Pound Forecast to Rise to 1.40s vs US Dollar, 1.17s vs Euro says MUFG's Hardman

Pound Sterling is correcting higher having fallen to notably undervalued levels over the course of recent months says a leading foreign exchange analyst who sees more gains to come for the Pound against both the Dollar and Euro.

MUFG - the global investment and financial services provider - have upgraded their forecasts for the British Pound in the wake of a substantive shift in tone at the Bank of England.

Investors have been aggresively buying Sterling over recent days as they account for the increased likelihood that the Bank will raise rates as soon as November. Heading into this week there was a less-than 20% chance of such an occurance according to market pricing. At the close of the week the odds are up to 66%.

Sterling rallied to a 15-month high against the Dollar at $1.3590 and a two-month high against the Euro at €1.1373. The adjustment has caught many in the analyst community off guard and we are already seeing institutional analysts adjust their forecasts.

MUFG have conceded they were wrong to downgrade Pound Sterling's profile following the August Bank of England inflation report. Analyst Lee Hardman - based in MUFG's London office - says their mid-year forecasts have been proven to be more on-target than what now appears to be a knee-jerk downgrade in response to the Bank's August Inflation Report where GDP and wage forecasts were downgraded.

The Bank's minutes to September's policy meeting note the majority of committee members now favoured raising interest rates if current conditions persisted.

The message has since been reinforced by Governor Mark Carney and MPC member Gertjan Vlieghe on two seperate occassions.

That Vlieghe - who is known to traditionally be cautious on advocating for rate rises - has sparked another fresh rally in the Pound.

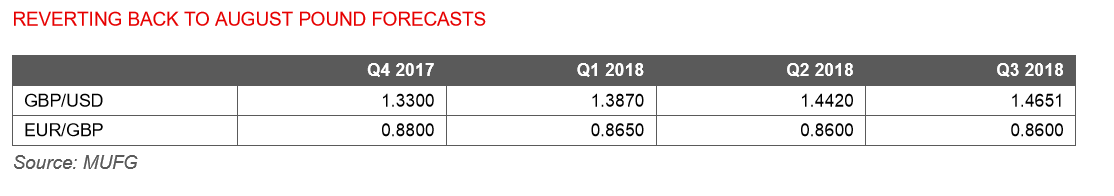

As such, "we are reverting back to our prior call for the first BoE rate hike to take place in November, and to our stronger Pound forecasts from the August FX Outlook report," says Hardman referencing the set of forecasts issued by MUFG in August prior to subsequent downgrades.

Indeed, a sweathe of investment banks also chose to downgrade their profile on Sterling around the same time as the currency embarked on a notable move lower against the Euro.

The Pound had become notably undervalued as a result, reaching the bottom of an envelope around the long-term average for the Trade Weighted Index, which is a composite valuation of the Pound versus a basket of currencies.

Sterling had recently touched the bottom of a price envelope representing an extreme reading of two standard deviations below the average.

The ongoing rebound from the bottom of the envelope was regarded as a reversion from extreme undervaluation, with Hardman noting the BOE's response was, "another reason for Pound undervaluation to ease."

Previously the BOE had said they were willing to tolerate an inflation overshoot due to the weak Pound but it appears that after revising up their inflation expectations to 3.0% the limit of their toleration has been reached.

There is now less reason not to push the button on raising interest rates to compel rampant inflation; nor are the other offsetting risks sufficient to stay their hand.

"The lack of a pick-up in wage growth and continued Brexit uncertainty is no longer judged sufficient to prevent the BoE from embarking on “gradual” and “limited” rate hikes," says Hardman.

However, Bank of England Monetary Policy Committee member Gertjan Vlieghe has today said he believes wage growth is rising at an healthy pace.

“Wage growth is not as weak as it was earlier in the year: over the past 5 months, annualised growth in private sector pay has averaged just over 3%... if these near-term labour market trends continue, I would expect this to lead to somewhat more upward pressure on medium-term inflation," Vlieghe told an auidence in London.

Vlieghe is one of the more cautious members of the Bank's MPC, and when he said he believes an interest rate rise is due owing to the improving dynamics in the economy, markets were caught off guard. They now believe a November rate hike is more likely than not and they bought the Pound as a result.

"We would agree that it makes sense to start taking back some of the emergency easing currently in place given that there now appears to be limited spare capacity left in the UK economy with the unemployment rate moving further below the BoE’s equilibrium estimate of 4.5%," says Hardman.

Hardman also notes how falling immigration figures have further tightened the labour market, leading to hope wages might rise.

"There have been tentative signs as well that Brexit could already be delivering a negative supply shock to the UK economy by dampening the pace of net immigration inflows since last year’s referendum," says Hardman.

The more bullish set of pound forecasts expect cable to rise towards the mid-1.4000’s by the middle of next year, while EUR/GBP is also expected to decline but more modestly towards the mid-0.8000’s," said Hardman.

This gives a GBP to EUR conversion in the region of 1.17.

The Pound's current uptrend now puts these targets comortably in reach.

The Pound's current uptrend now puts these targets comortably in reach.

Oliver Harvey, a Macro Strategist with Deutsche Bank suggests "it is too soon to fade the rally in GBP" referencing the prospect of some traders looking to sell Sterling on expectations for potential weakness in the future.

"Yesterday's meeting was even more hawkish than we expected and we have subsequently changed our rate call for a hike in November. With this still less than 100% priced, and given the build up in short positioning over recent weeks, we wouldn’t fade the rally in GBP just yet," says Harvey.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.