EUR/USD Week Ahead Forecast: Bearish Vibes

- Written by: Gary Howes

- EURUSD back in the bear camp

- Sub-1.15 levels could be encountered

- German sentiment data to be watched

- Fed's Powell is the USD's highlight

Image © Adobe Images

The short-term technical picture facing the Euro has turned bearish once more and all eyes are back to the downside over the coming days.

The Euro to Dollar exchange rate was building up a head of steam last week as the broader U.S. Dollar rally over recent weeks faded, largely thanks to guidance from Federal Reserve officials that cooled expectations for further rate hikes.

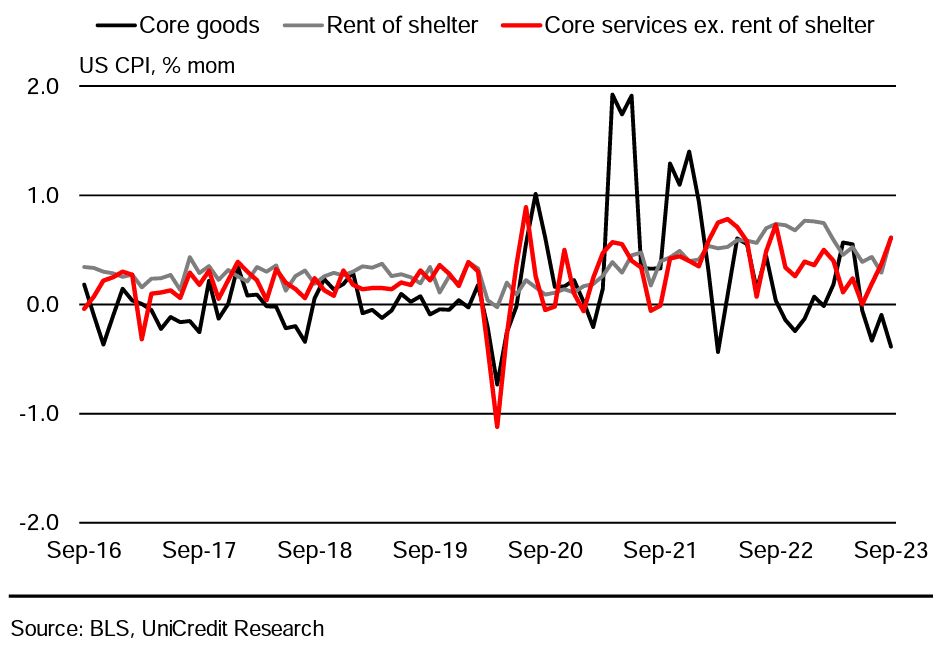

This sanguine tone to markets was rudely interrupted Thursday with the release of U.S. inflation figures and the Dollar promptly shot higher. "EUR/USD generally rallied through the first half of the week before reversing sharply to the downside on Thursday after a slightly hotter-than-expected US CPI report and a poor Treasury auction drove interest rates higher," says Matthew Weller, Global Head of Research at Forex.com.

Shaun Osborne, Chief FX Strategist at Scotiabank, has turned bearish on his assessment of the Euro's near-term prospects against the Dollar.

"The EUR’s failure to push on through the low 1.06s area with any real conviction this week suggests the daily bear trend remains intact and may set spot on course for a retest of the mid-1.04 zone, or lower. Price action is turning soft again," says Osborne.

Above: "EURUSD fails at trend resistance" - Scotiabank. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

"EUR/USD remains in a bearish channel amidst general strength in the greenback – potential for more downside in the coming week," says Forex.com's Weller.

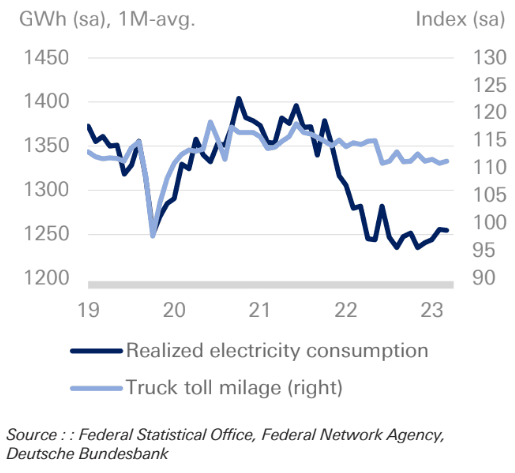

Turning to the event risks for the coming days, the Eurozone is subject to German sentiment readings on Tuesday at 10:00 BST and markets will be keen to see how Germany's prospects are rated, particularly given the deterioration in activity.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

We reported last week that the situation in the Eurozone's economic engine has deteriorated to such an extent that economists at Deutsche Bank now predict a double-dip recession is shaping up. This is hardly EUR-bullish.

Wednesday sees final confirmation of the Eurozone's inflation figures and because this is an update to the preliminary release we would not anticipate markets to be too flustered.

All signs point to the European Central Bank (ECB) being ready to pause its interest rate hiking cycle with Governing Council members last week pointing to the importance of Q1 2024 wage data for informing future moves.

The pause on rates does, on balance, deny the Euro support from the interest rate channel, particularly against the likes of the Dollar and Pound whose central banks could yet hike interest rates again in 2023.

Above: "German real-time data point to weak activity in Q3" - Deutsche Bank.

There is a fair amount of data to come out of the United States in the coming week, although the market-moving impact of the releases will have been dented somewhat by last week's inflation release, which sparked some notable moves in the market.

In short, the hotter-than-expected core services element of the inflation basket prompted investors to bet the Federal Reserve might have to raise interest rates again, with December now being favoured.

The data jolted the 'higher for longer' interest rate trade back to life from a short slumber, sparking a rally in U.S. bond yields and the Dollar.

The question for the coming week is how incoming data contributes to, or detracts from this theme.

Above: Rising core services inflation proved a major boost for the USD. How Fed speakers address the issue this week will be important.

The Empire State Manufacturing Index is due Monday at 13:30 BST with markets poised for a reading of -1.5 for October as activity deteriorates from 1.90.

Keep an eye on the Federal Reserve's Harker, who is due to speak on the same day, we would watch for any reaction to last week's inflation numbers.

The Fed's Williams speaks Tuesday, as does Bowman.

Tuesday's data includes retail sales at 13:30 BST, where a headline 0.2% month-on-month is expected for September, with core retail sales expected at 0.1%.

On Wednesday, building permit figures are expected to read at 1.45M and housing starts at 1.405M. The data is not traditionally impactful on the Dollar, but it will provide a decent insight into how the higher interest rate environment impacts the sector.

The Fed's Waller, Harker, Cook and Williams are all booked to speak, so perhaps its central bank guidance that offers the interest for markets.

Thursday sees Fed Chair Powell speak and if he touches on monetary policy, we would expect this to be the highlight of the week for the market.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes