Pound Sterling: "Grinding Underperformance" Against the Euro and Dollar Ahead Warn Investment Bank Names

- Written by: Gary Howes

- GBP/USD eyes three-month lows

- But GBP/EUR holds gentle uptrend

- Crédit Agricole warn of "buyers remorse"

- RBC Capital expect more decisive GBP declines

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1727 | GBP/USD: 1.3820

- Bank transfer rates: 1.1500 | 1.3534

- Specialist transfer rates: 1.1645 | 1.3724

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound looks set to retest three-month lows against the U.S. Dollar but looks better supported against the Euro, although two major investment banks we follow are expecting a more decisive decline in the Pound into the end of the year.

The Pound-to-Dollar exchange rate (GBP/USD) dropped by half a percent in the wake of the release of hotter-than-expected U.S. inflation numbers on Tuesday and a retest of the July 02 low at 1.3731 looks to be possible near-term.

The Dollar was bought against all major peers after U.S. inflation for June rose 5.4% year-on-year, well ahead of market expectations for a reading of 4.9%.

"The latest US inflation report came in well above expectations and the markets have reacted by sending the dollar higher and indices lower," says Fawad Razaqzada, Market Analyst at ThinkMarkets.com.

Above: There was a notable sell-off in GBP/USD in the wake of U.S. inflation data.

Although GBP/USD was under pressure the Pound-to-Euro exchange rate (GBP/EUR) remains outside of the fray and holds steady around the 1.17 level.

The overall trend is pointed upwards, although the rate of appreciation remains lacklustre and those aiming for the 2021 highs will require some patience.

Note that there is inflation data due out of the UK on Wednesday followed by employment data on Thursday, keep an eye on Pound Sterling Live for the market reaction to these events as any surprises could trigger some volatility.

GBP/EUR currently remains supported amidst expectations for higher UK economic growth in 2021 relative to that of the Eurozone, which should in turn allow the Bank of England to hike interest rates ahead of the European Central Bank.

Above: GBP/EUR maintains a gentle, albeit uninspiring, uptrend.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Optimism for the UK economic outlook was boosted Monday by a government announcement that all remaining domestic covid restrictions would be lifted on July 19, which could allow the economic recovery to accelerate over coming weeks.

But, foreign exchange analysts at RBC Capital Markets have told clients in a new monthly research update they are expecting the Pound to take a more decisive turn lower over coming weeks as the UK economy will disappoint.

"Going forward, we think the risks are shifting to the downside, though timing is difficult," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

RBC Capital note that government support for the economy is due to expire over coming weeks and this could in turn undermine the economic recovery, something the foreign exchange market might not yet be prepared for.

"Several temporary supports for activity are set to roll off in the coming months – the furlough scheme is already tapering and ends in September," says Cole.

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole shares these concerns.

"We further think that there are other downside risks to the current UK economic outlook given the removal of government support measures and the persistent post-Brexit uncertainty," says Marinov in a recently published strategy briefing.

Pricing on money markets shows investors are positioned for an interest rate rise at the Bank of England to take place in 2022, ahead of a similar move at the European Central Bank in 2024.

But Crédit Agricole says pricing for a 2022 hike at the Bank of England is too optimistic and a rate rise is only likely in 2023, a prediction that if correct would likely require an unwinding of recent Sterling gains as the market readjusts.

"The BoE may disappoint current rate hike expectations by delaying lift-off till 2023. We therefore maintain a cautious outlook on the GBP for now," says Marinov.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

To be sure, the UK economy is currently experiencing a strong rebound, however of late data it has been surprising to the downside.

Currencies tend to appreciate when data surprises to the upside and the opposite direction is taken when data disappoints.

Therefore further data disappointments over coming weeks will only undermine any recovery potential in the Pound going forward.

Weekly card spending data from the Bank of England has shown the rate of growth in spending has stalled and is coming down somewhat, a development some economists blame on the rebound in Covid-19 cases.

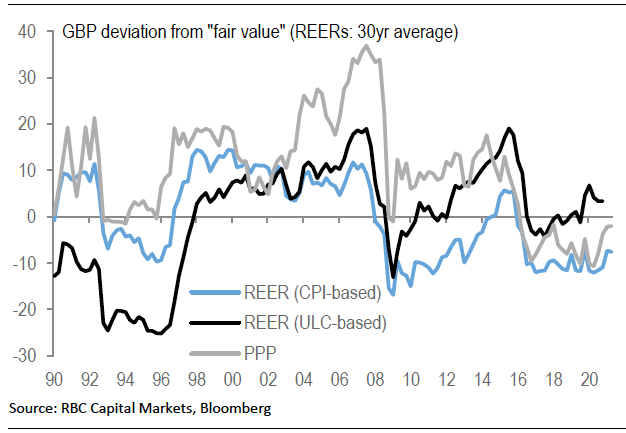

Above: "GBP close to fairly valued" says RBC Capital.

While the government has committed to dropping all Covid restrictions the rebound in cases still creates an air of caution amongst consumers and businesses and this will be reflected in economic activity.

"The GBP continues to suffer from 'buyer’s remorse' as investors who once saw the pound as a good way to benefit from the rapid vaccine rollout in the UK and the subsequent reopening of the British economy are now 'bailing'," says Marinov.

RBC Capital meanwhile forecast notable declines in the Pound during the second half of 2021.

Their assessment is that the currency will be fundamentally undermined by the UK's persistent current account deficit which has been trending at an already sizeable 3.2% of GDP the last four quarters.

"There is no sign yet of the inbound M&A boom that many expect to cover the deficit. Our longer-term expectations for GBP have to include the risk that attracting the foreign inflows the UK will need “requires” a relative cheapening of UK assets via the currency," says Cole.

RBC Capital therefore expect "grinding GBP underperformance to continue into the medium-term".

RBC Capital Markets forecast the Pound-Euro exchange rate to end 2021 at 1.1236 while they see the Pound-Dollar exchange rate ending the year at 1.28.