Pound Sterling Rebounds vs. Euro as UK PMIs Confirm Ongoing Growth

- Written by: Gary Howes

- UK PMIs show economy continues to grow

- As Eurozone PMIs disappoint

- But UK natural gas prices are surging

- Weighing on GBP against most majors

Image © Adobe Stock

The British Pound's fortunes were resurrected ahead of the weekend after the UK economy continued to expand in July, according to a much watched survey, but surging UK gas prices ensure the currency is underperforming against most peers.

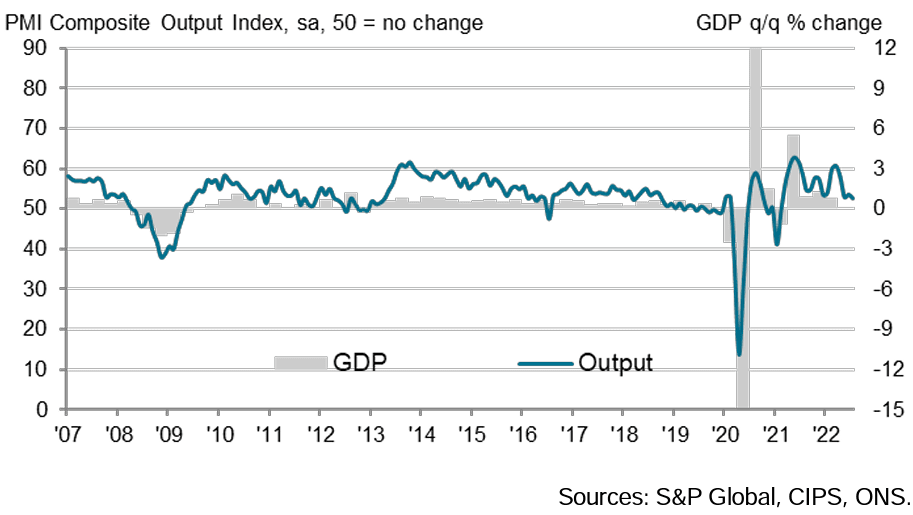

The S&P Global PMI series for July showed the UK's manufacturing sector continued to grow with the Manufacturing PMI printing at 52.2, against expectations for 52 but below June's 52.8.

The all-important services sector - which accounts for over 80% of UK economic activity - also expanded, reading at 52.8, although this is below the 53 expected and June's 54.3.

The Composite PMI, which adjusts the figures to give a more accurate account of the broader economy, read at 52.8, beating an estimate for 52.5 but still coming in below June's 53.7.

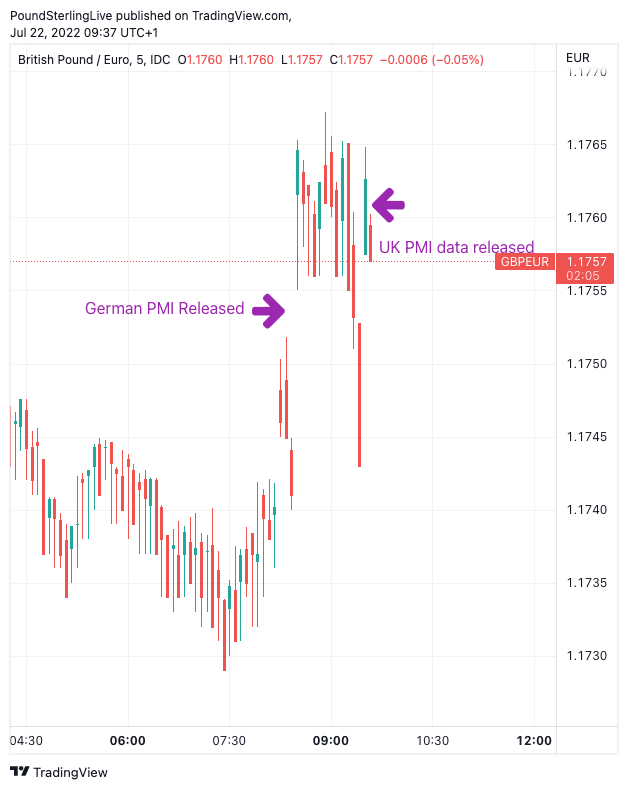

The Pound reacted to the figures by going higher against the Euro and recovering some losses against the U.S. Dollar.

However, the Pound is still lower on the day against the Dollar and most other major currencies amidst an ongoing surge in the price of UK gas.

The price of UK natural gas reached its highest level since March Friday, following three days of successive gains.

There is little to indicate what exactly is causing the issue, but the rising cost of the fuel means UK inflationary pressures will remain elevated then elsewhere in the world.

The rising gas prices suggest the UK's inflationary headache will continue to run with economists warning that a hike in Ofgem's price cap in the region of 50-60% is likely come October.

But, should prices continue to rise the increase will come in towards the top end of this estimate. The prices also suggest further increases are now likely in early 2023.

The market must be looking at the prices as the Pound is recording losses against most peers on Friday, apart from the Euro which is also struggling amidst rising European gas prices and indications the Eurozone economy is stalling.

Eurozone PMI data for July out earlier pointed to contraction, in fact PMI figures from Germany suggest the Eurozone's largest economy contracted in July.

The Pound to Euro exchange rate rose to 1.1760, aided in part by the disappointing PMI figures out of the Eurozone. This took the euro rates on bank accounts to around 1.1530 and those offered by payment specialists to 1.1730.

Above: GBP/EUR at five minute intervals.

The Pound to Dollar exchange rate had been as low as 1.1918 ahead of the release of the UK PMI data but it recovered to quote at 1.1953 at the time of writing. Bank accounts are offering rates at around 1.1715 and FX payment specialists at 1.1918.

This exchange rate will likely remain under pressure until some relief in UK gas market pricing is seen.

Above: GBP/USD at five-minute intervals.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

S&P Global said although business activity at UK private sector companies increased for the seventeenth month running in July, the rate of expansion was the weakest over this period.

The slowdown in output growth mostly reflected softer demand, alongside ongoing capacity constraints arising from shortages of materials and staff.

"On a more positive note, latest data indicated that input cost inflation eased considerably since June and was the lowest for ten months," said S&P Global.

"Survey respondents often commented on lower commodity prices and a stabilisation in fuel costs, but there were still widespread reports citing intense salary pressures," read the report.

That wage pressures are noted as a pain-point for businesses has particular relevance for the Bank of England, as this provides evidence of growing inflation expectations.

While the Bank cannot target commodity prices through interest rate hikes, it can aim to stamp out inflation expectations.

The findings would therefore, at face value, support market expectations for a 50 basis point rate hike in August.

The survey data does however show a key development: the input prices faced by businesses is easing, suggesting a peak in inflation is coming.

In fact, the manufacturing output prices balance fell to a five month low, at 70.0, from 72.1.

S&P Global also note the fall in the value of the Pound is becoming acute: "Some firms noted that exchange rate depreciation against the US dollar had added to their purchasing costs during July."

Some members of the Bank's Monetary Policy Committee have said the Bank should be conscious of how its policy is impacting the value of the Pound. The findings from the PMI survey could therefore resonate with a need to deliver policy with Sterling in mind.

James Smith, Economist at ING, says there is "something for everyone at the Bank of England" in the report.

"Doves will be pleased that input inflation is showing signs of cooling. Hawks can point to ongoing staff shortages & FX worries. We still narrowly expect 50bp to prevail in August," says Smith.

But ahead of the PMI figures the ONS reported UK retail sales fell 0.1% month-on-month in June, which is stronger than the -0.3% reading the market was looking for and an improvement of the -0.8% recorded in May.

Core retail sales rose 0.4% said the ONS, beating expectations for -0.4%.

The figures mean sales were down 5.8% in the year to June, coming in softer than the -5.3% the market was anticipating.

"The UK consumer remains in a dire state. Small bump higher in core UK retail sales but not good enough. All food related around Jubilee weekend. Spending across other items fell. What's a red flag is online spending falling sharply," says Viraj Patel, Macro Strategist at Vanda Research.

Paul Dales, Chief UK Economist at Capital Economics however says the PMI data shows the economy is slowing, but that non-retail activity is holding up better than retail sales.

"Actual CPI inflation still won’t peak until October, perhaps around 12%. But these figures suggest the debate will soon shift to whether inflation will fall back to the 2% target quickly or slowly. We’re in the second camp, which is why we still think the Bank of England will have to raise interest rates from 1.25% now to 3.00%," says Dales.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes