deal will likely suffer a +100 MP defeat.

Importantly, no legal assurances on the matter have been provided by the EU, ensuring this letter is effectively dead rubber as far as shifting the outcome of Tuesday's vote is concerned.

The EU had been expected to present further concessions in order to help Theresa May sell their deal, the timing of the move was however less certain: would it come before the first vote or ahead of a second vote once the scale of the loss of the first vote was made clear? Could the EU come back with further assurances after the first vote fails? Based on today's letter, we doubt it.

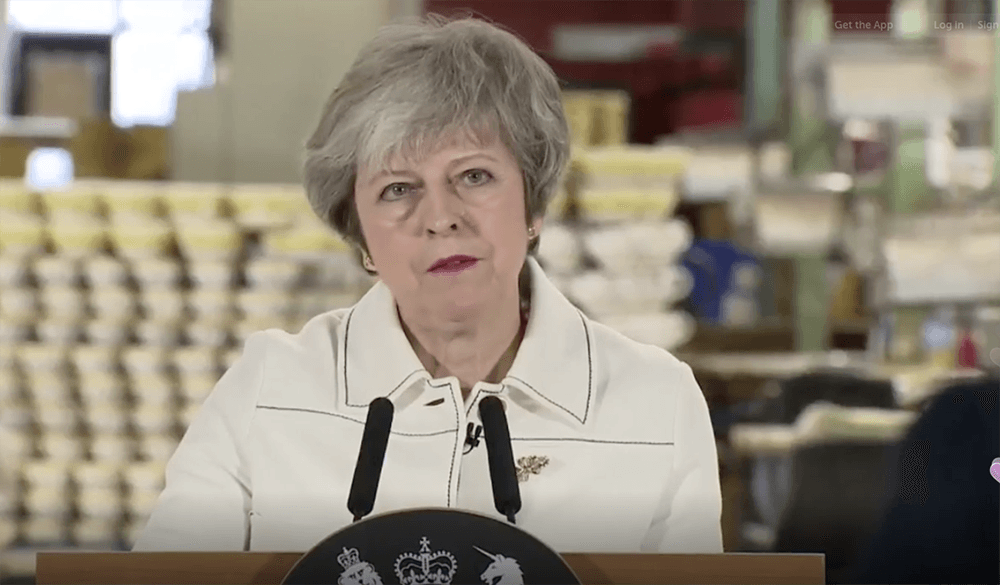

Above: Prime Minister Theresa May addresses reporters in Stoke-on-Trent a day before parliament's Brexit vote. Image © Pound Sterling Live.

UK Prime Minister Theresa May has meanwhile told an audience in Stoke-on-Trent that she believes the letter published by the EU does carry legal force, but acknowledges that it does not go as far as she would have liked. May adds the UK will be leaving the EU on March 29, and she does not see any reason to extend the Article 50 process and delay the date of departure.

In the speech that comes a day before the key Brexit vote in the UK parliament, May does however say "there are some in Westminster who would wish to delay or even stop Brexit and who will use every device available to them to do so". This represents a clear warning to advocates of Brexit that they might end up with no Brexit at all if they fail to back her.

She adds that, based on the evidence of the last week, she believes it is more likely that members of parliament will block Brexit than allow Britain to exit with no deal. Last week saw the government suffer two defeats in parliament as Conservative 'remain rebels' joined forces with opposition parties to vote on pieces of legislation that seek to frustrate the government's ability to plan for a 'no deal' Brexit.

While May's reading of the situation is disconcerting to Brexit purists who prefer a 'no deal', it is good for Sterling which would likely suffer sharp falls in such an event. And according to FX strategist Hans Redeker with Morgan Stanley, the Pound should see limited weakness going forward as a result.

"The probability of a 'no deal' Brexit has reduced. While the government is likely to be defeated in the Brexit meaningful vote tomorrow, this is in line with market expectations and may generate only limited GBP weakness. Given the way forward suggests a higher likelihood of a soft Brexit outcome – although there may be a phase of higher volatility first – we look to fade any GBP weakness," says Redeker in a note to clients dated January 14.

Advertisement

Get up to 3-5% more foreign exchange by using a specialist provider than a bank. A specialist will get you closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Article 50 Extension being Mooted by EU

Media reports on Monday morning meanwhile suggest the EU is readying to delay Brexit by extending the Article 50 period at the request of the UK.

The Guardian's Daniel Boffey reports, "the country’s 29 March deadline for exiting the EU is now regarded by Brussels as highly unlikely to be met given the domestic opposition facing the prime minister and it is expecting a request from London to extend article 50 in the coming weeks."

An EU official told the Guardian: “should the prime minister survive and inform us that she needs more time to win round parliament to a deal, a technical extension up to July will be offered.”

This story follows up a separate report carried by the Evening Standard last week which cited unnamed ministers who believe a delay to Brexit is inevitable.

The British Pound rallied in response to the news with markets believing a delay would be a prudent course of action to pursue and diminishes the prospect of a 'no deal' Brexit owing to the increasingly limited time remaining between now and Brexit day.

We believe anything other than a 'no deal' Brexit outcome would ultimately see the British Pound move higher.

"Our base case remains that either the deal on the table or a slightly amended version of it will eventually pass in the Commons, at the second or third time of asking. We would expect Sterling to rally across the board once it becomes clear that a deal will be found," says Kathrin Goretzki, a FX strategist with UniCredit Bank in Milan.

In the event of the deal passing, UniCredit see the GBP/EUR exchange rate rising to 1.1765.

"A no-deal is very unlikely as a majority of MPs have demonstrated their determination to prevent it. However, should the risk of a no-deal Brexit materialise, this would likely cause another period of sharp sterling depreciation," adds Goretzki.

MPs will vote on the EU-UK Brexit deal at 19:00 on Tuesday.

With the government expect to suffer a sizeable defeat, we would not expect Sterling to move substantially as the result has been so well signposted: markets are expecting the outcome and only a major surprise would likely move markets.

Such a surprise would be if the loss is narrower than many had been expecting, i.e. is less than 100. Such an outcome could see Sterling move higher.

We are however of the belief that it is what comes next which is more interesting: expect the Labour Party to table a no confidence vote in the government, which will ultimately prove futile as even the prospect of Conservative 'remain rebels' supporting the motion is highly unlikely while the DUP have stated they will not vote against May in the event of her deal failing.

We expect further negotiations with the EU and we also expect negotiations between the government and Labour MPs to be stepped up. As we noted last week, it could well be Labour's Brexit supporting MPs that ultimately seal the deal for Prime Minister May.

Advertisement

Get up to 3-5% more foreign exchange by using a specialist provider than a bank. A specialist will get you closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Killing the 'No Deal' Brexit

Nick Boles, a prominent opponent of a 'no deal' Brexit in the Conservative party has shone a light on how a majority of MPs opposed to a 'no deal' Brexit would effectively prevent such an outcome.

Speaking on BBC 4, Boles says he and others will call for a vote that would give parliament's Liaison Committee the job of finding a Brexit plan that can get through the House Commons if May fails to come up with a Plan B that commands a majority.

However, Labour MP Mary Creagh who sits on the Liaison Committee says this is the first she has heard of this "cunning plan", warning the "idea that 30 MPs can agree among selves on Brexit, let alone persuade Government & backbenchers from across the house is wishful thinking."

The important point to note in all this is that the mechanisms by which parliament can control the Brexit narrative is finally starting to flesh out. This weekend the Times reported that MPs were seeking to deny the government the ability to govern via a change parliamentary rules.

Under the scheme, motions proposed by backbenchers can take precedence over government business, ensuring the agenda on Brexit effectively passes from the government to the parliamentary majority opposed to a 'no deal' Brexit. We know the speaker of the House, John Bercow who effectively sets parliamentary business, is sympathetic to the 'remain' cause and would likely allow this unprecedented move to proceed.

These developments are supportive of Sterling as they diminish the prospect of a 'no deal', but we believe they are potentially destabilising longer-term in that they represent not so much a coup against the government but a coup against the people who voted for Brexit in 2016.

Therefore, it could open the door to years of bitter division in UK politics which we believe is not consistent with a Pound valued at its true potential longer-term.

"On the face of it a rejection of the UK PM's Brexit deal and a forced stay in the EU may be taken as good news for sterling but it's clearly bad news for a Government that's been determined to leave. The political turmoil that's likely to follow if the UK is effectively forced to remain, whether temporary or lasting, is bad news," says Jeremy Boulton, an analyst with Thomson Reuters.

Boulton adds, traders might do well buying GBP on the back of the growing expectation that the UK will stay part of the EU for longer but then look to sell into the post-vote rally, anticipating the worsening of the UK economy that's arisen because of the stalemate is set to continue while the government is focused on Brexit and not on domestic matters."