Pound / New Zealand Dollar Week Ahead Forecast: 1.9000-1.8950 Downside Target Zone Looms

- Written by: Albert Townsend

- GBP/NZD in short-term downtrend

- Expected to extend to at least 1.9000.

- RSI convergence is warning bear trend may be nearing its end

- Building Permits main NZ data release

- Analysts still bullish the Kiwi

- GBP eyes up Thurs. Bank of England meeting

Image © Adobe Stock

- GBP/NZD reference rates at publication:

Spot: 1.9190 - High street bank rates (indicative band): 1.8518-1.8653

- Payment specialist rates (indicative band): 1.9017-1.9094

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Pound to New Zealand Dollar rate is trading at around 1.9031 at the time of writing after falling 0.75% in the week before. Studies of the charts suggest the pair will continue falling in line with the dominant downtrend.

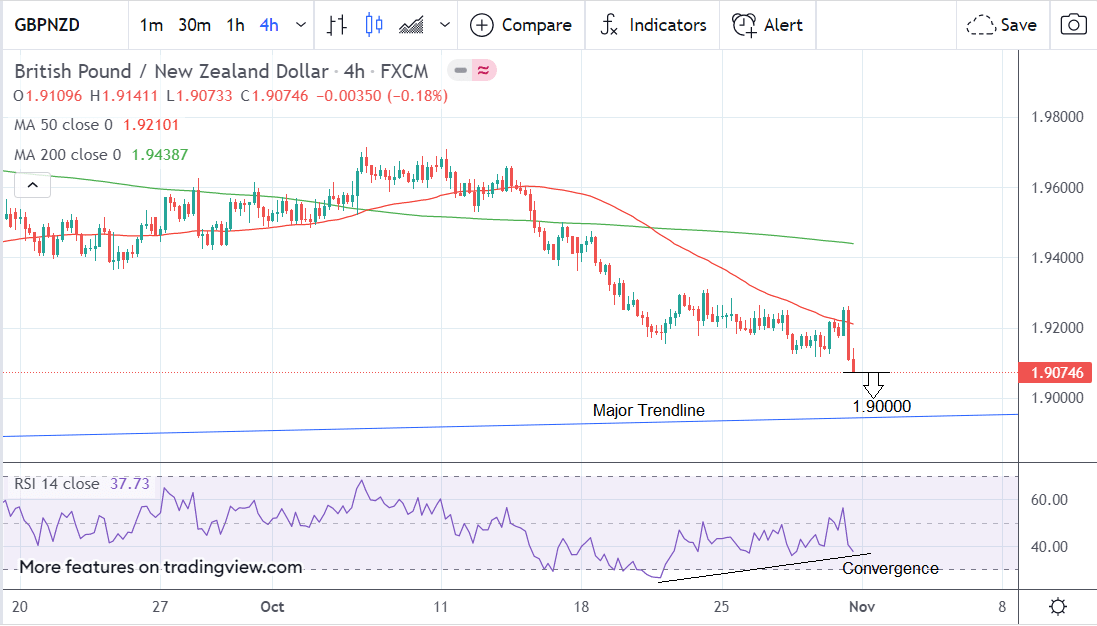

The 4-hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair undulating lower in a series of descending peaks and troughs - which is likely to extend in the week ahead.

A break below last week’s 1.9073 lows will likely result in more downside pressure, to a possible initial target at 1.9000, followed by the major trendline at circa 1.8950.

Above: Four hour GBP/NZD chart.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

At that level bulls will be expected to come in and offer support.

One concerning sign is the converging RSI indicator in the bottom panel, which is bullish.

This is as a result of the RSI not mirroring price in making a new low last week compared to when it made a new low at the October 20 bottom, and suggests diminishing downside momentum.

Bears should be cautious about shorting the market heavily given this rather acute convergence, although on its own it is not sufficient to indicate a reversal.

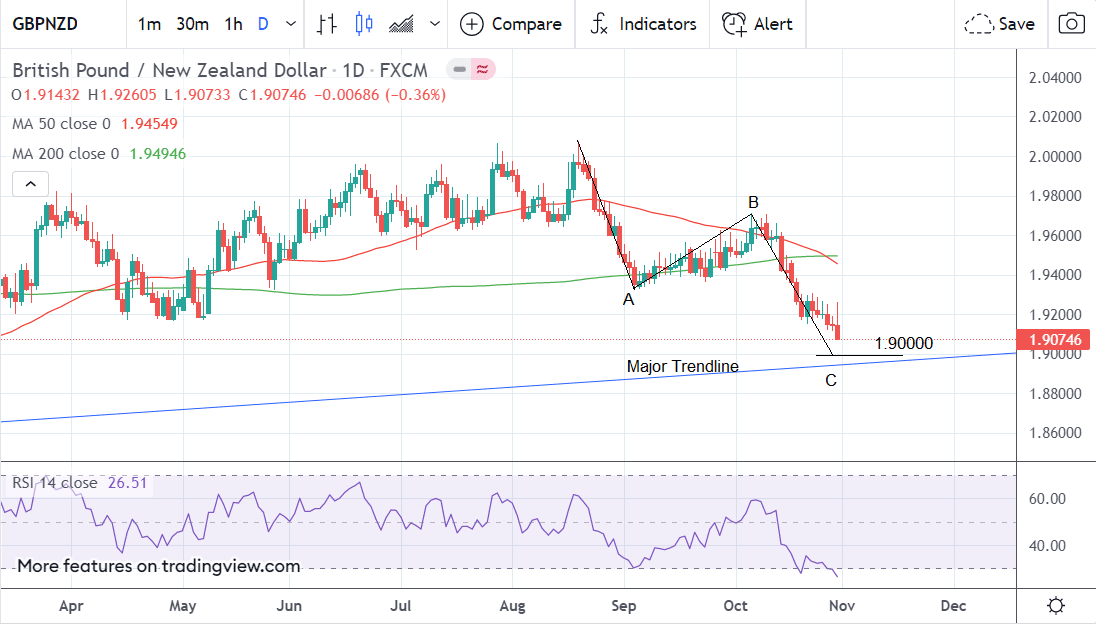

Above: Daily GBP/NZD chart.

The daily chart shows the pair close to completing a measured move pattern that started at the August 19 highs.

These patterns are symmetrical 3-wave zig-zags, where the final 3rd wave down (C) is usually of a similar length to the first wave (A), or Fibonacci extension thereof. The pattern on GBP/NZD has now almost finished as wave C is close to the same length as wave A.

The endpoint of C lies in the 1.9000-1.8950 zone, which also corresponds with the level of the major trendline at around the 1.8950-75 mark - however, 1.9000 is now our conservative target given its added significance as a round number level.

The daily chart shows how the trend could play out over the medium-term, or next week to month.

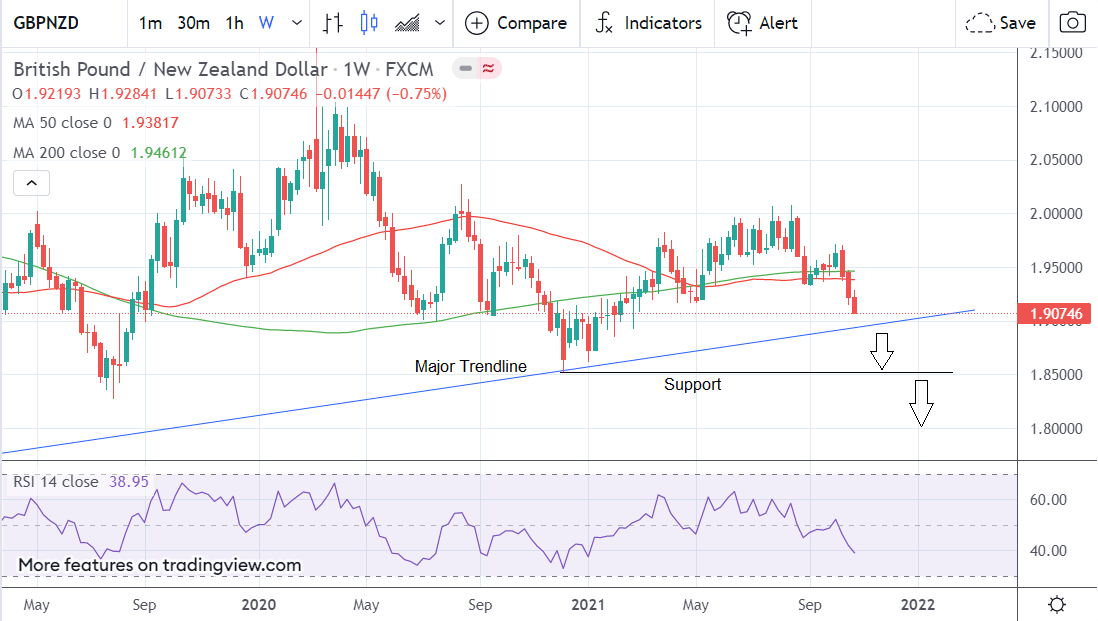

Above: GBP/NZD weekly chart.

The weekly chart is showing a bearish long-term picture, albeit within a sideways trending secular market.

This time frame is used to give an idea of the longer-term outlook, which includes the next few months.

The pair has successfully broken below both the 50 and 200-week moving averages; it has also formed a bearish red candlestick in the prior week increasing the chances of a continuation lower.

A successful break below the long-term trendline at 1.8950 would probably usher in a move down to support at the key 1.8500 region, followed by 1.8000 on the weeklies.

The New Zealand Dollar: What to Watch this Week

There are no tier one releases for the Kiwi Dollar in the week ahead but Building Permits data for September is the most significant, out at 21.45 GMT, on Monday, November 1.

Building Permits shows the number of permits for new construction projects. It is considered a leading indicator for the housing market.

It showed a 3.8% increase in August. There are no official estimates for September, but if it beats the August figure that would be a positive sign for the economy and might lift the Kiwi a wee bit.

Overall the fundamental picture for the New Zealand (NZ) currency is positive suggesting it might continue to benefit from positive backdraughts.

A recent report by leading NZ lender ANZ Bank, for example, highlighted the country’s high inflation rate as a positive driver for the currency, via the ‘carry trade’.

This is a type of investment in which traders borrow in a currency where interest rates are low like the Eurozone to invest in a country where interest rates are relatively high like NZ.

Their profit constitutes the difference between the cost of borrowing and the interest.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The higher inflation rate in NZ, now at 4.9%, has led the RBNZ to adopt a more aggressive approach to raising interest rates - an approach it is likely to continue for the foreseeable future, and be supportive of the Kiwi.

“As long as the RBNZ remains at the “front of the pack” in the race to raise interest rates and normalise policy, we expect the NZD to be on firmer ground than its peers - especially against currencies like JPY and EUR, where bond yields remain very low (or are still negative).” Says Sharon Zollner, Chief Economist at ANZ.

Compared to most other leading economies NZ also enjoys relatively strong economic data, which is also supportive of its currency.

“New Zealand has the highest interest rates, lowest unemployment, and is in a better fiscal position than most of its peers. Its only weakness is the current account deficit.” Says Zollner.

The Pound: All About the Bank of England

Further potential for any substantive moves in GBP/AUD would likely only come in the wake of the Bank of England policy decision, due Thursday mid-day.

The Bank could raise interest rates by 15 basis points, a decision that has been anticipated by investors for much of the past month according to money market pricing.

Faced with surging inflation members of the Bank's Monetary Policy Committee (MPC) have spoken about the need to raise rates in order to ensure inflation expectations amongst businesses and consumers do not start running higher.

The decision to raise rates would therefore be in keeping with the Bank's key role of guarding price stability in the economy.

It is however worth bearing in mind that the odds of a November hike have fallen over the duration of the last week while the odds of a December rise have increased, according to money market pricing:

The repricing in favour of a December rate hike over recent days might go some way in explaining why the Pound to New Zealand Dollar exchange rate continues to face downside momentum.

"The probability of a November hike, which jumped to 100% following the hawkish turn by the BoE early this month and tough remarks by BoE Governor Andrey Bailey and other MPC members, has now converged with the probability of a move in December," says Roberto Mialich, a foreign exchange strategist at UniCredit.

Above: "A BOE RATE HIKE EITHER IN NOVEMBER OR DECEMBER IS EQUALLY PRICED INTO THE UK OIS CURVE" - UniCredit.

Waiting for December will be preferred by some members of the MPC as they will have received the full suite of official labour market data since the ending of the government's furlough scheme in September.

This will give policy makers a clue as to just how robust the labour market is and also suggests the November labour market report (due Nov. 16) could perhaps be the single most important event in the remainder of the year for Sterling.

A better than expected labour market report could give the MPC the cover required to move on rates in December, while a softer than expected outcome could provide enough hesitation to push any rate hike in 2022.

If the Bank forgoes a November rate rise the Pound could initially fall, but losses might prove shallow if the Bank offers guidance to suggest a December hike is likely - provided the November labour market report is strong.

Such guidance "could reduce the risk of some disappointment regarding the GBP," says Mialich.

But foreign exchange analysts at Goldman Sachs have told clients they are 'bearish' on the Pound's prospects in the near-term as the Bank of England will disappoint.

"The 'rubber meets the road' for the Bank of England, and markets have set a high bar for the MPC to deliver, essentially fully pricing a 15bp hike for this meeting and close to 60bp cumulatively through February," says Zach Pandl, an economist with Goldman Sachs.

The Wall Street bank says it will prove difficult for the Bank of England to significantly over-deliver at this point, and sets up room for disappointment if the MPC guides towards a more "measured" pace.

Such a "measured pace" would be a 15bp hike in November, followed by 25bp in February, which is Goldman Sachs' current expectation.

"This means that the risks are skewed towards GBP downside over the near term," says Pandl.