Pound to Dollar Exchange Rate Week Ahead Forecast: Big Supports to be Tested

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate (GBP/USD) is under pressure at the start of the new week, and we will watch for key support levels to be tested in the coming days.

The Dollar strengthened after Donald Trump convincingly won the U.S. presidential election and the Republican party took the Senate. The House of Representatives is all but certain to be held by the Republicans, giving Trump a strong hand in shaping his economic agenda, one that is overwhelmingly bullish for USD.

"The USD bull case remains a convincing one, with US economic outperformance still clear for all to see, and with risks around the FOMC outlook becoming somewhat more two-sided into 2025, amid Trump’s reflationary fiscal agenda, and the inflationary risks posed by the imposition of tariffs," says Michael Brown, a strategist at Pepperstone.

Yet, the Pound withstood the U.S. Dollar's onslaught better than most major currencies, and GBP/USD is left consolidating within a range defined by 1.30 at the top and 1.2834 at the bottom.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The coming week could see price action contained within this area, but with the lower end tested before any rebound to 1.30 can take place.

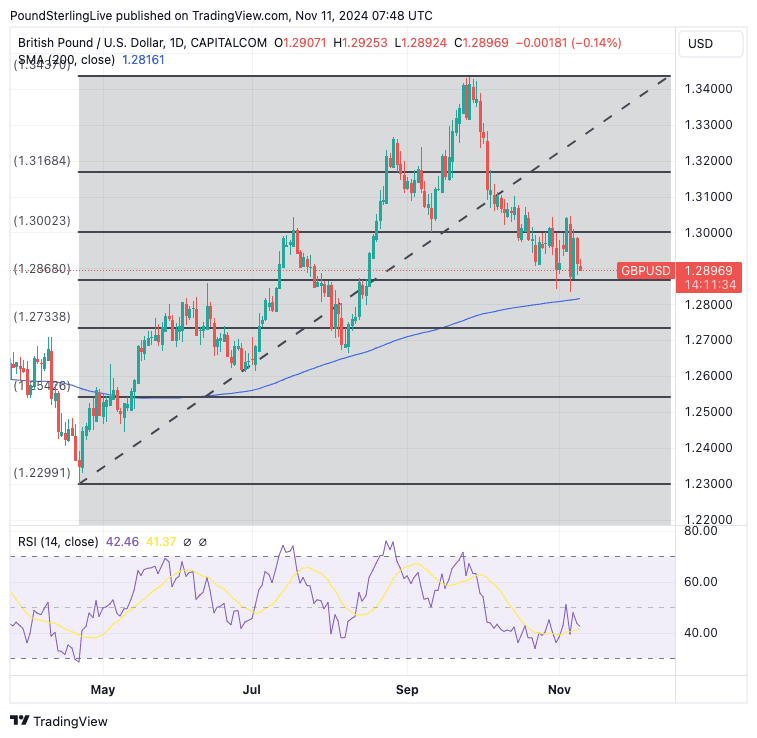

With this in mind, we are watching the 50% Fibonacci retracement of the April to September rally. This is located at approximately 1.2868, which coincides with the lower end of the aforementioned range.

The 200-day moving average is also rising into this support area, currently at 1.2816, and is likely to offer further support.

Above: GBP/USD with Fibonacci retracement lines shown and the 200-day moving average (blue line).

So, we are seeing strong support levels come in, which can ensure GBP/USD doesn't fall too much further.

That said, any pro-USD impulse would potentially break this confluence of support and we could then witness a rapid decline towards the August lows at 1.2664.

The main event on the USD's calendar is the release of inflation data, due Wednesday.

Here, the expectation is for a reading of 0.2% month-on-month and 2.6% year-on-year. Anything more and we could see the USD catch a bid.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

However, there has been a significant repricing away from Federal Reserve rate cuts during October as investors prepare for U.S. economic outperformance, with the market now seeing a limited number of cuts forthcoming in 2025.

We think delivering a material reduction in rates would take a significant upside surprise for the USD. This is because a large part of the reduction in rate cut bets has already taken place, and it is difficult to see too much by way of USD upside in response.

Instead, the bigger reaction could follow a softer-than-forecast outcome, given there is now more space for markets to rebuild rate cut bets.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

This week's key event for Pound Sterling arrives on Tuesday when the UK releases wage and employment data.

These numbers are typically a key component of the Bank of England's decision on interest rates, and any sign that wage pressures are easing could bolster the case for a December rate cut.

The market looks for average earnings to have declined to 4.7% in September, with the figure falling to 3.9% for earnings with bonuses included. The unemployment rate is expected to have risen slightly to 4.1%.

The September data precede the budget, which looks to have been a job killer owing to the significant costs associated with employing staff (national insurance paid by employers was hiked, but the threshold at which they start paying the tax was lowered significantly).

The official data will only start covering the fallout of the decisions announced by Chancellor Rachel Reeves early in 2025.

We think the signal coming from more timely surveys, such as November's PMI survey, will be more important in this regard.

Would the Bank of England be in a position to cut interest rates if it thinks the labour market is deteriorating? Usually, the answer would be yes.

But Reeves' budget is also set to boost inflation well above 2.0% in the coming months which will tie the Bank's hands and keep interest rates higher for longer.

We will hear from Bank of England Governor Andrew Bailey midweek and then again on Thursday, where he should address last week's policy decision and matters concerning the budget's impact on policy.

His commentary could offer some near-term volatility.

The week concludes with a tranche of GDP data for the third quarter. This can provide some near-term price action. However, we don't think it will have a lasting impact on Sterling exchange rates.

This is because the third quarter is clearly in the rearview mirror, particularly given the changes to policy settings announced in the budget.