Dollar Pares Advance on Spike in Jobless Claims

- Written by: Sam Coventry

Image © Adobe Images

Some heat has been taken out of the Dollar after a measure of the U.S. labour market showed unexpected weakness, bolstering chances for further Federal Reserve rate cuts beyond September.

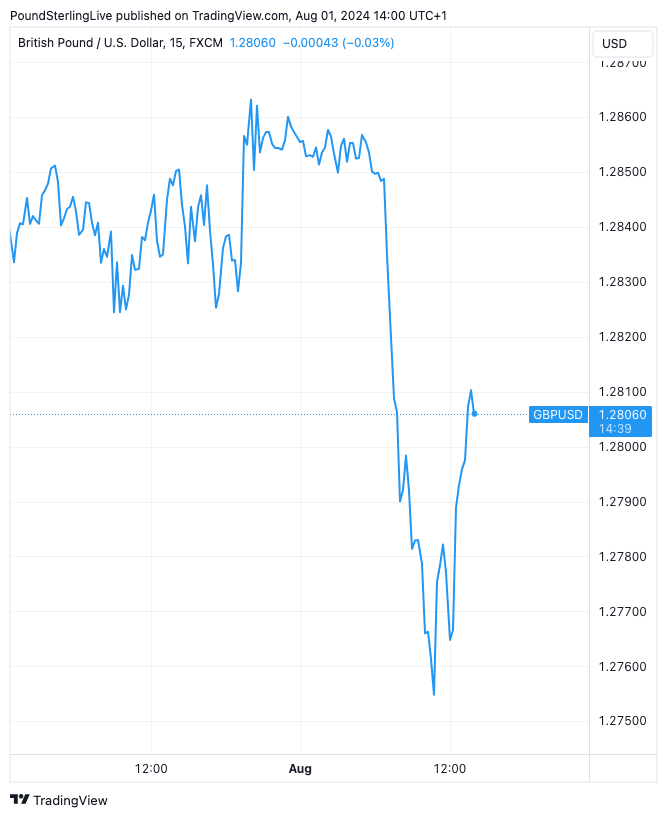

The Pound to Dollar exchange rate pared its losses to go back above 1.28 after initial jobless claims rose by 249k last week, from 235k the week prior and above the consensus expectation for 236k.

The Dollar index slid to 104.23, and the Dollar exchange rate recovered earlier losses to 1.0797.

This is the highest jobless claim figure in a year and comes a day ahead of the U.S. non-farm payroll jobs report. "Layoffs still appear to be on a renewed rising trend, as high borrowing costs force businesses to reduce costs and shelve expansion plans," says Oliver Allen, Senior U.S. Economist at Pantheon Macroeconomics.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Our bet is that labour market weakness will accelerate between now and the end of the year, leading to U.S. recession and an even more rapid pace of rate cuts than is already priced," says Ryan Swift, an analyst at BCA Research.

Should the reassessment prove correct, and the market moves to price in more by way of Fed rate cuts, the Dollar will fall.

The Federal Reserve said on Wednesday it was likely to cut interest rates for the first time in September, judging that there were growing signs of deterioration in the labour market. These jobless claims underpin this observation, raising the odds of another rate cut before year-end.

Above: GBP/USD has recovered some of its recent weakness. Track GBP/USD with your custom alerts; find out more here

"A reduction in our policy rate could be on the table as soon as the next meeting in September," said Federal Reserve Chair Jerome Powell at Wednesday's policy update.

"With these words, Powell clearly opened the door to a cut in the very near term. The September cut looks like a done deal – and markets are fully priced for that outcome," says Evelyne Gomez-Liechti, Rates Strategist at Mizuho Bank.

Powell said substantial progress had been made with regard to the Fed’s dual mandate of price stability and maximum employment.

"The Fed no longer considers the labour market to be a source of inflationary pressure and is watching closely for signs of further softening," says Luca Cazzulani, Head of Strategy Research at UniCredit.

For the Dollar, much of the upcoming rate cuts are already 'in the price', which could limit the extent of further weakness in the short-term.

However, further disappointing job figures will see markets accept more cuts are coming down the line, which can ultimately send the Dollar lower again.