Pound Sterling Battered by Euro, Dollar on Triple Hit of Poor Economic Data

- Written by: Gary Howes

- GBP is days worst performer

- Consumer confidence near crisis-era lows

- Retail sales plunge

- PMIs disappoint

Image © Adobe Stock

A slew of disappointing economic data readings has sent the British Pound sharply lower against the Euro and Dollar.

UK consumer confidence has plummeted to levels last seen during the Great Financial Crisis of 2008, portending a potentially significant economic growth slowdown.

Retail sales for April meanwhile came in far below expectations, reading -1.4% month-on-month in March, far below the -0.3% markets expected and the -0.5% print of February.

S&P Global's PMI data for April - the most timely of surveys for the UK economy - meanwhile showed a further slowing in growth rates as inflation surges.

"Downside risks for the pound are building with a host of specific negative developments providing reason for GBP sentiment to worsen over the coming days and weeks," says Derek Halpenny, Head of Research, Global Markets, at MUFG.

The impact on the Pound of the poor numbers was clear, with the UK currency losing ground to all its major peers on Friday:

Above: GBP is down against all major peers.

The Pound to Euro exchange rate slipped back below 1.20 again to 1.1947 and the Pound to Dollar exchange rate fell by nearly a percent to 1.2898. (Set your FX rate alert here).

"Our main reason for caution on GBP is that we do not believe the Bank of England will be able to keep pace with the aggressive tightening cycle priced in by the rates market," says Dominic Bunning, Head of European FX Research at HSBC.

"The consumer and PMI data today adds to our scepticism while increasing political volatility - both at home and abroad - will not make life any easier for GBP," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

PMIs

PMI data confirmed a further slowdown in UK economic growth with the S&P Global/CIPS Services PMI Flash for April reading at 58.3, below the 60 the market was expecting and sharply lower on March's 62.6.

Manufacturing PMIs actually beat expectations coming in at 55.3, ahead of the 54 the market expected.

But services account for a greater share of the economy meaning the overall Composite PMI read at 57.6, which is below the 59 forecast and April's 60.9.

S&P Global said April data pointed to a much weaker speed of recovery across the UK economy, largely due to the slowest rise in new orders so far in 2022.

Survey respondents said the 'cost of living crisis' and economic uncertainty arising from the war in Ukraine had impacted client demand.

"The survey data signal a marked cooling in the pace of UK economic growth during April, caused by an abrupt slowing in demand," said Chris Williamson, Chief Business Economist at S&P Global.

Consumer Confidence

Consumer confidence is an incredibly important component of the UK economy as it underpins the all-powerful consumer.

The UK's is a services economy and therefore how consumers and businesses spend and invest contributes to overall growth and decline.

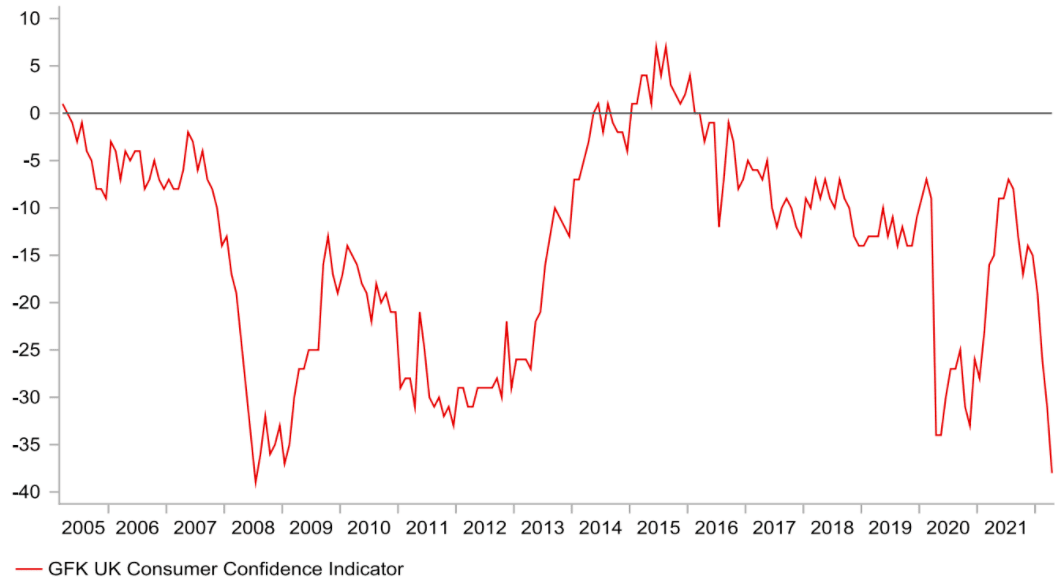

GfK said their UK consumer confidence measure is now "in freefall as Index crashes in April to -38".

Staggeringly, these levels were last seen during the Great Financial Crisis of 2008.

“The cost crunch is really hitting the pockets of UK consumers and the headline confidence score has dropped to a near historic low," says Joe Staton, Client Strategy Director GfK.

Above: UK consumer confidence is in free fall. Image courtesy of MUFG, data sourced: Bloomberg, Macrobond and MUFG GMR.

Retail Sales

Retail sales for April meanwhile came in far below expectations, reading -1.4% month-on-month in March, far below the -0.3% markets expected and the -0.5% print of February.

"The hefty fall in retail sales in March marks the second consecutive month of decline and adds to signs that the real wage squeeze is hitting consumer spending," says Bethany Beckett, UK Economist, at Capital Economics.

"March’s substantial fall in retail sales volumes looks like the start of a period of weakness in consumers’ spending, rather than just a blip," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

Above: "Retail sales in March were well below the level implied by their pre-Covid rising trend" - Pantheon Macroeconomics.

Tombs says the very low level of consumers’ confidence—GfK’s composite index now is lower than at any stage during the pandemic and just one point above its record low in July 2008—suggests that households will draw down their savings only cautiously.

"Looking ahead, we expect retail sales volumes to fall further over the coming months as the pressure on households’ finances from high inflation builds and consumers prioritise spending on services with they forewent during the pandemic," he says.

What Does this Data Mean for the Pound?

The slowing data will almost certainly prompt the Bank of England to consider the pace at which it hikes interest rates going forward.

The Pound has rallied through late 2021 and early 2022 on the belief the Bank of England would raise interest rates sooner and faster than many peers, particularly the European Central Bank.

But just how much further can the Bank raise rates into an economy that is clearly starting to come under stress?

If the answer is "not much" then the Pound would understandably come under pressure as financial markets pare back expectations for rate hikes.

"In line with retail sales this morning, preliminary PMIs out of the UK show the consumer is getting absolutely hammered at the moment. BoE pricing looks far too aggressive amid this consumption backdrop," says Simon Harvey, Senior FX Market Analyst at Monex.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Indeed, Bank of England Governor Andrew Bailey said in a speech late Thursday the Bank is walking a "tight line" between curbing inflation and tipping the UK into a recession.

Inflation is at a 30-year high of 7% and looks set to approach 9.0% in April, meaning the Bank's mandate of keeping inflation anchored around 2.0% has been shot to pieces.

Of course the Bank cannot control global oil prices and geopolitics, the fundamental source of the inflationary shock, but they are now concerned inflation expectations are becoming embeded amongst UK households and businesses.

That would require action from the Bank, via higher interest rates.

BoE Monetary Policy Committee member Catherine Mann said in a speech Thursday that there could be a case for a sizeable 50 basis point hike at the Bank in May, if data allows.

But the sheer gloominess of Friday's numbers will cast such a bold move in doubt, thereby undermining support for the Pound.

"We expect the UK expansion will continue although at a slower pace due to high inflation eroding consumers’ purchasing power and because the easy part of the post-covid recovery is now behind us," says Mikael Milhøj, Chief Analyst, at Danske Bank.

Danske Bank have this week released forecasts showing that the Pound's rally against the Euro has now ended.