Euro to Dollar Rate Week Ahead Forecast: Biased Lower

- Written by: Gary Howes

File image of Donald Trump. Official White House Photo by Shealah Craighead.

EUR/USD looks like it wants to go lower, and election anxiety and a potentially hot U.S. jobs report could ease the way.

The latter end of the previous week saw the Euro recover somewhat, hinting that maybe the Dollar's trend of appreciation was approaching an exhaustion point.

Thursday's rally of 0.42% was the biggest one-day gain since September 24 and had the potential to mark a turning point from the frantic selling, and there was some chatter in the FX market commentariat that the selloff was finally tiring.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

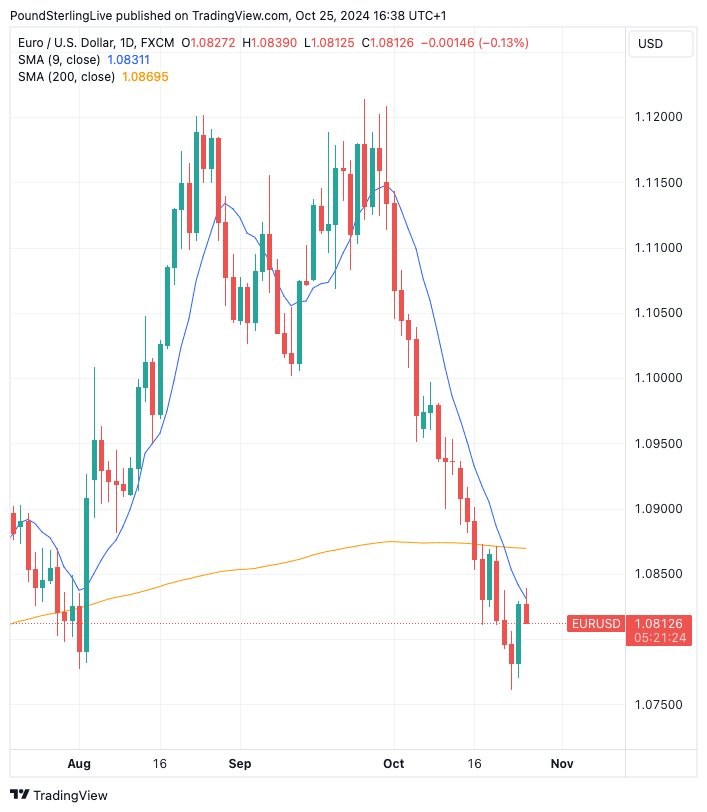

However, Friday's price action was hardly inspiring, and a failure at the nine-day moving average signalled it was too soon to call a turn.

Given this, the coming five days could see further weakness and our initial target is 1.0760.

If EUR/USD can manage a break above the 9-day MA (currently at 1.0831) then consolidation is likely. To be sure, at the time of writing, this level is near and achievable.

Any subsequent consolidation would involve the EUR/USD returning back to the 200-day MA, currently located at 1.0869, which will act as a region of resistance.

But this is as optimistic as we are prepared to get when considering topside, as we would need to see a fundamental shift occur for a notable recovery to evolve.

Stepping away from the technical perspective, a potential fundamental boost to the Euro could arrive on Wednesday with preliminary inflation data for October for Spain and Germany.

It was September's inflation data for these two countries that sunk the Euro when released at the start of the month, as it led to an interest rate cut at the European Central Bank two weeks later.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The market anticipates inflation to pick up slightly into year-end, which, if confirmed midweek, could cushion the Euro.

That said, any strength will be limited. On the other hand, an undershoot in the inflation figures will only add to the belief that the ECB must get its skates on, which would weigh on the Euro.

The Eurozone-wide inflation data are due the following day, although recent history has suggested the market would usually have gotten a steer from the previous day's German and Spanish releases.

The U.S. Dollar side of the equation will remain the most important driver, with Friday's U.S. labour market figures the marquee event of the week.

Should the U.S. non-farm payroll component of the report beat expectations then look for U.S. yields to firm as markets lower expectations for the quantum of rate cuts to come from the Federal Reserve in coming months.

This would bolster the Dollar and trigger fresh multi-week lows for EUR/USD.

Expect the U.S. election to hold the market's focus through all this. What we have seen in recent days is that rising odds of a Trump win are consistent with Dollar strength.

To be sure, market-implied odds are settling around a 60% chance of a Trump win, and stabilisation around here could ease downside pressure on Euro-Dollar in the coming days.

We think markets are going to remain nervous ahead of the vote, with uncertainty remaining high. This is fertile ground for the Dollar and can only add to the sense that Euro-Dollar is biased lower.