Euro-Dollar Week Ahead Forecast: Sub-1.07 Levels in Sight as ECB Offers Little Prospect of Relief

- Written by: Gary Howes

- EURUSD downtrend tipped to extend

- ECB is key event this week

- Few bullish scenarios likely say analysts

- U.S. inflation data dominates midweek

Image © European Central Bank

The downtrend in the Euro to Dollar exchange rate (EURUSD) is forecast to extend over the coming days as analysts see few supportive scenarios on offer at the European Central Bank and the Dollar's bull run becomes increasingly entrenched.

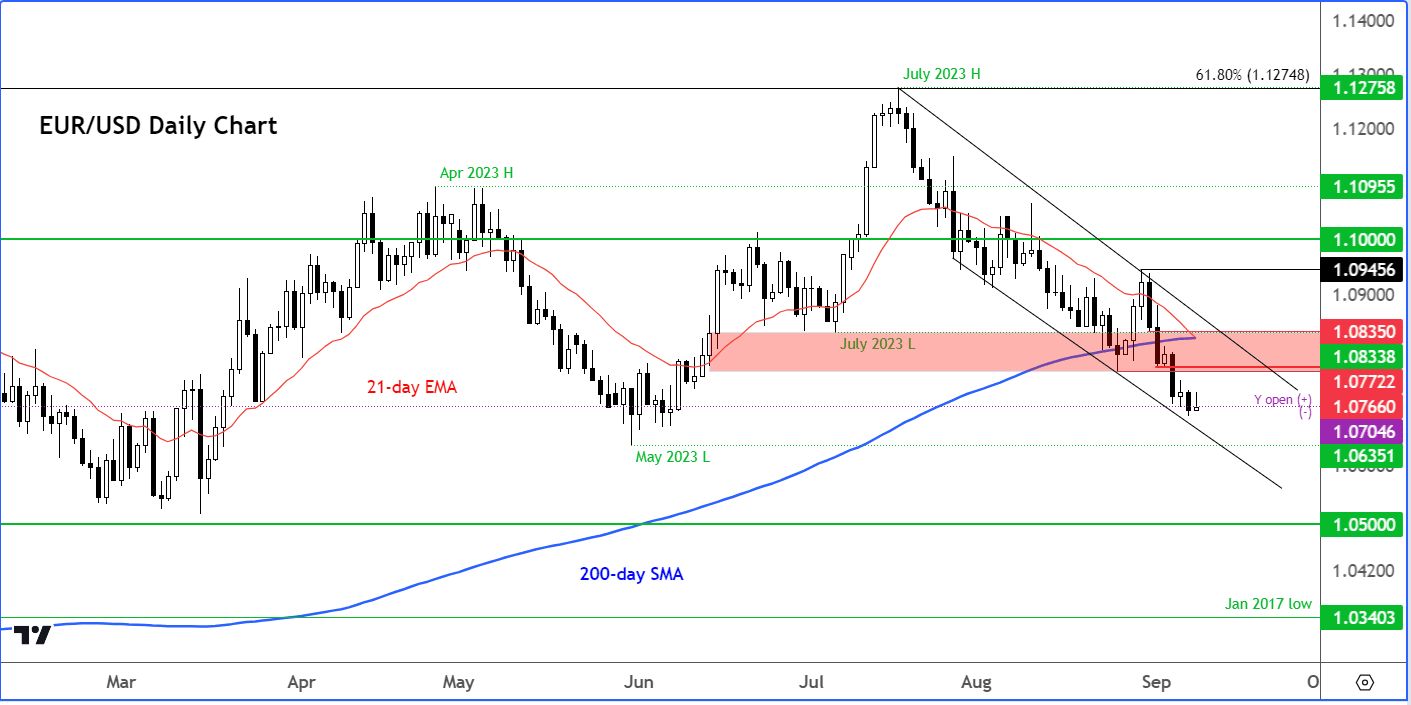

The Euro peaked at just north of 1.12 on July 18 and has been caught in one-way price action ever since with the retreat extending to a low of 1.0699 on Friday with little suggestion a turning point is at hand.

Analysts we follow say the exchange rate now looks set to entrench below 1.07 if the ECB fails to strike the right chord on Thursday and midweek data out of the U.S. proves hotter than expected.

"EUR/USD remains fragile as U.S. data stays strong and the news out of the eurozone and China remains bleak," says Chris Turner, a foreign exchange analyst at ING Bank N.V. "There seems no reason for EUR/USD to bounce and pressure could build for sub 1.0700 levels."

Above: EURUSD with key annotations, courtesy of City Index.

"More weakness appears likely for the EUR/USD, especially given that the dollar is looking very strong across the board," says Fawad Razaqzada, an analyst at City Index.

Razaqzada explains the EUR/USD and other euro crosses have come under pressure in recent weeks, owing to growth concerns both over the Eurozone and China, with the latter being one of the largest export destinations for European goods.

"After hitting 1.12 in July, EUR/USD has been precipitously falling back towards its lows of the year," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "The EUR’s recent fall from grace reflects growing stagflation fears in the Eurozone as well as worries about the global growth outlook."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Last week saw Eurozone PMI data for August revised sharply lower to levels consistent with contraction and Eurozone GDP for the second quarter was revised lower to just 0.1%. German industrial figures meanwhile confirmed an entrenched slowdown in the region's largest economy continued to deepen.

As a result, "the probability of a final rate hike at this ECB meeting has fallen sharply," says Razaqzada.

The consensus is for no change to be announced by the central bank, but the guidance is almost certainly likely to be of greater importance to the Euro than the final decision.

This is because the market is currently placing minimal weight on where interest rates peak, instead focusing on how long interest rates can be sustained at that peak level.

This means the Euro can fall even if the ECB surprises with an interest rate hike but the market judges the hike will ultimately be reversed sooner given the economic growth slowdown.

A decision to keep rates on hold could meanwhile push back the timing of that first interest rate cut, ultimately supporting the Euro, although there appear to be few 'hawkish' outcomes for the central bank given the slowing economic growth pulse.

"Directionally there is only one way for the EUR/USD from here," says Brad Bechtel, Global Head of FX at Jefferies LLC.

"If they do a hawkish hold it won't be enough to fight back inflation and if they do end up hiking it will be at the expense of growth," says Bechtel, "In either scenario, the EUR should underperform," says Bechtel."

Above: The Dollar index, a broad measure of USD performance, is in a firm uptrend. Image courtesy of City Index.

Disappointing data in Europe, the UK and China meanwhile contrasts with a better-than-expected run of U.S. data that raises expectations that the U.S. Federal Reserve can maintain interest rates at current levels for an extended period.

The rise in oil prices is also tipped by analysts to be supportive of the U.S. Dollar as non-oil exporting countries are expected to see inflation rates remain elevated as growth continues to slow.

Such stagflationary conditions are however unlikely to be experienced by the U.S. where growth continues to outperform expectations relative to China and Europe in what amounts to a reboot of the 'U.S. exceptionalism' trade.

"The dollar is having a technical rebound against most major currencies. Given the dollar is a momentum currency, this could continue in the near term," says Chester Ntonifor, Foreign Exchange Strategist at BAC Research.

Wells Fargo - a major U.S. bank - said in its most recent monthly research note the dollar can exhibit more strength through to to end of 2023 than had been previously expected.

"Our view on the U.S. dollar has changed slightly. We now believe the dollar can exhibit more strength through the end of 2023 than previously expected as China's slowdown and a resilient U.S. economy can support the greenback," says Nick Bennenbroek, an economist at Wells Fargo.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

In the U.S. this week all eyes are on the release of inflation data for August on Wednesday at 13:30 BST.

Core CPI is expected to rise 0.2% in the month to August with the headline figure expected at 0.5% m/m.

Should the figures beat expectations the Dollar would likely find further support as markets price in U.S. interest rates staying at elevated levels for a longer period.

Thursday sees the release of PPI inflation numbers, with the headline expected to come in at 0.4% m/m for August.

"It is a very big week for U.S. data as the last major reports ahead of the Federal Reserve's September FOMC meeting come in," says James Knightley, Chief International Economist at ING Bank.

For inflation, ING looks for fairly big jumps in August's month-on-month headline readings with upside risk relative to consensus predictions.

"Higher gasoline prices will be the main upside driver, but we also see the threat of a rebound in airfares and medical care costs, plus higher insurance prices," says Knightley

U.S. retail sales are due Thursday at 13:30 BST and the market looks for a reading of 0.2% growth, down from July's 0.7% increase. Industrial production is due out Friday at 14:15 BST and the figure to beat is 0.1%.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes