GBP/NZD Week Ahead Forecast: Turning Higher Again, NZ Inflation Release in Focus

- Written by: Gary Howes

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate (GBP/NZD) could be turning higher again amidst solid technical support and deteriorating global investor sentiment, but inflation data from both New Zealand and the UK could provide two-way volatility this week.

GBP/NZD has found support at a key technical level and is rebounding, with further gains being possible over the coming days.

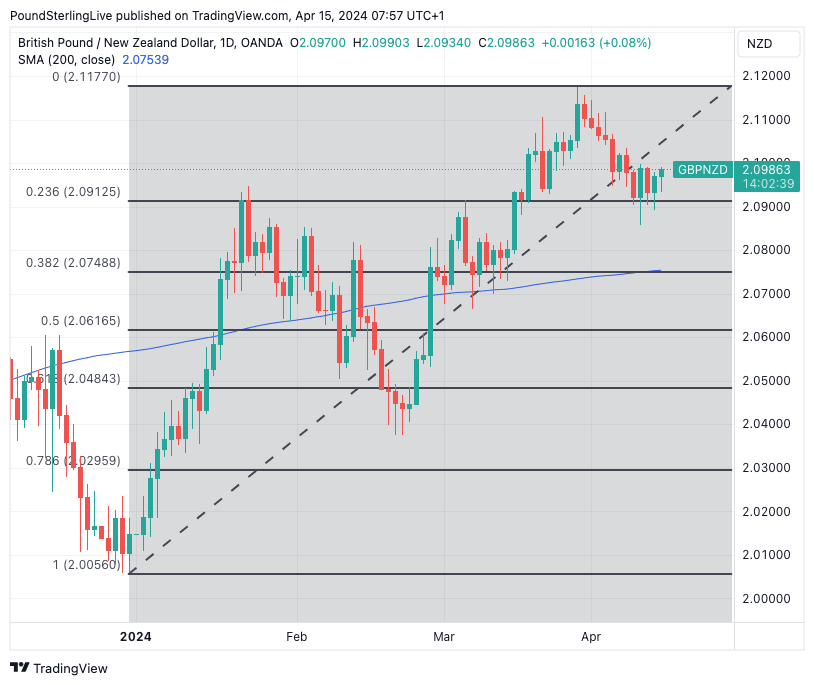

Having hit a new 2024 high in late March, GBP/NZD has retreated to an April low at 2.0857. But it has failed to close below 2.0912 on a daily basis, which is a potentially significant development from a technical perspective.

This area represents the 23.6% Fibonacci retracement of the 2024 rally. The below chart shows near-term support in this region and we would expect it to hold in the coming days. From this base, the short-term recovery can extend.

Above: GBP/NZD at daily intervals showing the Fibonacci retracement levels of the 2024 rally. Track GBP/NZD with your own custom rate alerts. Set Up Here

The New Zealand Dollar - alongside its Australian cousin - lost ground last week after markets slashed expectations for Federal Reserve interest rate cuts. Data released last week showed inflation is rising again amidst enduring U.S. economic resilience, which means U.S. interest rates will need to stay at current levels for many months yet.

GBP/NZD recovered from its April lows as markets slashed the number of rate cuts expected from the Fed in 2024 to just one, with pricing showing this will most likely come in September.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The New Zealand Dollar is highly correlated to global growth and market sentiment, ensuring it sold off alongside stock markets and commodity prices. Should global markets come under further pressure this week we would expect GBP/NZD to move higher.

There is also domestic interest in the form of New Zealand inflation data for the first quarter. A reading of 0.6% quarter-on-quarter is expected for the first quarter, which means the annual rate of inflation in New Zealand is running well ahead of what the Reserve Bank of New Zealand is comfortable with.

Should inflation undershoot expectations, we anticipate a weaker NZD as it would confirm the stagnant economy is starting to weigh on inflation, allowing the RBNZ to cut rates from mid-year onwards.

Because the RBNZ has raised interest rates more than its peers, there is more scope to cut rates, leaving the NZD vulnerable as the world's central banks approach a rate cutting cycle.

Look for volatility in GBP/NZD on Tuesday morning when the all-important UK wage figures for February are released. The Bank of England has been reticent to cut interest rates for fear wages are running too high and propping up domestic inflation rates.

Should the figures undershoot expectations, then the market will grow more comfortable with the idea of a June rate cut, which can result in GBP/NZD weakness.

Tuesday also sees a speech by Bank of England Governor Andrew Bailey, which will offer him the chance to address the issue of potential rate cuts at the Bank in the coming months.

There is no Bank of England decision due in April, making this a potentially important speech as it will serve as the link to the May meeting.

Any hint of increasing confidence that rates can be cut without stoking inflation will likely result in a softer Pound. Wednesday brings with it another Bailey appearance and that of fellow MPC member Haskel.

The week's FX focus will be Wednesday's all-important inflation releases from the UK. Any undershoot vs. expectations will weigh on the UK currency.

Any above-consensus reading (consensus = 2.9% y/y) would offer the Pound a boost as it would shift the balance of odds for the first rate cut from June to August, putting the Bank of England and RBNZ on par with regards to the start date of the upcoming rate cutting cycle.