Euro-Dollar Relief As ECB Expected to Fight Back Against Rate Cut Expectations

- Written by: Gary Howes

Above: Commerzbank HQ dominates the Frakfurt skyline. Image © Andre Douque, reproduced under CC licensing conditions

The Euro-Dollar could recover lost value if the European Central Bank (ECB) next week pushes back against rising expectations for interest rate cuts.

Economists at Commerzbank - the German lender and investment bank - say the ECB "will endeavour to limit market expectations of faster interest rate cuts" as inflation will only fall to the 2.0% target in 2025.

The Euro has fallen over recent weeks as the market brought forward the timing of the first cut to April and increased expectations for the total number of cuts that would come in 2024.

Pushback, therefore, opens the door to a degree of recovery.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"Some reasons speak against rapid rate cuts," says Jörg Krämer, Chief Economist at Commerzbank. "The strong rise in wages continues to argue against a sustainable return of the inflation rate to the ECB's target in the near future."

If the ECB is successful, the Euro could retrace some of its recent losses as markets lower the odds for an April hike.

Markets brought forward the timing for the first rate cut to April after Eurostat said Eurozone inflation fell to 2.4% year-on-year in November, putting it on the cusp of the 2.0% target, far earlier than expected.

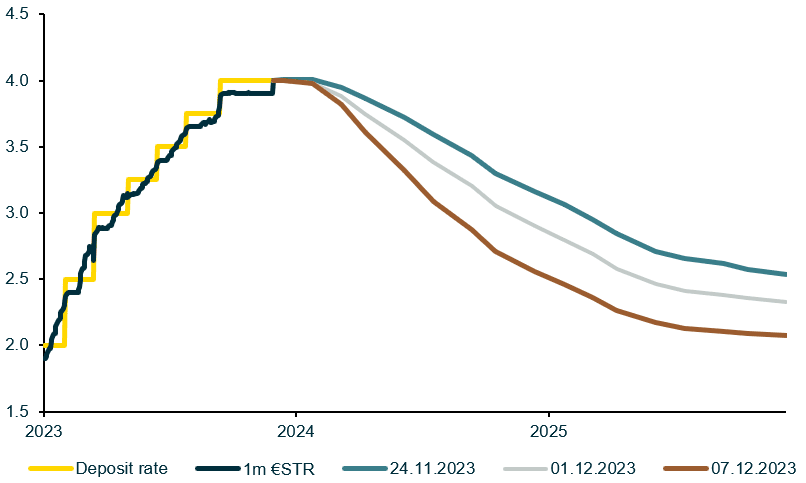

Above: Money market pricing shows expected interest rate levels in the Eurozone have fallen notably over recent days. Image courtesy of Commerzbank.

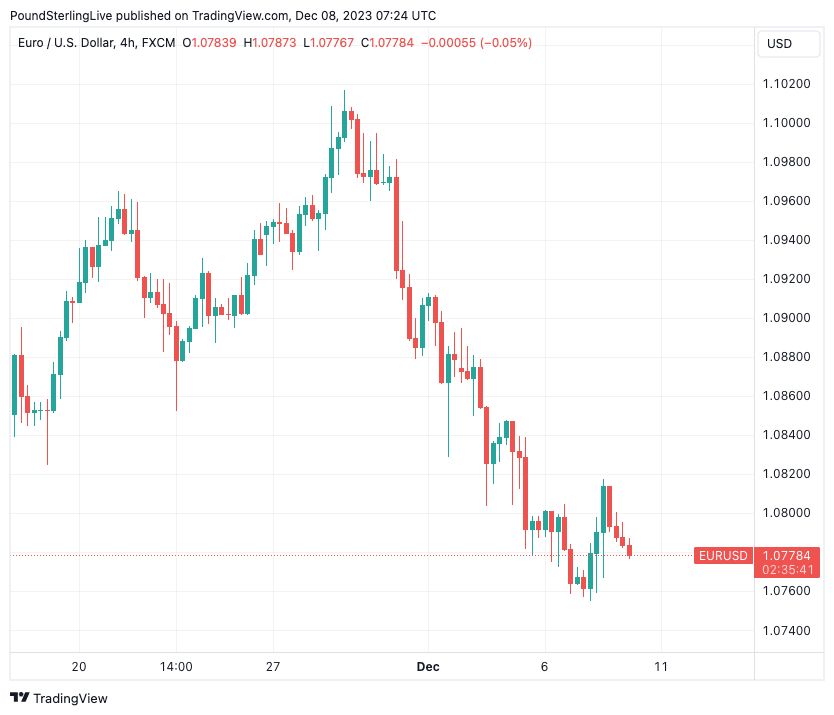

This was accompanied by a retreat in the Euro to Dollar exchange rate from 1.10 in late November to 1.0778 at the time of writing.

Indeed, markets felt validated in expecting earlier cuts after one of the ECB's most influential members, Isabel Schnabel, said the decline in inflation was "remarkable".

But Commerzbank reminds us the ECB's guiding principle is "higher for longer".

Above: EURUSD has fallen alongside rate expectations. Track EUR with your own custom rate alerts. Set Up Here.

"Almost all ECB Governing Council members repeatedly emphasised in their speeches and comments that interest rates would have to remain at the current level for a sufficiently long period of time in order to achieve the 2% inflation target sustainably," says Krämer.

He explains that any rapid departure from this stance would require considerable explanation, especially for the "neutrals" and hawks in the ECB Governing Council.

Ultimately, however, the strength of wage increases will scupper any hopes of an April rate hike.

"The strong rise in wages continues to argue against a sustainable return of the inflation rate to the ECB's target in the near future. The year-on-year increase in collectively agreed wages picked up once again in the third quarter to 4.7%, the highest value since the beginning of the time series," says Krämer.

We reported recently that economists at HSBC are pencilling a first ECB rate hike for 2025 because wage increases are expected to remain too high to allow inflation to fall to the 2.0% target in 2024.

Krämer says the rise in wages, which companies can only partially offset through rising productivity and/or their profit margins, suggests that service prices will continue to rise sharply, meaning that the decline in the seasonally adjusted core price index in November is likely to prove to be a one-off blip.

Commerzbank forecasts that the ECB will cut interest rates for the first time in the fourth quarter of next year, although the risks of an earlier cut have risen following the November inflation reading.

Commerzbank says rises in wages suggest that core inflation will ultimately settle at 3% rather than 2%, which is why economists consider interest rate cuts from April, as the market currently expects, to be unlikely.

"The ECB is likely to lower its forecasts next Thursday. In its communication, however, it is likely to endeavour to limit market expectations of faster interest rate cuts," says Krämer.

Successful pushback against increased expectations for rate cuts could support Euro exchange rates and limit any downside in Euro-Dollar.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes