Euro to Dollar Week Ahead Forecast: Targeting 1.0930

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate (EUR/USD) risks further losses in the coming days, however, downside momentum will likely fade.

"The FX market has suffered a hard reset as the notion of an aggressively dovish Fed has now evaporated," says Francesco Pesole, an FX strategist at ING Bank, distilling the overarching theme of recent days that has resulted in a sizeable U.S. Dollar rebound.

Friday's unmistakeably strong U.S. labour market report means the Federal Reserve is highly unlikely to cut interest rates by 75 basis points in 2024, meaning investors will likely only receive two more 25bp moves.

This adjustment in expectations has been reflected in a stronger Dollar that sent EUR/USD down 1.68% last week, slicing the 50-day moving average in the process and shifting the setup from bullish to neutral, with growing odds of sliding bearish.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

How much further Euro-Dollar falls will depend on the degree of repricing left. We suspect the lion's share of this has now taken place, which should allow the Euro to breathe better and start to consolidate.

"We could see some mild support coming the pair’s way in the coming days as the Fed and ECB repricing have both run their course," says Pesole.

However, strength will likely be limited from here and many market participants could use bounces to offload exposure or enter fresh shorts.

Kenneth Broux at Société Générale, says for EUR/USD, the hawkish repricing of the U.S. rate outlook comes at the worst possible time.

"It inflicted maximum pain at a moment when the ECB is lining up another rate cut. Spreads are widening in favour of the dollar in the front and the long end. This year’s highs of 1.12 may not be revisited anytime soon, and we must brace for a deeper drop. The 200dma is running at 1.0873," says Broux.

The market has ramped up expectations for the European Central Bank (ECB) to cut interest rates again next week in response to September's below-consensus Eurozone inflation numbers and ongoing evidence of an economic slowdown in the region.

As recently as mid-September the expectation was the ECB would wait until December before cutting rates again.

"EUR/USD below 1.10 seemed to us to be a matter of when rather than if following the rewidening of the USD:EUR short-term rate gap. At the same time, we think 1.100 would have worked as a sturdier support had we not seen such strong US jobs numbers," says ING's Pesole.

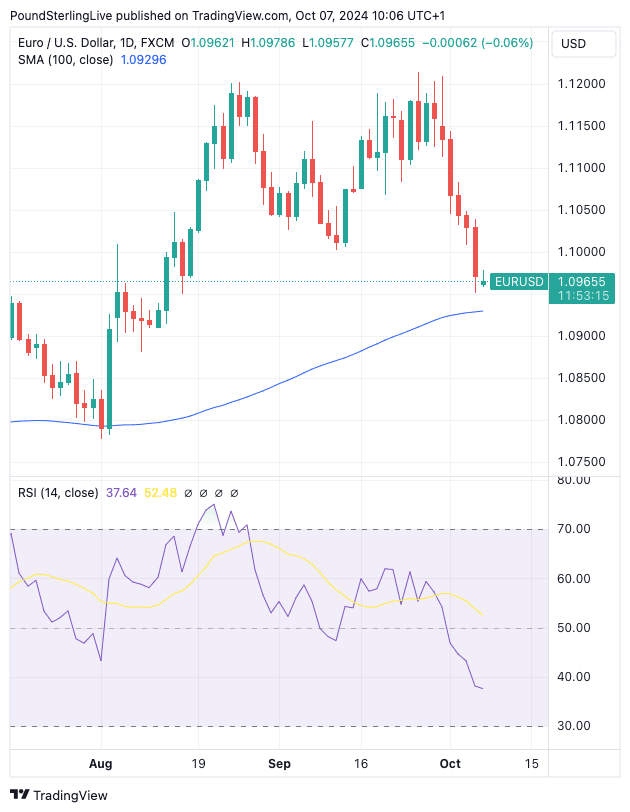

Looking at the charts, the daily Relative Strength Index (RSI) is at 37 and is pointed lower, which advocates for further near-term weakness.

The Euro-Dollar could now be on course to test the 100-day moving average support located at 1.0929 where some buying interest might emerge, as was the case the last time the exchange rate reached this point in August.

"Many of the factors that weighed on the Dollar through the summer had reversed—our data surprise index has steadily improved, recession concerns have faded somewhat, and price action after the Fed’s 50bp cut suggests we are at the limits of pricing a dovish reaction function with this dataset," says Kamakshya Trivedi, an analyst at Goldman Sachs.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Thursday's U.S. inflation report is the highlight of the week for FX, as it will determine how market sentiment evolves in line with expectations for Fed rate cuts.

A below-expectation reading would firm hopes that the Federal Reserve will cut interest rates two more times in 2024, which can bolster the USD recovery against EUR.

The market is looking for a reading of 2.3% year-on-year and 0.1% month-on-month. Anything above this could act to pushback against rate cut expectations yet further and could see GBP struggle into the weekend.

Further downside risks for EUR/USD come in the form of ongoing geopolitical concerns centred over the Middle East.

Bear in mind that Israel has promised a significant retaliation to last week's Iranian missile attack. The scale and nature of the attack could be significant and could drive demand for currencies that are sought when investors are fearful, such as the Dollar, Yen and Franc.