Sterling's Achilles Heal, the Current Account Deficit, Surges

- Written by: Gary Howes

Image © Adobe Images

The UK's current account deficit has long been an 'achilles heal' for the British Pound, and new data shows it has surged in size.

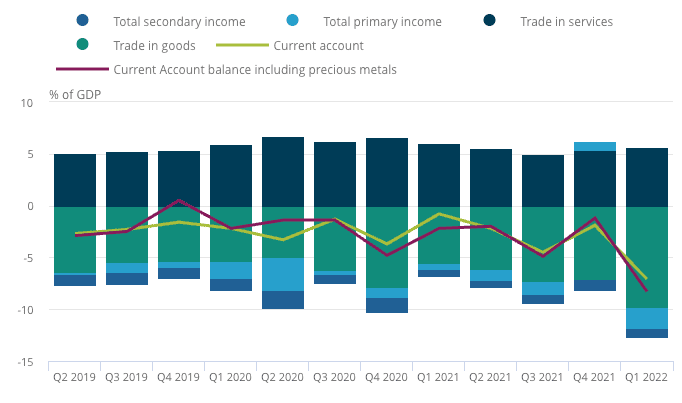

The ONS reports the underlying UK current account deficit excluding precious metals expanded to £44.2BN, or 7.1% of GDP in the first quarter of 2022.

This is a surge of £32.8BN from the previous quarter and represents a joint record with the the fourth quarter of 2015.

"The current account deficit, which grew to a record share of GDP in Q1, will remain large over the coming quarters," says Samuel Tombs, Chief U.K. Economist at

Pantheon Macroeconomics.

Above: Contributions to the UK’s current account balance as a percentage of gross domestic product, Quarter 2 (Apr to Jun) 2019 to Quarter 1 (Jan to Mar) 2022. Source: Office for National Statistics – Balance of payments.

The ONS does warn however that the data must be treated with caution as the impact of data collection changes on trade in goods imports and foreign direct investment are being investigated.

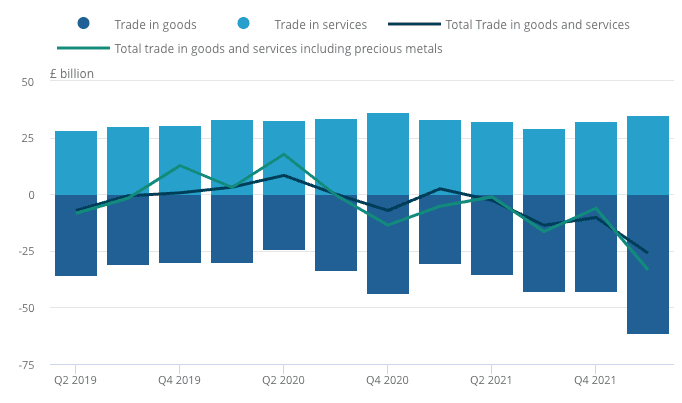

Nevertheless, the overarching message is unambiguous as the total trade deficit expanded to £26.0BN as imports of manufactured goods and fuels increased.

Above: Contributions to the UK’s trade balance, £ billion, Quarter 2 (Apr to Jun) 2019 to Quarter 1 (Jan to Mar) 2022. Source: Office for National Statistics – Balance of payments.

The primary income account recorded a deficit of £12.4BN, or 2.0% of GDP, after recording a surplus in the fourth quarter of 2021. The primary income account records income the UK receives and pays on financial and other assets, along with compensation of employees.

Technically, when a country imports more than it exports its currency will come under pressure.

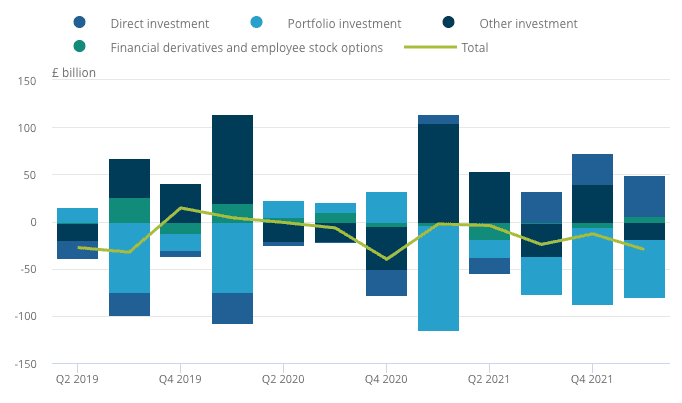

But, net financial flows increased in the first quarter of 2022 with a net inflow to the UK of £29.6BN, or 4.8% of GDP.

This means net financial flows have provided a positive support to Sterling, offsetting the negative pressures of the trade deficit.

Above: UK financial account balances, Quarter 2 (Apr to Jun) 2019 to Quarter 1 (Jan to Mar) 2022. The financial account recorded a net inflow as UK liabilities increased more than assets.

"The UK must attract net financial inflows to finance its current (and capital) account deficit," says the ONS.

"The adverse consequences of the U.K. dependence on external finance that stems from the large current account deficit have been clear over the last month, with sterling depreciating sharply as global investors have collectively shunned risky assets," says Tombs.

The ONS said the UK's yawning trade deficit was driven in part by the surge in oil and other energy prices: oil contributed a deficit of £3.1BN and other fuels £2.0BN.

UK goods exports were steady but oil exports were up to the tune of around £2.8BN.

The UK meanwhile continues to run a strong surplus in services which offsets a decent chunk of the deficits elsewhere.

The UK's trade in services strengthened its surplus position by £2.8BN said the ONS, increasing to £35.2BN in the first quarter, as imports of travel and other business services decreased.

The UK's current account deficit is expected to remain significant say economists.

"In Q2, oil and natural gas prices have risen further, while global travel patterns have continued to normalise; both these developments will boost the value of imports more than exports," says Tombs. "In addition, the S&P Global/CIPS U.K. manufacturing survey indicates that export orders have fallen continuously since February."

For the Pound, these developments suggest further weakness.

"With the current account deficit set to remain large over coming quarters, sterling will remain very sensitive to global trends in risk appetite," says Tombs.