Pound Sterling Higher after UK Retail Sales Surprise

- Written by: Gary Howes

- GBP higher after retail sales release

- Retail sales grow in April, defying expectations for a fall

- GfK consumer confidence fall to all-time low

- But recession is not inevitable say economists

Image © Adobe Stock

The British Pound turned higher following another better than expected economic data release.

UK retail sales volumes rose by 1.4% in April 2022 following a fall of 1.2% in March 2022 says the ONS, an outcome that was better than the -0.2% the market was looking for.

Food store sales volumes rose by 2.8% in April 2022, mostly because of higher spending on alcohol and tobacco, car fuel sales volumes meanwhile rose by 1.4% in April 2022 following a fall of 4.2% in March when record increases in petrol prices impacted sales.

The report "suggests that the cost of living crisis hasn’t caused consumer spending to collapse," says Nicholas Farr, Assistant Economist at Capital Economics. "While things are likely to get more difficult for consumers as the squeeze on households’ real incomes from higher inflation intensifies, the signs of resilience in economic activity in the retail sales data are encouraging."

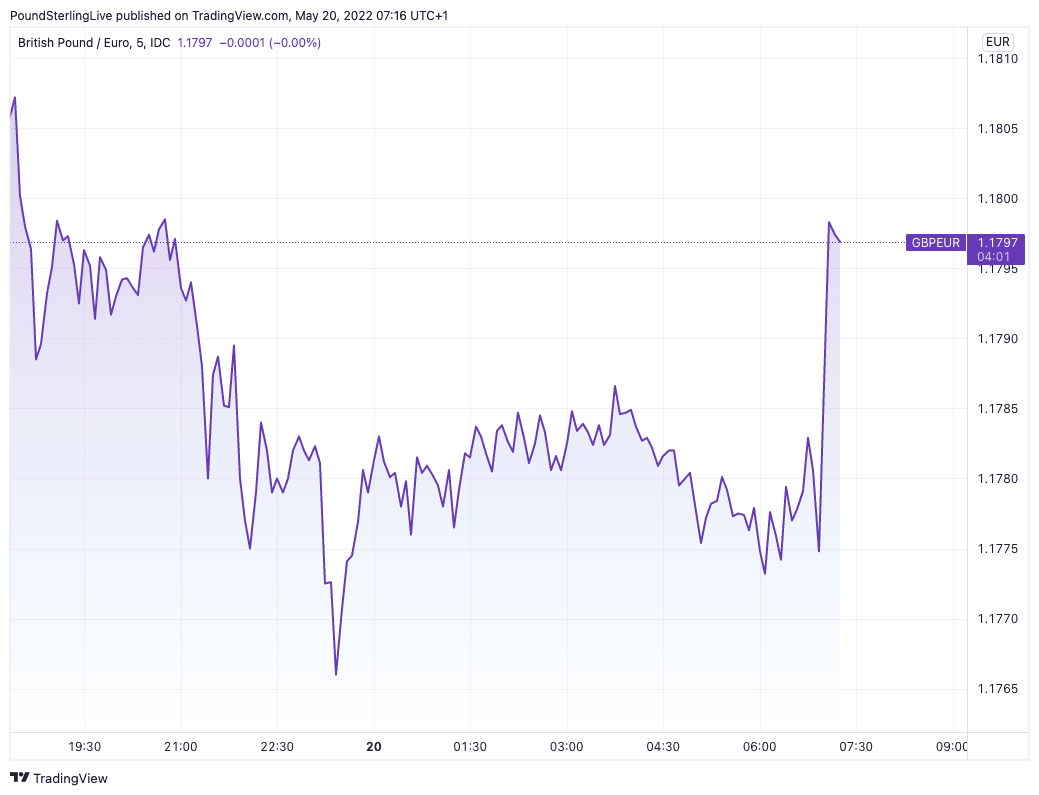

The Pound ticked higher on the numbers with the Pound to Euro exchange rate rising to 1.1790 and the Pound to Dollar exchange rate rising to 1.2478.

Above: GBP/EUR at five minute intervals showing post-retail sales release reaction.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

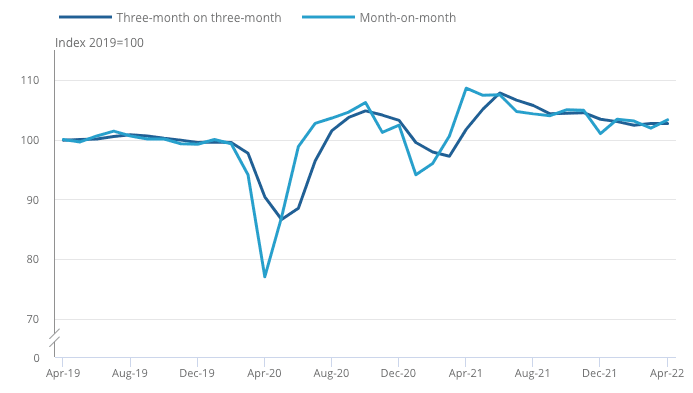

Despite the upside surprise retail sales are nevertheless trending lower: in the three months to April 2022, sales volumes fell by 0.3% when compared with the previous three months; this continues the downward trend since summer 2021.

This is explained in part by the post-Covid shift from goods consumption to services consumption.

It is also explained by rising inflation which will likely prompt a slowdown in demand.

It is this expectation for a consumer-lead drop in demand that has prompted the Bank of England (BoE) to warn of slowing economic growth over coming months.

Currency analysts meanwhile maintain the expected slowdown is one reason to be wary of the Pound.

Above: Volume sales, seasonally adjusted, Great Britain, April 2019 to April 2022. "Retail sales volumes rose over the month but fell in the three months to April 2022" - ONS.

The above chart does not show a significant slump in retail spending, rather a flatlining which could calm nerves amongst those who were expecting a sharp decline as inflation rises as consumer confidence falls.

"Big picture, overall retail spending is still down slightly on levels seen during last autumn, which is mainly due to a noticeable downtrend in online sales. These are down by roughly 5% on the third quarter of last year. While it’s tempting to ascribe this to the increase in the cost of living, we think it at least partly reflects consumers rebalancing spending away from goods and back towards services," says James Smith, Developed Markets Economist at ING Bank.

Separately, GfK reported their consumer confidence index fell to its lowest level on record to -40.

“Consumer confidence is now weaker than in the darkest days of the global banking crisis, the impact of Brexit on the economy, or the Covid shutdown," says Joe Staton, client strategy director at GfK

"Confidence is now at all-time lows and that's likely to help produce a negative second quarter growth reading," says ING's Smith. "Nevertheless, a large savings buffer and a solid jobs market means a severe recession is not inevitable".

ING expect the economy will experience negative growth this quarter but this is largely due to the fall in government Covid spending and the effect of the extra bank holiday that falls for the Queen's jubilee, rather "than the deteriorating consumer story".

Pound Sterling Live carried a story Thursday that a number of economists do not see the UK economy sliding into recession as consumers have savings accrued during the pandemic to tap into. The household savings rate can also still come down from higher levels, allowing consumption to continue.

Another analyst said a UK recession would only be likely if one of the three pillars of the UK economy fell: labour, housing or the banks.

Neither of the above look as if they are about to suffer a shock.