GBP/NZD Week Ahead Forecast: 2.1222 Targeted

- Written by: Gary Howes

Image © Adobe Images

The Pound and New Zealand Dollar have a lot of fundamental similarities, which have conspired to suppress volatility in the Pound to New Zealand Dollar exchange rate (GBP/NZD).

For one, New Zealand and the UK have the highest central bank policy rates in the G10 now that the Federal Reserve has lowered its rate, which makes UK interest rate-yielding assets more attractive to global investors.

As long as financial volatility remains low - which economists think is possible - the NZD and GBP should see ongoing demand. However, the relative advantages offered by both currencies is conspiring to make the GBP/NZD exchange rate a rather uneventful prospect:

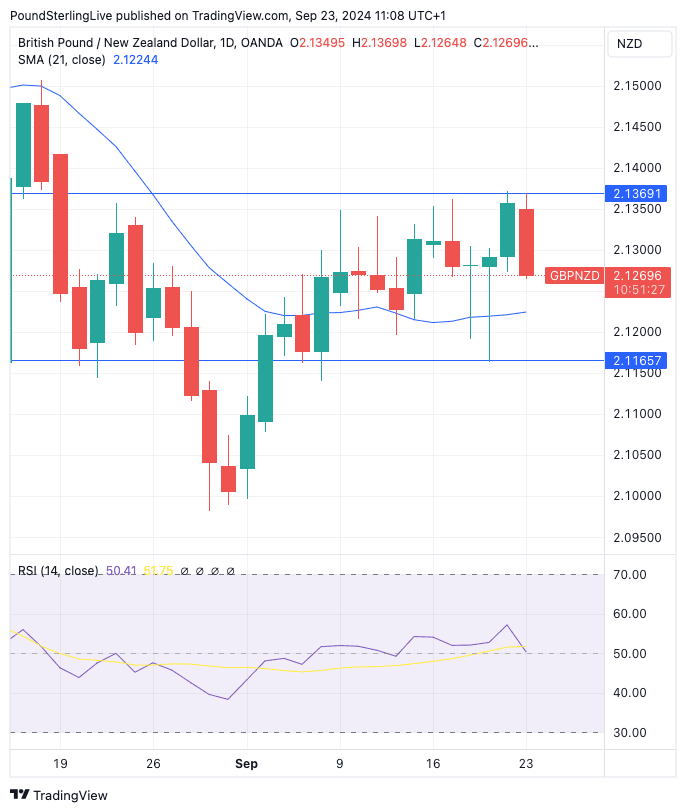

Above: GBP/NZD at daily intervals.

As the above shows, the pair is respecting an unprecise graphical range located between 2.1367 and 2.1165. The 21-day moving average is acting as a magnetic support and Monday's drop is reinforcing that magnetism, hence a fall to 2.1222 in the coming days is our preferred bet.

However, downside can extend to the graphical horizontal support loosely based around the aformentioned 2.1165 level. Expect GBP/NZD to stay heavy as long as global equity markets are rising, as the NZD has a stronger correlation to global risk sentiment than does the GBP.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The calendars in New Zealand and the UK are relatively quiet this week, and this will leave GBP/NZD watching sentiment, with any market declines potentially bolstering GBP/NZD and allowing for a potential retest of 2.1367.

Any weakness should be limited: last week's 50 basis point rate cut at the Federal Reserve boosted investor sentiment and helped global markets increase in value and the prospect of further rate cuts could offer further gains.

"While we do not expect the FOMC to cut the Funds rate as much as the market predicts, the USD is likely to fall while volatility is low and risk appetite is high. FOMC chair Powell and Vice chair Williams speak on Thursday. We expect neither to push back against the positive market reaction to the outsized 50bp interest rate cut," says Kristina Clifton, a foreign exchange analyst at Commonwealth Bank.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

This week’s most notable U.S. risk event will be Friday’s core PCE figures, which is the Fed’s preferred inflation gauge.

Markets look for inflation to have risen 0.1pp to 2.7% year-on-year in August. Rising inflation is at odds with generous expectations for Fed rate cuts, and should the market sober up somewhat, the Dollar can recover.

Keep an eye on the various Federal Reserve policymakers who are due to give speeches this week. Any sounds of caution regarding the pace of future cuts can give the market reason to rebalance lower from last week's euphoria.

"Fedspeak returns with a vengeance this week, as a whole host of policymakers make remarks now that the ‘blackout’ period has concluded. Thursday’s comments from Chair Powell, dissenter Bowman, and NY Fed President Williams will be of most interest to participants," says Michael Brown, an analyst with Pepperstone.