GBP/NZD Week Ahead Forecast: Threatening Another Breakdown

- Written by: Gary Howes

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is forecast to remain under pressure in the coming days, but a strong U.S. job print could offer the Pound some relief.

GBP/NZD dropped 2.25% in April, the biggest monthly drop since September 2023. This is a signal that the tide has turned in favour of the Kiwi recently.

The New Zealand Dollar has been buoyed by expectations that the antipodean central banks will be amongst the last of the major central banks to cut interest rates, bestowing a degree of support via the interest rate channel.

A broader recovery by the Pound following April's above-consensus inflation print and the calling of a general election stabilised GBP/NZD. However, it's important to note the potential risks of further downside in the near term, urging our audience to exercise caution.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

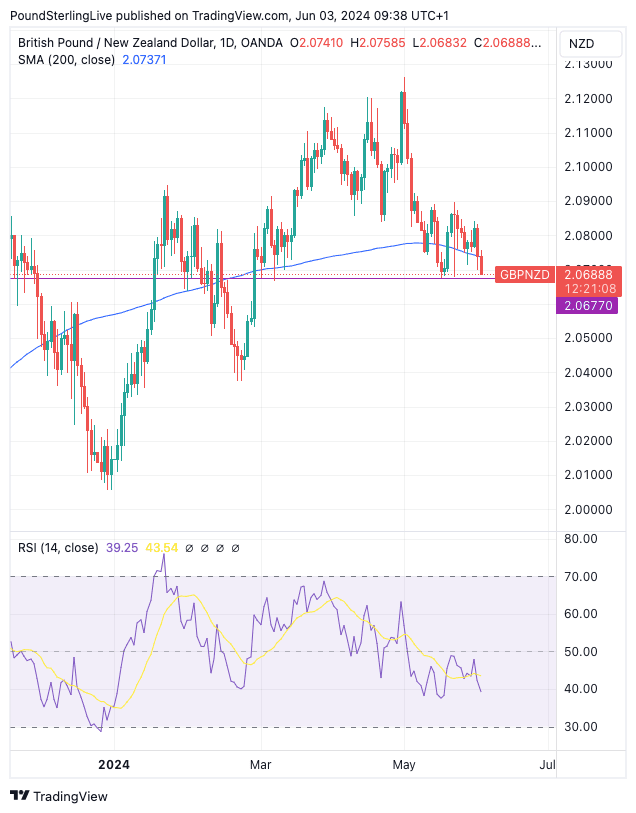

At the time of writing on Monday, we're back below the 200-day moving average, and we will be watching to see whether the exchange rate closes below here today and in the coming days. The RSI is at 39 and pointed lower, confirming the downside is favoured in the next few days.

If the pair registers a string of closes below the 200 DMA, we will take that as confirmation of a decisive flip in fortunes from the upside to the downside of GBP/NZD. A break below horizontal support at 2.0677 is being threatened as part of this mix; moves below here would take the market back to the February lows at 2.04 in the next two to four weeks.

Above: GBP/NZD at daily intervals. Track GBP/NZD with your own custom rate alerts. Set Up Here

A breakdown of this support then opens the door to the late-2023 lows at 2.01.

There are no significant calendar events due from New Zealand or the UK this week, leaving the focus squarely on the global setup.

We will be watching Thursday's European Central Bank (ECB) policy decision where interest rates are to be cut by 25 basis points. But, we see risks of policymakers warning it is too soon to speculate about further rate cuts owing to recent signs Eurozone inflation is proving resilient.

This would add to the sense that global interest rates won't be falling quickly, which will act as a headwind to stock markets and risk-sensitive currencies like the NZD.

In the same vein, Friday's U.S. labour report will be instrumental in determining when the U.S. Federal Reserve cuts interest rates.

The market is looking for a headline non-farm payroll reading of 180K and an unemployment rate of 3.9%. Average hourly earnings are expected to have risen 3.9% year-on-year.

If the data comes in at softer-than-expected levels, the New Zealand Dollar would potentially be a leading beneficiary.

This is because a soft print would suggest to the market that U.S. interest rates will be cut sooner than previously expected, which can boost global investor sentiment and stock markets.

NZD is a 'high beta' currency, meaning it tends to benefit when stock markets are rising and investors are confident. Under such a scenario, a breakdown in GBP/NZD and a resumption of the April selloff might ensue.

"If U.S. labour market data are on the soft side, markets may upgrade the likelihood of a first rate cut in July, which would weaken the USD even more," says Dominic Schnider, a strategist with UBS' Chief Investment Office.

An above-consensus job report would have the opposite effect, as markets would be resigned to a belief the Fed will struggle to get away with a rate cut before year-end.

Indeed, the risks would grow that the Fed will not cut rates until 2025, potentially meaning the Fed cuts after the RBNZ and diminishes any yield advantage the Kiwi Dollar has recently garnered.

Falling stocks and souring investor sentiment can lead to notable NZD underperformance and a potential break by GBP/NZD back towards 2.09 and into a more constructive technical setup.