NatWest Forecasts Show Pound Sterling Better Supported against Euro and Dollar in 2023

- Written by: Gary Howes

- GBP downside risks "exaggerated"

- Current account deficit to close

- GBP/USD can trend higher

- GBP/EUR seen steady, but with upside risks

Image © Adobe Stock

Pound Sterling is near multi-decade lows and the risk of a major decline is limited, says NatWest Markets as it assesses the currency's prospects for 2023.

The UK bank says it expects to see the Pound appreciate against the Dollar and remain relatively stable against the Euro, although the risks are titled to the upside against its European counterpart.

"Downside risks for Sterling are exaggerated and all-time lows seen this year are unlikely to be revisited," says Paul Robson, Head of G10 FX Strategy, EMEA, at NatWest Markets.

The Pound to Dollar exchange rate plumbed its lowest point on record at 1.0354 on September 28, the declines came amidst the financial market tremors ignited by previous Prime Minister Liz Truss' ill-fated mini-budget.

Truss caused alarm amongst international investors as her government announced aggressive tax cuts, all of which would be funded by additional borrowing.

This led markets to ponder on the sustainability of UK debt and policy over the coming months and years.

The Pound to Euro exchange rate meanwhile fell to a low of 1.0774 at the time, its lowest since March 2020.

"Political risks have been reduced significantly," says Robson. "A return to fiscal orthodoxy, reduced political risk premium... also play positive for the currency."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But according to NatWest Markets, holding the keys to the Pound's performance over 2023 will be energy prices and their associated impact on the country's current account.

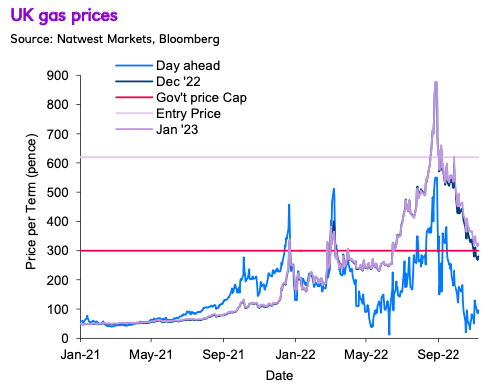

"The main risk is that energy prices surge once again and gains persist through 2023, something that would see weaker growth, higher government borrowing and a wider current account deficit," says Robson.

The UK typically runs a current account deficit courtesy of the country importing more than it exports. This imbalance would typically create an outflow of currency and put downward pressure on the Pound.

The budget ballooned in 2022 as the cost of importing fuels surged in the wake of Russia's invasion of Ukraine.

Defending the Pound against the impact of the UK's penchant for imports is the inflow of foreign capital from international investors. The Pound therefore finds itself weaker when the import bill balloons or foreign investors are no longer willing to fund the deficit by increasing inbound investments.

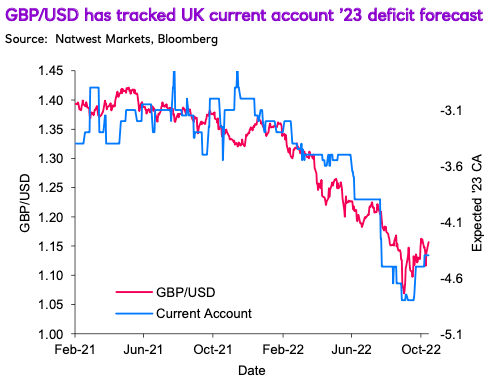

"Sterling has tracked the evolving consensus forecasts for the UK current account deficit. But there are good reasons to believe the deficit will be smaller than the consensus expects in 2023," says Robson.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Such an observation, if correct, implies less downside pressure from a fundamental source of vulnerability for the Pound.

But this outcome depends on what happens to energy prices.

"Prices have fallen and futures now suggest prices are expected to be far below the summer peak. Energy demand erosion is running at double digit rates, enough to make blackouts unlikley unless winter is unseasonably cold. Hence the “fuel” deficit may narrow notably in coming months," says Robson.

But there is unlikely to be rapid appreciation in Sterling exchange rates over the duration of 2023 warns NatWest Markets.

"Weakening growth prospects raise the bar for attracting capital to offset the deficit at current exchange rates. There is limited scope for fiscal policy to support growth," says Robson.

The prospect of a UK recession in 2023 has been well-telegraphed for some time now, with the Bank of England first setting alarm bells ringing in August.

A fall into recession is now a consensus expectation amongst institutional, independent and international economists and informs an ongoing pessimism towards the Pound.

The Bank of England meanwhile looms as December's primary domestic event risk for Sterling, with markets split on expectations for either a 50 basis point or 75bp hike.

The Pound has tended to weaken in the wake of previous Bank of England policy decisions, as the scale of the hikes has tended to be smaller than the market was anticipating.

But NatWest says the Bank's tightening cycle isn't expected to provide Sterling with much support.

"In fact, the pricing out of tightening would be a positive as it would further reduce fears of a housing market slump and raise hopes of a milder recession. A better inflation/demand profile would make other assets more attractive," says Robson.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Looking at the trajectory the Pound might follow, it is a story of gradual gains against the Dollar and sideways movement against the Euro.

"GBP/USD is expected to finish modestly higher over the coming twelve months as the USD slips back from cyclical highs," says Robson. "With uncertainty set to linger, GBP/USD is likely to move within a large trading range as it has done in recent years."

Gains against European currencies are meanwhile expected to be more limited as regional economies face a similar cost of living shock.

"GBP/EUR is seen finishing the year largely unchanged, although risks are seen skewed modestly to the upside," says Robson.

NatWest forecasts the Pound to Dollar exchange rate at 1.20 by the end of the first quarter of 2023, 1.22 by the end of June, 1.23 by the end of September and 1.23 by year-end.

The bank's Pound to Euro exchange rate forecasts are for 1.14 by the end of March 2023, 1.15 by the end of June and September and 1.14 by year-end.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)