Pound-Dollar Ticks Higher on Stronger than Expected Rise in Employment

- Written by: Gary Howes

Image © Adobe Stock

The Pound caught a bid on Tuesday in the wake of better than expected labour market statistics, confirming our suspicions that the currency was likely to become increasingly responsive to data releases in the short-term.

The ONS on Tuesday reports 84K jobs were created in the three months to March, up on the -73K reading in the three months to February.

The result was a beat an expectation for a reading of 50K.

"The latest estimates for January to March 2021 show signs of recovery, with a quarterly increase in the employment rate," said the ONS.

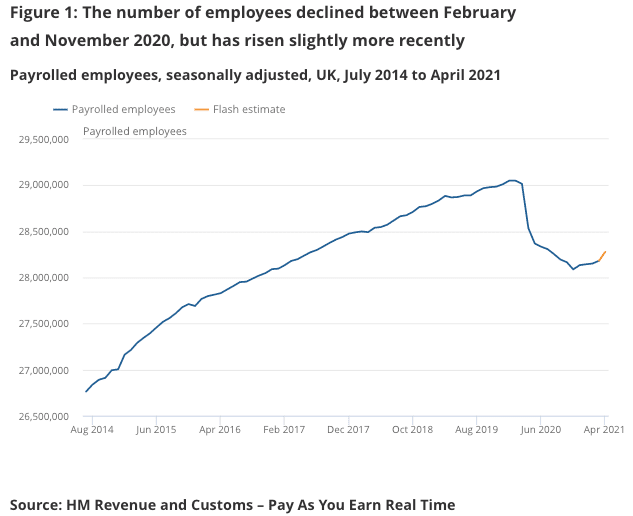

The number of payroll employees has now increased for the fifth consecutive month but still remains some 772K below pre-coronavirus pandemic levels.

The Unemployment Rate for March meanwhile fell to 4.8%, better than the 4.9% the market was expecting and the 4.9% printed in February.

The Pound-Dollar exchange rate edged up to its highest level since February 25 at 1.4170 following the release:

Above: GBP/USD was bid in the minutes following the 07:00 data release.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Policy makers at the Bank of England have said they would like to see the labour market firm before they consider raising interest rates and the market will bet that such a move will only come sooner should unemployment recover at a faster rate than current Bank forecasts envisage.

The general rule of thumb is that when expectations for a rate rise are brought forward the Pound benefits.

The rise in employment was met with a rise in the Average Earnings Index (+ Bonus) to 4.0% in March, which is less than the 4.5% the market was expecting and the 4.5% published in February.

The ONS has said the rise in pay during the covid crisis has largely been the result of lower paid workers falling out of employment: the ONS says since February 2020, the largest falls in payrolled employment have been in the hospitality sector, among those aged under 25 years, and those living in London.

The lower-than-expected rise in pay for March could therefore be linked to a rise in employment, suggesting these lower paid jobs are returning.

Looking at job vacancies, the ONS says the number of vacancies reached its highest level since January to March 2020.

Most industries were said to be displaying increases over the quarter, most notably, accommodation and food service activities.

Both the ONS experimental single-month vacancies measure and the experimental Adzuna measure showed strong increases in April.

However, the headline number of job vacancies remains below the pre-pandemic levels, with arts, entertainment and recreation, and accommodation and food service activities industries the worst affected.

"This recovery was driven by a 1.2% increase in full-time roles; part-time employee numbers dropped by 2.0%," says Samuel Tombs, UK Economist at Pantheon Macroeconomics. "The recovery in employment should gather momentum over the coming months."

Despite the improvement in today's data, Pantheon Macroeconomics expect redundancies to start rising again.

This projection is based on the numbers of people still held in the furlough scheme, with the ONS reporting some 4.2M people - or 15% of all employees — were still furloughed at the end of March.

"That number never dropped below 2.4M last year, despite nearly all businesses reopening. While most furloughed staff will return to their former roles, a significant minority won’t, especially in sectors such as retail where over-employment is rife," says Tombs.

Pantheon Macroeconomics expect redundancies to pick up again from July, when employers will have to cover 10% of the missing wages of any furloughed staff, and then jump in September, the final month of the scheme.

As a result, they forecast the unemployment rate to fall to a low of about 4.5% by June, before rising to around 5.2% in the fourth quarter.