EUR/USD Week Ahead Forecast: Watching for the Breakout

- Written by: Gary Howes

Image © Adobe Images

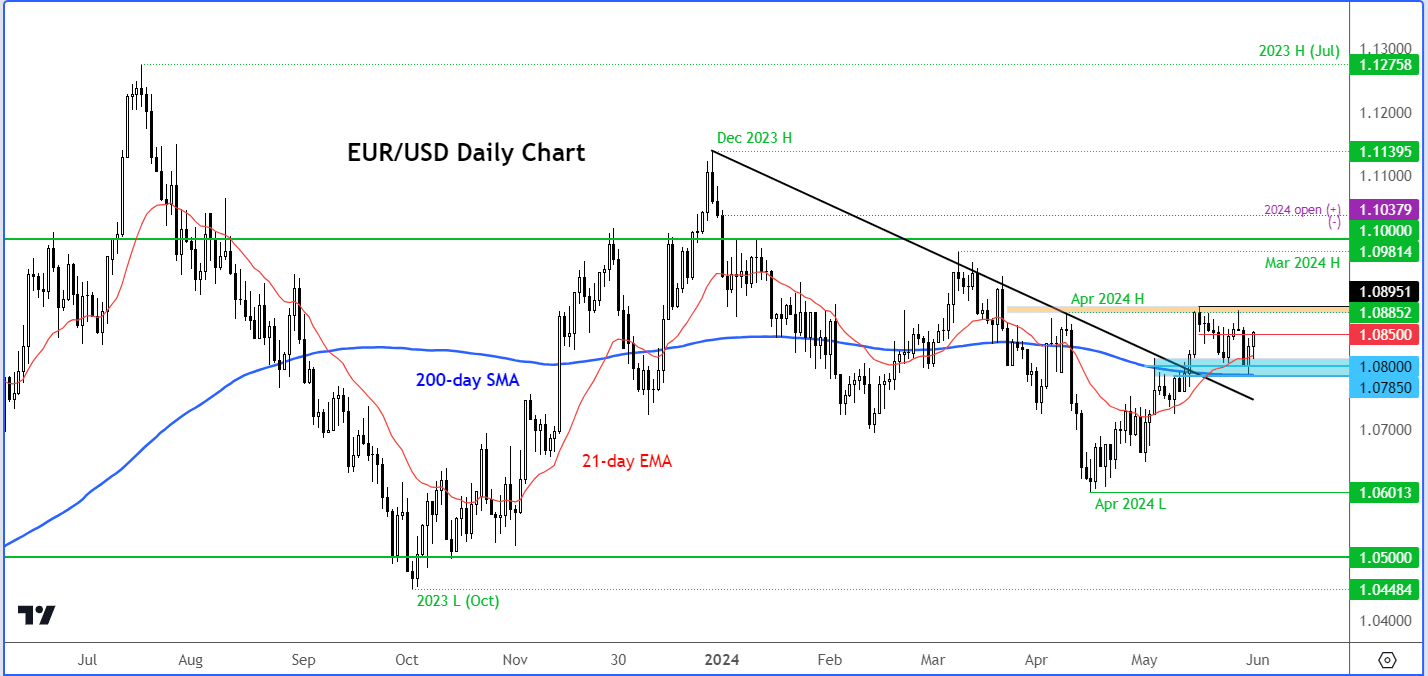

What is the Euro to Dollar exchange rate's forecast for the week ahead? We forecast a test of 1.09 and a potential breakout from the May range, but U.S. labour market numbers must come in weak.

Friday's impressive rally in the Euro to Dollar exchange rate reassured those bulls looking for higher levels, but the advance was not enough to trigger a break out of May's broader consolidation range.

The Euro rose against all its G10 peers after Eurozone inflation beat expectations, while the Dollar succumbed to a below-consensus PCE print that will be welcomed by those at the Federal Reserve would would be eager to cut interest rates before the year is out.

The close above 1.0860 is constructive and it sets up a potential test of 1.09 in the coming days. We note Euro-Dollar's daily RSI is at 60 and pointing higher while the exchange rate is also above its major moving averages.

"The EUR/USD has built modest bullish momentum, even if it remains stuck in a consolidation range. So far, it has been unable to decisively climb above April's high of 1.0885. Meanwhile, support around the 1.0785 – 1.0800 area continues to hold on the downside," says Fawad Razaqzada, an analyst at City Index.

Image courtesy of City Index.

"The underlying trend appears modestly bullish after breaking the bearish trend line established since December. The bulls will remain confident as long as the key support around the 1.0800 level is maintained," adds Razaqzada.

The European Central Bank (ECB) is expected to cut interest rates this week, which won't be a market-moving surprise given that it has been signposted for months. What will potentially move the market is the guidance regarding future rate cuts.

"The highlight is the ECB meeting, with a rate cut well anticipated, so the guidance for future policy moves will be a key driver. We think the euro will weaken, especially given its strong rally in recent weeks," says Dominic Schnider, a strategist with UBS' Chief Investment Office.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Eurozone economy is rebounding, and inflation continues to prove sticky, suggesting there is little need to rush into another cut as early as July.

Instead, expect the ECB to confirm that it remains data-dependent and argue that it is prudent to allow some time before cutting rates again.

This would be a status-quo outcome for the Euro and could result in further strength as Eurozone bond yields firm relative to those of the U.S., likely sending Euro-Dollar to 1.09. "We expect a cautious easing cycle and forecast only two cuts in 2024. The ECB will also publish updated economic forecasts. In our view there is a risk the ECB is a little less dovish than expected, providing some modest support to EUR/USD," says Carol Kong, a currency strategist at CBA.

Turning to USD, Monday's U.S. PMI print should generate some interest, although we would not place too much weight on any market movements ahead of Friday's all-important job report.

"Last month, U.S. nonfarm payrolls came in below 200,000 for the first time since 4Q23. All eyes are on this month’s release to gauge whether this was just a one-off or if new employment is actually cooling down. This is critical for the US dollar," says Dominic Schnider, a strategist with UBS' Chief Investment Office.

The market is looking for a headline non-farm payroll reading of 180K and an unemployment rate of 3.9%. Average hourly earnings are expected to have risen 3.9% year-on-year.

"If US labour market data are on the soft side, markets may upgrade the likelihood of a first rate cut in July, which would weaken the USD even more," says Schnider.

The Federal Reserve is in no rush to cut interest rates, leaving markets pricing in one full rate cut by December, with September being a 50/50 shot.

"This jobs report and wages data should provide further clues on that front. In recent weeks, we have seen bond yields rise, with investors growing increasingly worried about the possibility of interest rates staying elevated for a longer period," says Fawad Razaqzada, an analyst at City Index.

"If that sentiment changes, say because of a run of below-forecast U.S. data, then the US dollar may finally break down more decisively and start a clean trend. However, if data remains super-hot, then this may, paradoxically, weigh on risk sentiment as rate cut expectations are pushed further out," he adds.