GBP/NZD Week Ahead Forecast: Bouncing Off Crucial Support

- Written by: Gary Howes

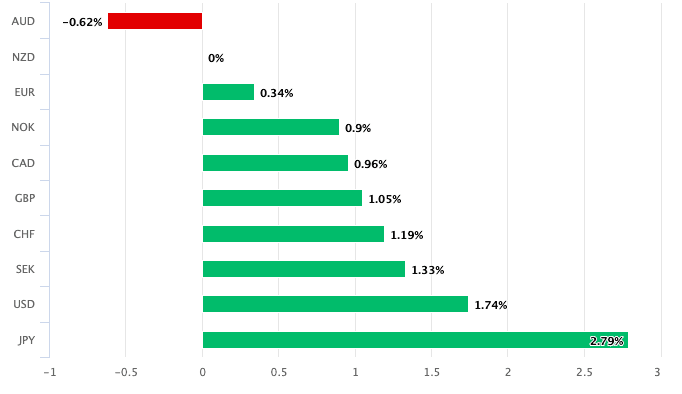

Above: NZD is down against all G10 peers on Monday.

The New Zealand Dollar starts the new week on a soft footing following news inflation expectations in New Zealand have fallen, increasing the odds that the Reserve Bank of New Zealand can cut interest rates later this year.

RBNZ data showed shorter-term inflation expectations continued to trend lower in Q2. Meanwhile, longer terms were largely unchanged. "The RBNZ will be pleased to see inflation expectations broadly drifting lower to levels that are more consistent with the RBNZ’s 1-3% inflation target," says Kim Mundy, Senior Economist at ASB.

Following the release, the New Zealand Dollar is the day's worst-performing major currency and has fallen against all its G10 peers, suggesting markets see the potential for the RBNZ to strike a 'dovish' tone at next week's interest rate meeting.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

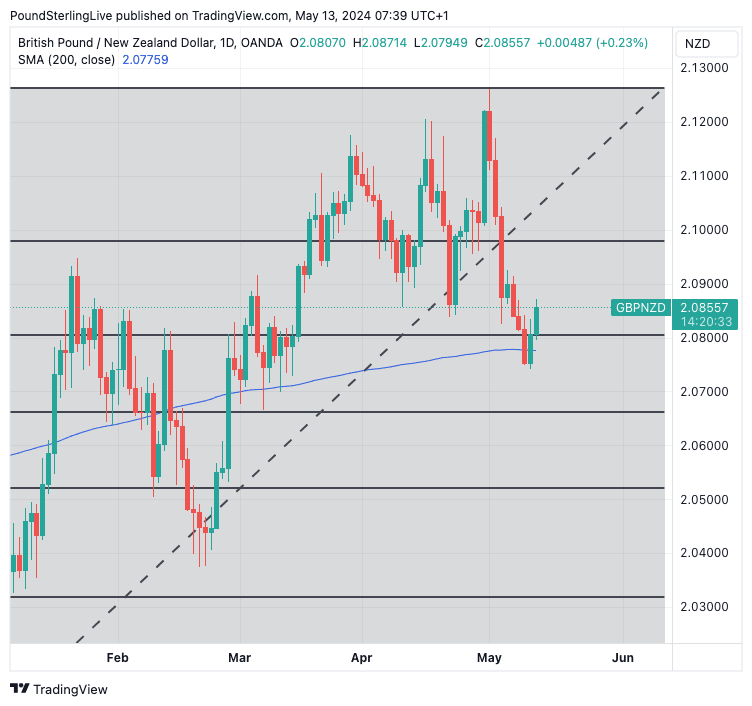

NZD weakness has helped the Pound to New Zealand Dollar exchange rate recover from last week's lows to 2.0855, having found support at the 200-day moving average, currently located at 2.0775.

The 200 DMA was always likely to prove a strong technical support area, and this is playing out. We will look for weakness to be faded here in the coming days:

Above: GBP/NZD at daily intervals with Fibonacci retracement lines (of the 2024 rally) and the 200-day moving average annotated. Track GBP/NZD with your own custom rate alerts. Set Up Here

Should the 200 DMA hold, we can see the pair extend higher short-term; however, for now, it appears strength will be limited. Resistance is seen at 2.0979, which is the 23.6% Fibonacci retracement of the 2024 rally.

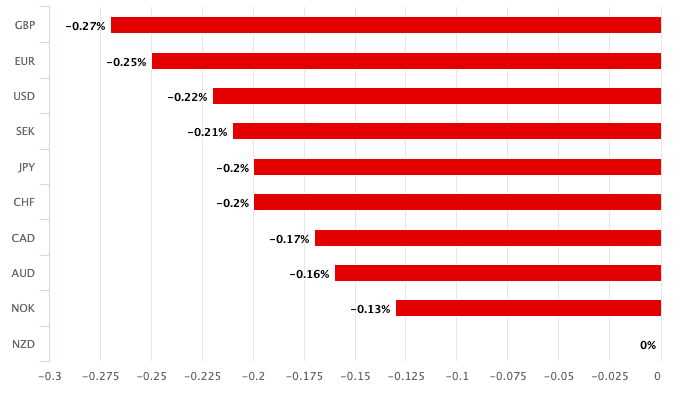

Although the NZD starts the new week on a soft footing, it is still one of the best performers of the past month; in fact, it sits just behind the Aussie Dollar in the G10 performance stakes:

Above: When tracked over a month, the NZD is the second-best performing G10, courtesy of a broader improvement in investor sentiment, which is in turn linked to the Fed.

Antipodean outperformance against the Pound, Euro and Dollar owes itself to growing expectations for a September interest rate cut at the Federal Reserve which has bolstered global investor sentiment. But this recovery will be undermined if Wednesday's U.S. inflation figures beat expectations and once again lower the odds of a September cut.

"We expect the core CPI for April to be stronger than the prediction of the consensus of U.S. economists," says Kristina Clifton, an analyst at Commonwealth Bank of Australia. "A strong core CPI will put at risk current market pricing for a September start of the FOMC’s interest rate cutting cycle."

However, a soft U.S. inflation print will turbocharge risk sentiment, sending the Kiwi Dollar higher and pushing the GBP/NZD exchange rate below the 200-day moving average once more. This will especially be the case if this week's UK wage data undershoots expectations on Tuesday. (For the UK week ahead, please see here).

Second-tier data prints from New Zealand will be released in the coming week, but they will be important in finessing expectations ahead of the May 22 Reserve Bank of New Zealand interest rate decision.

Markets are priced for an RBNZ interest rate cut this year, but economists at Westpac warn that rates will not be cut until early 2025.

This is an important view; a later start day to the cutting cycle can ultimately support the NZD in the coming months.

Westpac's Senior Economist Darren Gibbs says to watch New Zealand's migration update, due Tuesday.

The issue of migration is important for the RBNZ in that immigrants are easing labour market tightness (lower wages = lower inflationary pressures = earlier rate cuts).

But they are also a source of demand in the economy, which can boost prices.

"Net migrant inflows seem to have slowed a little in recent months but remain at very high levels. There is considerable uncertainty about how quickly inflows will respond to the weakening labour market that is now in train," says Darren Gibbs, Senior Economist at Westpac.