EUR/USD Week Ahead Forecast: Pulling Back

- Written by: Gary Howes

Image © European Central Bank

The Euro reached its highest level in five weeks against the Dollar last Friday, but there is a possibility of a consolidative retreat in the coming five days.

"The euro surged to a five-week high, driven by a weakening US dollar on the back of a lower-than-expected US CPI report which reinforced hopes of a Fed rate cut in September. European stocks and bonds trended higher as investors cheered the news," says Ruta Prieskienyte, Lead FX Strategist at Convera.

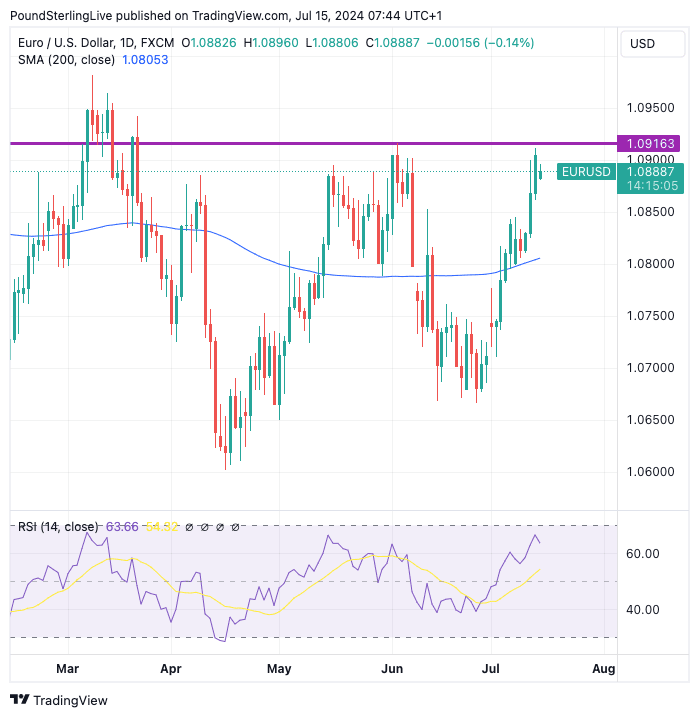

The Euro to Dollar exchange rate rallied to 1.0911 on Friday, which meant it fell just shy of the June 04 peak at 1.0916. The pair has opened the new week lower at 1.0887, and we wonder if this signals that 1.0916 is established as the near-term resistance point for the bulls to overcome:

Above: EUR/USD at daily intervals with the RSI in the lower panel. Track EUR/USD with your custom alerts; find out more here.

The RSI (lower panel in the above) approached overbought conditions at 70 but has since turned lower, further suggesting some near-term consolidation is possible in the coming days.

For now, weakness is likely to be short-lived, and a move back to the 200-day moving average (1.0805) is possible in the coming one to two weeks as part of any consolidative price action.

"EUR/USD threatened to break the $1.09 resistance level but was met with fading interest," says Prieskienyte.

For the week ahead, the Euro's big test comes on Thursday at midday when the European Central Bank makes its latest policy decision.

No change to interest rates will be made, but markets will want to know whether the Bank will cut again in September. Should the ECB signal such a move, the Euro can come under pressure.

However, the Bank is expected to maintain a data-dependent approach, which means it will keep its guidance as noncommittal as possible.

"Market focus would be on the outcome of the July ECB policy meeting. Ahead of that, we have heard from several Governing Council members who reiterated the bank's data-dependent monetary

policy stance," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

"These officials have also suggested that the September rather than the July policy meeting may be more consequential for the bank’s rate outlook. As a result, we and the markets do not expect any significant changes in the ECB’s guidance," he adds.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Euro-Dollar's performance nevertheless reflects the bout of Dollar weakness that is underay, as opposed to outright enthusiasm for the Euro. We note that the dollar has come under pressure over recent days as investors settle on a high likelihood that the Federal Reserve will cut interest rates for the first time in September.

Confidence was boosted by last week's undershoot in U.S. CPI inflation data. Euro-Dollar breached the 1.09 figure in the wake of U.S. CPI inflation printing -0.1% month-on-month in June, down from 0% in May and below expectations for a 0.1% rise.

Money market pricing shows the odds of a September interest rate cut at the Fed are now priced as a near certainty after the headline inflation rate fell to 3.0% year-on-year from 3.3%, undershooting expectations for 3.1%.

Tuesday's retail sales will be the U.S. data highlight for the coming days, shedding light on demand in the economy. The market's expectation of an undershoot of the 0% m/m figure could result in further USD weakness as the Fed would become increasingly confident that the disinflation process was underway again.

"Increased market confidence that the Fed may be growing more comfortable in moving toward rate cuts may soon put $1.10 on the agenda for the euro," says Prieskienyte.