Pound to Maintain Strength against Euro Near-term, but Further Out Headwinds Remain says Crédit Agricole

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's outlook remains upbeat in the near term although headwinds will likely ensure the prospect for substantial gains remains limited, according to one of Europe's largest commercial and investment banks.

"The outlook for the currency could remain upbeat if historic seasonality is anything to go by," says Valentin Marinov, who heads FX strategy at Crédit Agricole.

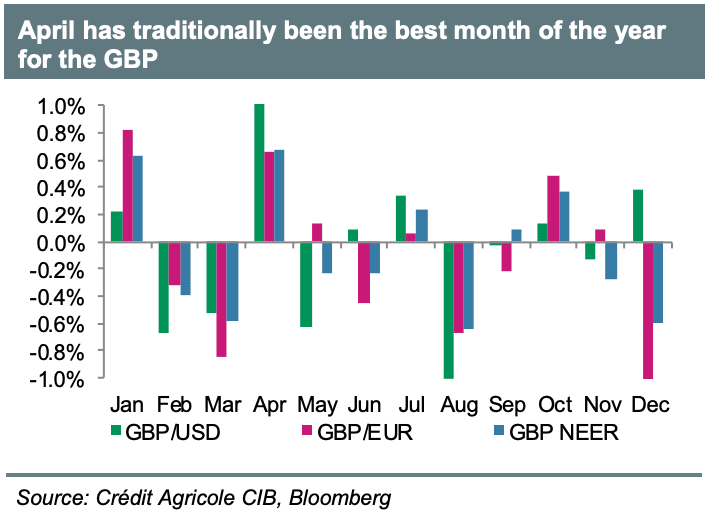

The call comes at the start of April, a month that has historically seen the Pound appreciate.

"April has been by far the best month for the GBP over the years, and its outperformance across the board has usually been explained with the start of the new fiscal year and the related corporate repatriation and hedging flows," says Marinov.

The Pound was the best-performing major currency of the first quarter, defying a bearish consensus amongst the investor and analyst communities that existed at the start of the year.

"Next to the JPY, the GBP has emerged as one of the best-performing currencies in March," says Marinov.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

He says April is a month that tends to experience relatively calm market conditions in which the Dollar retreats and equities rise, which is of significance for the risk-correlated Pound.

It tends to appreciate in benign market conditions when investors are comfortable taking on risk, but it can endure losses when markets retreat.

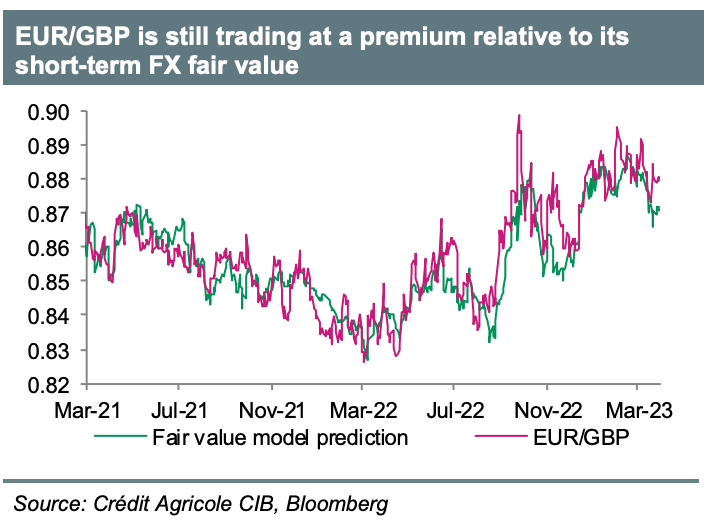

Crédit Agricole analysis meanwhile reveals EUR/GBP is trading at a premium relative to its short-term fair value which is estimated on the basis of the two-year EUR-GBP rate spread, peripheral bond yield spread to bunds and a measure of risk appetite among other drivers.

"This much could mean that the GBP should be able to hold its ground vs the EUR in April," says Marinov.

However, looking further out, the Pound could struggle to appreciate against the Euro on a meaningful basis and Crédit Agricole is sticking with a "less constructive outlook for the currency".

Economists at the investment bank expect the UK economic outlook to remain relatively subdued with the potential for some data disappointments ahead.

"In addition, BoE speeches will further highlight that the MPC remains very divided on the need for further aggressive monetary tightening from here. The GBP should therefore continue to trade at a nominal and rate disadvantage vs its G10 peers," says Marinov.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes