Pound Sterling and Euro are a Buy against the Dollar in 2023 says HSBC

- Written by: Gary Howes

- HSBC predicts GBP & EUR to turn tables on GBP in 2023

- As stock market bears make way for the bulls

- Present their GBP/EUR, GBP/USD and EUR/USD forecasts

Image © Adobe Stock

At the start of 2022 HSBC told clients they were buyers of the Dollar against the Euro and British Pound, a strategy that would have delivered a 6% gain against the former and a 10.7% gain against the latter.

But for 2023 investors should flip the bet as a reversion is likely to take place and the two European currencies deliver gains against the Dollar, say economists at the UK-based bank.

"Buy EUR and GBP versus the USD," reads a year-ahead strategy note that sets out a range of thematic views that might play out.

"We believe the global backdrop has shifted and valuations are now appealing enough to look to buy both currencies against the greenback, whose upward momentum has run out of steam," says Paul Mackel, Global Head of FX Research at HSBC.

HSBC research finds EUR/USD and GBP/USD have both been heavily linked to changes in global risk appetite in the last year which explains a loss of value in the two pairs as stocks rode a bear market lower.

However, the relationship should now be supportive:

"We are seeing increasing signs that there will be room for this to remain a positive driver for both currencies in the months ahead," says Mackel.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"A bottoming out in global growth dynamics compared to excessively pessimistic expectations, as well as a peak in global interest rates on the back of softening inflation pressure could both allow the EUR and GBP to make gains versus the USD in an environment where risk appetite looks less febrile," says Mackel.

The weakness in the Pound and Euro has meanwhile allowed the external accounts of both the UK and Eurozone to rebalance which HSBC says should now start offering support to the two currencies, given their somewhat cheap valuations.

On this front, the Euro is tipped to benefit as domestic investors drive inward flows of capital as some of their external investments are repatriated, (overseas assets are said to be worth nearly €5trn since 2010).

Above: "Both currencies have been driven by “risk appetite” in recent months" - HSBC. Consider setting a free FX rate alert here to better time your payment requirements.

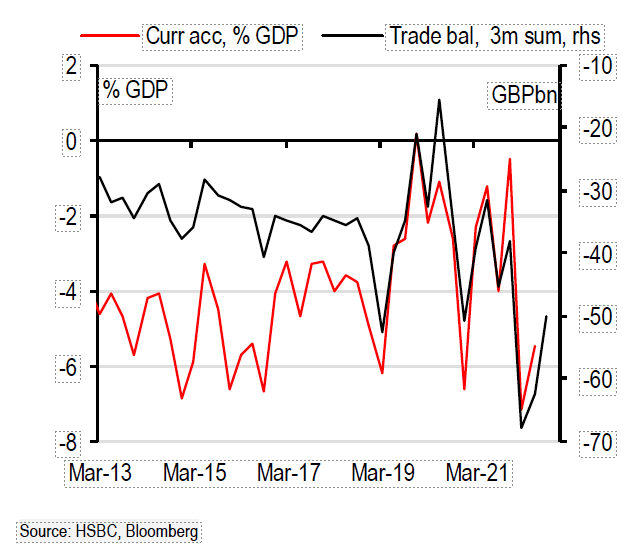

The UK's current account deficit meanwhile ballooned in 2022 as the cost of energy imports soared, leaving the Pound at risk of a halt in external investor demand for UK assets.

But the weaker Pound and falling domestic demand, as well as falling energy prices, have worked to shrink that deficit and limit the downside risks to Sterling of a foreign investor strike.

"Cheap valuations for GBP should also encourage income inflows in the current account, and may entice more inward financial investment into the UK," says Mackel.

Above: "Portfolio inflows into Eurozone suggest more positivity for the EUR" - HSBC.

Furthermore, HSBC says peak pessimism towards the UK and Eurozone might now have passed.

"This has historically been linked to some local currency strength," says Mackel. "A broader outperformance of the data compared to very pessimistic expectations would still support broader EUR and GBP outperformance."

In addition, "if supply-side inflation pressures dissipate faster than currently expected – something that appears to be happening in the US in recent months – then the negative real wage story which has plagued the region in the last year could turn decidedly less negative," he adds.

Above: "UK trade and current account deficits showing signs of recessionary rebalancing" - HSBC.

HSBC's house view is for the Pound to Dollar exchange rate to trade to 1.22 by the end of the first quarter as analysts warn that the speed of the USD's recent depreciation might have been excessively rapid.

The pair heads to 1.23 by the end of the second quarter, 1.24 by the end of the third and 1.25 by year-end.

The Euro to Dollar exchange rate is seen at 1.05 by the end of Q1, which suggests a retracement from current levels at 1.06, ahead of a move higher to 1.07 by the end of the second quarter, 1.09 by the end of the third quarter and 1.10 by year-end.

And what about the Pound's prospects against the Euro?

Because both European currencies are tipped to outperform the Dollar they are expected to respect a relatively constrained sideways trend against each other.

The Pound to Euro exchange rate is forecast to trade at 1.16 by the end of the first quarter, up from the current level of spot at 1.13, ahead of a moderation back to 1.15 by the end of the second quarter and 1.14 for the end of both the third and fourth quarters of the year.

If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

HSBC's more constructive stance on the Pound is not shared by all in the analyst community, however.

The British Pound will lose value to the Euro and Dollar over the duration of 2023 says J. Safra Sarasin, a private Swiss bank, in their year-ahead research briefing.

"The British pound has shown a remarkable recovery ever since the UK government turned away from its 'mini budget' plans. Yet we would not chase the rebound," says Dr. Claudio Wewel, FX Strategist at J. Safra Sarasin.

The call comes following a relatively robust final quarter to 2023 that saw the UK currency recover from multi-year lows against the Euro and U.S. Dollar and a host of other major world currencies.

The rally comes off the September lows that were triggered by a bond market meltdown that followed the mini-budget of former Prime Minister Liz Truss in which she attempted to push through a series of massive unfunded tax cuts.

Although markets have stabilised under the new Prime Minister Rishi Sunak, the UK's growth outlook remains challenging and J. Safra Sarasin says this could present a significant headwind to the Pound.

"We remain cautious on the pound, despite the easing of the confidence crisis induced by the Truss-led government," says Wewel.

Bank J. Safra Sarasin forecasts GBP/USD to trade at 1.15 by the end of the first quarter of 2023, 1.16 by the end of the second quarter, 1.18 by the end of the third quarter and 1.19 by the end of the year.

The bank's forecast profile for GBP/EUR is, like that of HSBC's, flat.

This is because the Eurozone is also expected to face significant challenges over the coming years.

EUR/GBP is forecast at 0.88 for the aforementioned points in time, yielding a GBP/EUR forecast profile of 1.1360 for 2023.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes