Pound-New Zealand Dollar Week Ahead Forecast: Cresting Near 1.9950 if RBNZ Story Stokes Kiwi Comeback

- Written by: James Skinner

- GBP/NZD could see 1.9950 on the interbank market this week

- Best levels since June 2020 may fade if NZD makes comeback

- NZD/USD comeback would see GBP/NZD recoil to 1.98 initially

- NZD/USD could benefit if RBNZ story stokes post-Fed recovery

Image © Adobe Stock

- GBP/NZD reference rates at publication:

- Spot: 1.9922

- Bank transfers (indicative guide): 1.9225-1.9364

- Money transfer specialist rates (indicative): 1.9743-1.9822

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-New Zealand Dollar rate remained ascendant early in the new week and was close to printing one-year highs around 1.9950, which would yet be seen if either the U.S. Dollar rebounds further, or if Thursday’s Bank of England (BoE) decision provides Sterling with reason for cheer.

This week the Pound-to-New Zealand Dollar rate may offer Sterling-denominated sellers a recently rare opportunity to buy the Kiwi at rates close to the two-for-one level, as GBP/NZD could be likely to come within arm’s reach of that threshold on the interbank market this week.

Such rates or levels near to them would also be available to retail as well as small-and-medium sized enterprise customers using a competitive money transfer specialist, although such rates could be unlikely to remain available for long.

This is in large part because of the strengthening New Zealand economy and what this could in turn mean for Reserve Bank of New Zealand (RBNZ) interest rate policies during the year ahead, which would have knock-on implications for Kiwi Dollar exchange rates including GBP/NZD.

“Here in New Zealand, we are now forecasting the RBNZ to lift the OCR in February. But data will have the final say on timing here,” says Sharon Zollner, chief economist at ANZ.

“That forecast assumes activity data continues to show that the economy is stretched; inflation expectations continue to lift, wage growth rises –and that global financial markets keep it together as expectations of Fed hikes evolve,” Zollner explains.

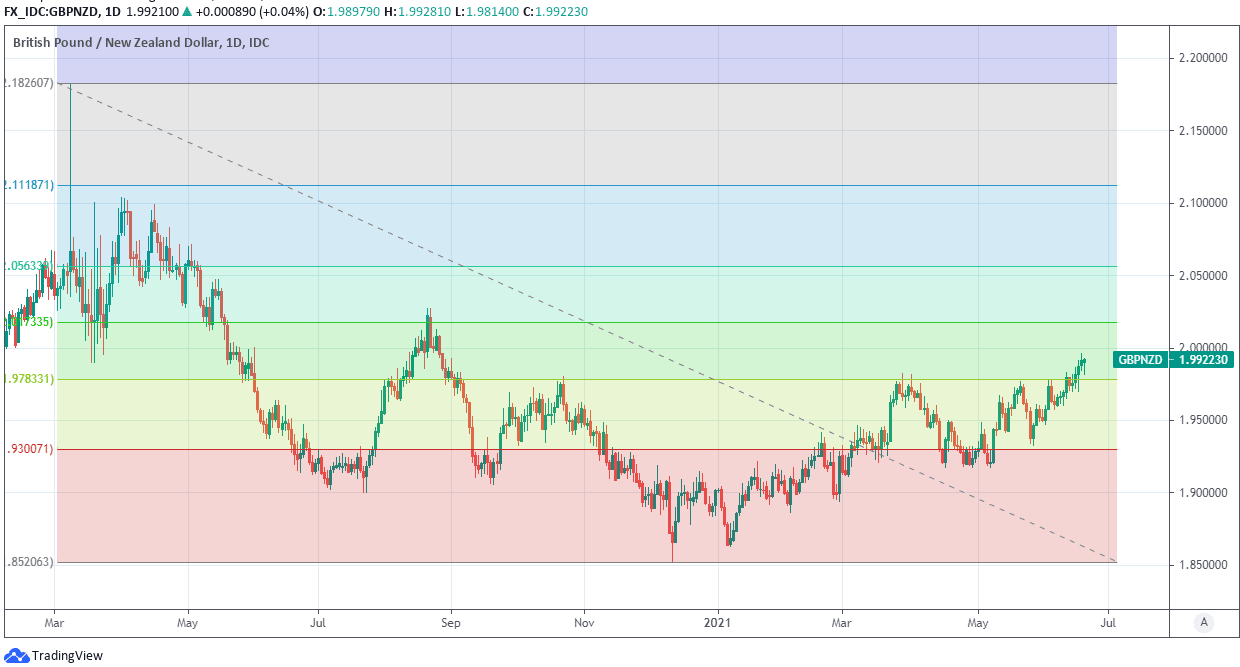

Above: Pound-to-New Zealand Dollar exchange rate shown at daily intervals alongside NZD/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Zollner and the ANZ team are tipping an RBNZ interest rate rise that would be sooner than financial markets are thus far prepared for, given that derivative market pricing implies that a move isn’t expected until later that year.

If correct ANZ’s forecast would see the RBNZ lifting its cash rate from 0.25% to 0.5% quite some time before the earliest likely timing of any U.S. interest rate rise and even before the most optimistic estimates out there of when the BoE might eventually lift Bank Rate from 0.10% to 0.25% or more.

This is, if nothing else, a recipe for a Kiwi Dollar recovery that could eventually weigh on GBP/NZD as it picks up, although this week it matters that investors may be reluctant to bet too heavily against the U.S. Dollar so soon after last week’s Federal Reserve (Fed) decision and given lingering uncertainties over the extent to which the U.S. central bank is really shifting its policy position.

“The Fed has clearly now rebalanced its guidance to emphasise inflation more. The market will now be very sensitive to inflation releases over the summer,rather than casually looking through them as it had done recently. Powell speaks next week and it will be interesting to see if he pushes back against the 2022 rate rise school,” Zollner says.

Last Wednesday’s Fed decision has also been a powerful yet indirect influence on GBP/NZD given the different ways in which the main New Zealand and British exchange rates, NZD/USD and GBP/USD, have gone about responding to it.

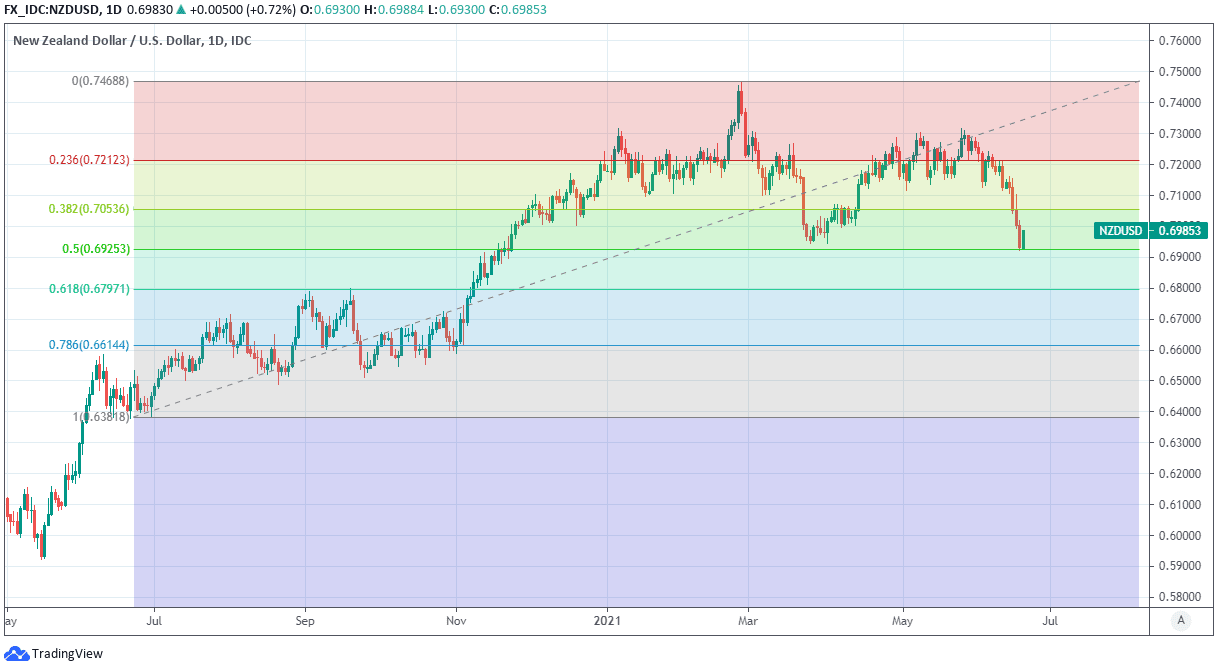

Above: NZD/USD at daily intervals

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Sooner or later the evolving RBNZ outlook could prove to be doubly supportive of the Kiwi Dollar but with NZD/USD and other commodity-related currencies bearing the brunt of last week’s surge by the U.S. Dollar, GBP/NZD has been lifted back toward June 2020 highs and remained ascendant on Monday.

It matters greatly to all currencies for the week ahead that Fed Chairman Jerome Powell will be speaking publicly again on Tuesday, and matters most to Sterling that on Thursday at 12:00 the BoE will itself announce the latest interest rate and monetary policy decision for the UK.

“While the public health experts in the UK are warning about future lockdowns, especially during the winter months, and PM Johnson confirmed the delay in full reopening by four weeks, there remains no obvious signs of consumer concerns yet,” says Ross Walker, chief economist at Natwest Markets.

“Most importantly, spending continues at pace compared to the start of the year. Elated not deflated. Retail sales declined by 1.4% in May. Strange as it may seem, that bodes well for the economic recovery, signaling that consumers are going out and spending more on services at last,” Walker writes in a weekly missive covering the latest in UK and global economics.

The Pound has this year derived much support from a BoE that is ever conscious of risks to its target to generate a 2% rate of inflation over a multi-year horizon, risks which have shifted to the upside in 2021 and may or may not eventually necessitate an interest rate response from the Monetary Policy Committee at the bank, so the currency market will listen to closely on Thursday.

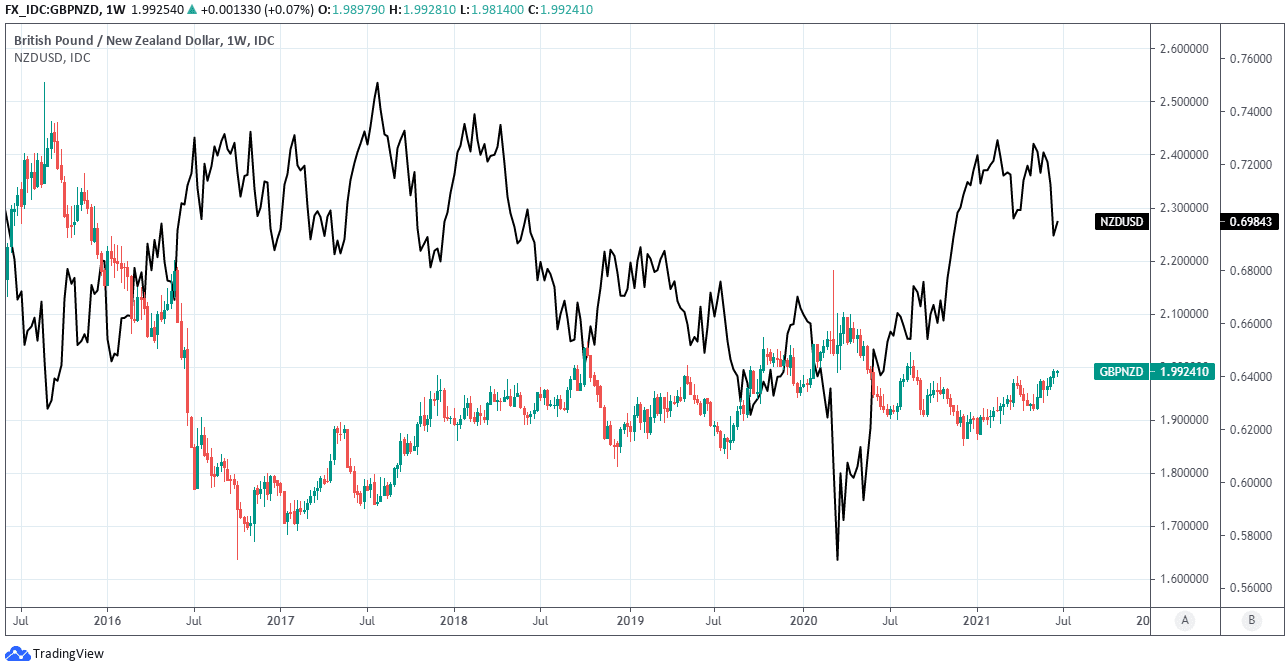

Above: Pound-to-New Zealand Dollar rate shown at weekly intervals alongside NZD/USD.

This and the market’s lingering caution about the Federal Reserve could be enough to support GBP/NZD near to 12-month highs for a few days more if-not slightly longer, although with ‘hawkish’ forecasts for the RBNZ stacking up a GBP/NZD correction lower would be just a matter of time without a competitive proposition from the BoE.

“We now expect the Reserve Bank to start increasing the OCR from August 2022,” says Michael Gordon, chief New Zealand economist at Westpac in a Monday research briefing.

“Previously we expected interest rate hikes to be delayed until early 2024. However, with signs of solid momentum in domestic demand, we’re now more confident that the economy can withstand a gradual normalisation of monetary policy settings,” Westpac’s Gordon adds.

The Pound-to-Kiwi Dollar exchange rate would eventually slip back toward 1.98 handle and potentially even below it if, in the absence of such a proposition from the BoE, the main Sterling and Kiwi exchange rates GBP/USD and NZD/USD retraced anything like a meaningful portion of last week’s losses.

“The Kiwi took another leg lower on Friday night as the USD strengthened, with the DXY index sharply higher for the third straight day. Although the NZD softened on some crosses, for the most part the USD is in the driving seat, continuing to benefit from the growing conviction that the Fed will move on rates earlier,” says David Croy, a currency strategist at ANZ and colleague of Zollner.