Euro to Dollar Week Ahead Forecast: Space for Weakness to Run

- Written by: Gary Howes

Image © European Central Bank

The Euro looks to remain under pressure against the U.S. Dollar in the near term but expect volatility around Wednesday's U.S. inflation report and Thursday's European Central Bank (ECB) decision.

The Euro to Dollar exchange rate registered a 0.65% peak-to-close decline on Friday amidst a notable readjustment in U.S. interest rate expectations that followed a robust U.S. job report and speeches from two influential members of the Fed's decision-making committee.

The net result was a realisation by the market that the Fed will cut by 25 basis points in September and that the prospect of a 50bp move before year-end is now unlikely. This is because all signs point to a U.S. economy that is gradually slowing but not fast enough to warrant aggressive easing, as any decision to cut by 50bp would imply.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

This has disappointed investors who are hungry for easy money from the Fed. This disappointment is reflected in weak stocks and a stronger 'safe haven' Dollar. The readjustment can continue in the coming days, meaning the Euro-Dollar's rally is on ice and the pullback can extend further.

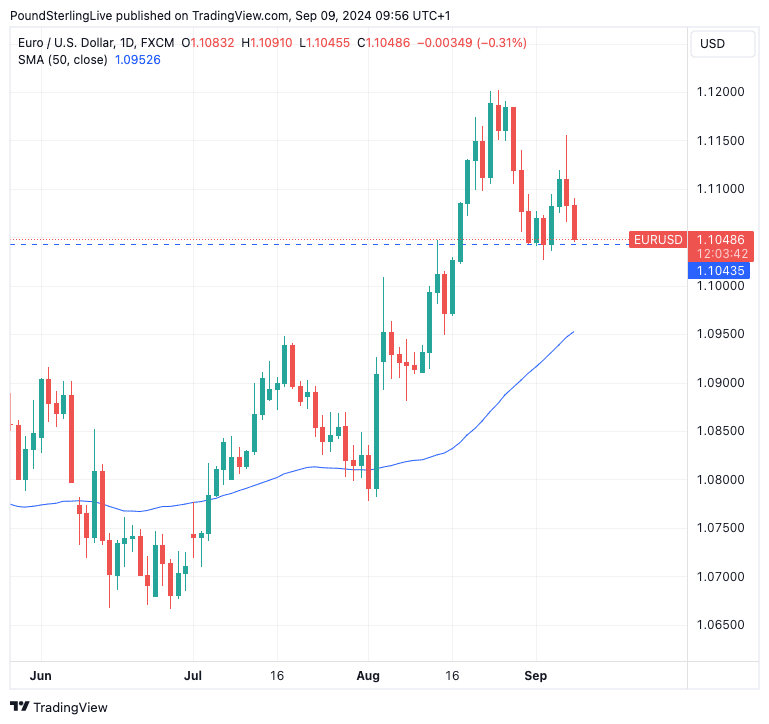

There is some graphical support at 1.1043 - last week's low - that could arrest declines in the early parts of the week, but there is ample space for the pullback to extend sub-1.10 given all the major moving averages are lower (the 50 daily moving average is down at 1.0952).

Above: EUR/USD at daily intervals.

So, technically speaking, there is room for the weakness to run.

U.S. monthly inflation release is due Wednesday, and given the importance of global drivers, this could ultimately prove to be the highlight of the week for dollar exchange rates. Should U.S. inflation undershoot forecasts, market expectations for a 50 basis point rate cut at the Federal Reserve on September 18 will increase, boosting equity markets and supporting Euro-Dollar.

However, should the data come in stronger, expect further selling pressures as the odds of a 50bp cut are completely erased, in which case stocks can come under further pressure and the USD can rally.

Last week, we heard from two influential members of the Federal Reserve's rate-setting committee that although rates need to come down, the path of progress remains dependent on the data. Markets read this as a signal that the Fed is not concerned enough to pursue 50bp cuts and will prefer to stick to more conventional 25bp increments.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The realignment towards this outcome can extend if inflation figures beat expectations, which raises the odds of another strong week for the USD.

Thursday brings the European Central Bank (ECB) decision and an interest rate cut is fully expected by the market. What is less certain is whether or not the central bank will cut rates again in October. Updated guidance will therefore be of more importance to the market than the cut itself.

"Although wage growth is slowing, it is still well above the ECB’s target rate of 2%, and the concern is that wage growth could pick up in Q3, especially in Germany. Thus, while we expect a rate cut on Thursday, the ECB may not provide forward guidance and instead say that they remain data dependent for the rest of this year," says XM's Brooks.

The odds of an October rate cut were reduced last week after a number of Governing Council members aired their views on the matter. "Recent ECB rhetoric suggests a high bar to a follow-up cut in October after a likely September easing," says a note from currency analysts at HSBC.

"The ECB is poised to continue its quarterly easing with a 25bp rate cut in September. We expect communication to remain cautious and non-committal, with no change in the formal language. We think October meeting will be 'live', but the path of least resistance is to continue with quarterly cuts this year," says Mariano Cena, an economist at Barclays.

This matters for euro exchange rates as consecutive rate cuts are not fully 'priced in', meaning such an outcome would necessitate a readjustment lower in Eurozone bond yields and exchange rates. But a pause in October would underpin current levels in the single currency, all else equal.

"The hawks, predictably, point to concerns about still elevated services inflation and wages growth," says HSBC. German Bundesbank President Joachim Nagel is one such hawk, and he said this week that "we shouldn’t prematurely burst into cheers and pat ourselves on the back."

Gediminas Simkus said there are "compelling arguments for an ECB cut in September", citing "structurally sluggish" growth, "clear disinflationary trends" and economic risks which are "tilted downwards".

However, despite this dovish cocktail, he argued that an October rate cut is "quite unlikely" as changes in the upcoming economic projections will likely be unsubstantial.

The market currently views a follow-up October cut as a 1-in-3 likelihood. Should the odds of a cut in October rise in the coming days and weeks, we would anticipate the Euro to weaken.

But given how slim such an outcome is, we think the Euro can remain supported near current levels against the Pound and Dollar.