Euro can Continue to Strengthen says DNB Markets

- Written by: Gary Howes

Above: Christine Lagarde. Image by Dominique HOMMEL. © European Union 2019 - Source: EP

Foreign exchange markets have miscalculated the Euro's value relative to the risks of European Central Bank rate hikes, according to a Scandinavian lender and investment bank.

DNB Markets says in a new currency research note that FX investors seemed to ignor the risks that the ECB is to tighten policy, leading the Euro undervalued as a result.

They add the risks to the Euro's outlook are tilted towards the upside.

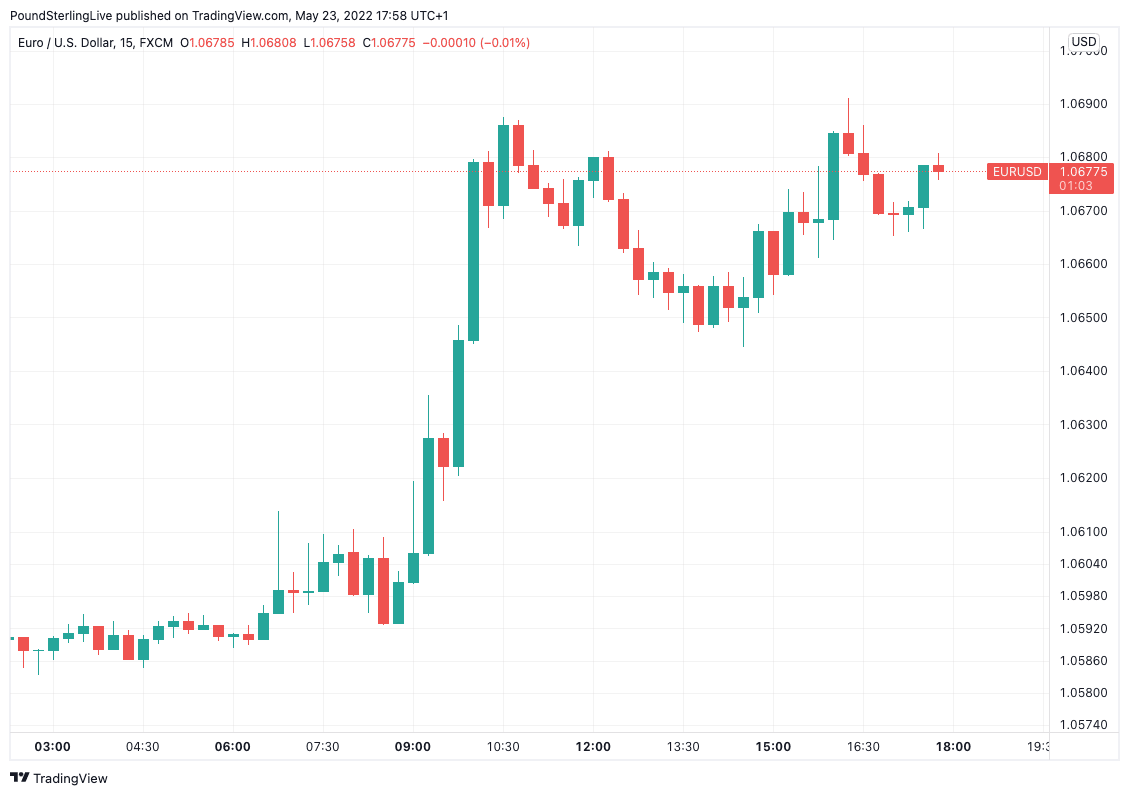

"Rising interest rate expectations in the Eurozone have lifted the EUR recently, which is staging a comeback against the USD. We believe the EUR will continue to strengthen and see EURUSD moving higher," says Ingvild Borgen, FX Analyst at DNB Markets.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

It was just last week Pound Sterling Live was reporting on the increase in predictions that were landing in our inbox saying the Euro was at risk of falling to parity against the Dollar.

But, fast forward a few days and it appears the odds of this likelihood have diminished somewhat owing to a significant shift at the European Central Bank (ECB).

The Euro shot higher at the start of the new week after European Central Bank President Christine Lagarde cemented expectations for a July interest rate hike. (Set your FX rate alert here).

"I expect net purchases under the APP to end very early in the third quarter," said Lagarde. "This would allow us a rate lift-off at our meeting in July, in line with our forward guidance."

"The conditions facing monetary policy have changed markedly. Three shocks have combined to push inflation to record highs," said Lagarde in a blog post aimed at addressing evolving investor expectations for future ECB policy.

Lagarde's comments follow those of other members of the Governing Council who had warned that a change in policy was coming.

Above: EUR/USD at 15 minute intervals.

This was further confirmed with the release last week of ECB minutes that suggested a 50 basis point hike was now even possible.

However, Lagarde seemed to suggest the the deposit rate would rise from -0.50% to 0% by September, hinting at two 25 basis point hikes.

"Interest rate markets had already priced this in, so the reaction there to Lagarde’s comments has so far been moderate. The EURUSD has risen significantly, however, underscoring that the FX and interest rate markets have been slightly out of sync recently when it comes to expectations for ECB tightening," says Borgen.

"In other words: the FX market appears to have disregarded that the ECB is also set to tighten monetary policy soon, and in our view this is one reason why the EURUSD has dropped to artificially low levels," she adds.

She says FX investors are now waking up to the fact that the ECB will join the Fed and other global central banks in tightening monetary policy.

"A continuation of this is the main reason why we believe the EURUSD will not remain at the current low levels and should instead rise. If anything, we see the risk to our current forecast for EURUSD to trade at 1.08 in three months and 1.10 in 12 months skewed to the upside," says Borgen.

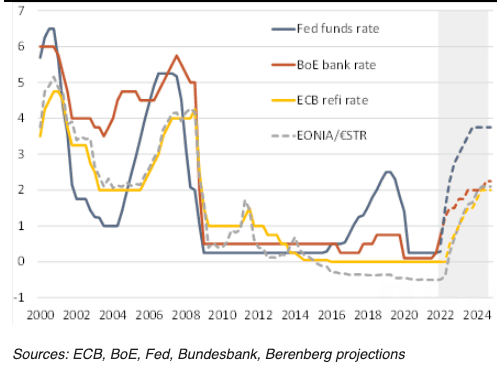

Above: ECB interest rates will ultimately catch those of the Bank of England.

Lagarde's comments follow those of other Governing Council members who have for weeks been priming investors for an imminent interest rate rise.

"In a remarkably explicit blog, ECB President Christine Lagarde today seems to have pre-announced the likely key policy decisions of the ECB’s9 June meeting. The ECB will end its net asset purchases in early July and raise rates at its 21 July and 8 September policy meetings," says Holger Schmieding, Chief Economist at Berenberg Bank.

The market now anticipates 108 basis points of hikes from the ECB in 2022 with a terminal rate at 1.66%, up from the 1.30% terminal rate expected on May 06.

This lift in terminal rate expectations is proving a source of support for the Euro at a time when investors are lowering their expectations for the terminal level at other central banks.

The ECB feels emboldened to act on its ultra-low interest rate settings by the belief inflation expectations in the Eurozone are finally moving higher.

Lagarde explains that a series of shocks such as Covid and the Ukraine war have contributed to higher global inflation, which has in turn helped push up inflation expectations amongst Eurozone businesses and consumers.

"Inflation expectations are becoming centred around our target, rather than at much lower levels like before the pandemic," says Lagarde.

"All this suggests that, even when supply shocks fade, the disinflationary dynamics of the past decade are unlikely to return. As a result, it is appropriate for policy to return to more normal settings rather than those aimed at raising inflation from very low levels," she adds.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes