GBP/EUR Week Ahead Forecast: Bouncing Off the 'Buy Line', Bank of England Risks Eyed

- Written by: Gary Howes

Image © Adobe Images

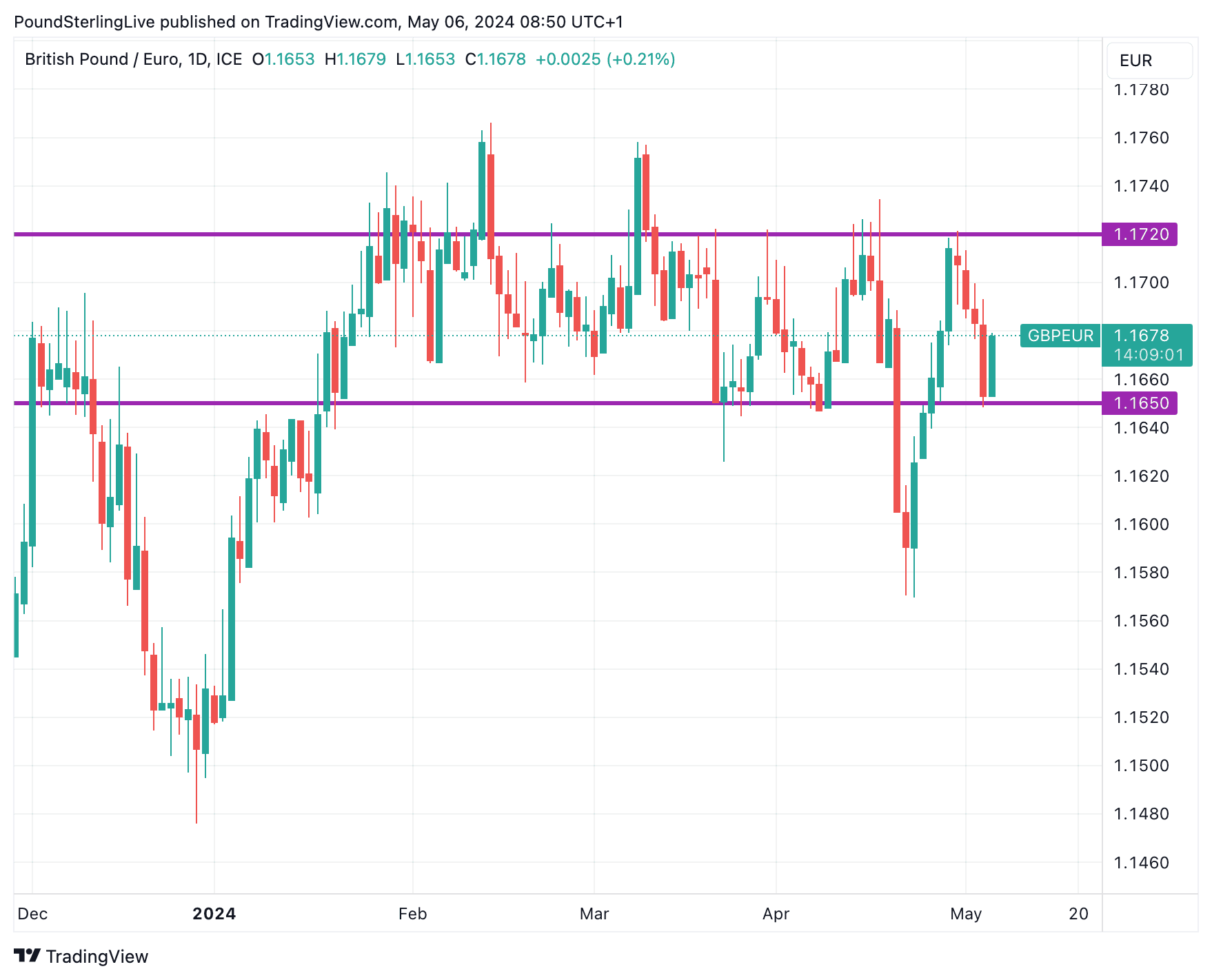

The Pound to Euro exchange rate starts the new week bid as it bounces off the 'buy line' located near 1.1650, but it could suffer a fall to April lows if this week's Bank of England guidance and forecasts point to a June interest rate cut.

Pound Sterling fell for four days in succession against the Euro last week as market expectations rose that the Federal Reserve would cut interest rates before December. This Fed repricing had the knock-on effect of boosting expectations for Bank of England rate cuts, something that weighed heavily on Pound exchange rates.

Friday's weaker-than-expected U.S. jobs report followed the midweek Federal Reserve policy decision that showed the Fed still believed the disinflation process would continue.

Should the Fed cut rates earlier than December (as is now assumed), the Bank of England could be enticed into an earlier cut. Global central banks are keen to start cutting under the cover of the Fed to insure against any unwanted financial risks and exchange rate volatility.

Furthermore, slowing economic activity in the U.S. will suggest to the Bank of England that activity in the UK could follow suit.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

There is greater scope for Bank of England interest rate repricing in a dovish direction than there is for European Central Bank repricing (markets have long expected the first ECB rate cut in June), which in turn weighs on the Pound relative to the Euro.

But the start of the new week sees Pound Sterling bouncing off the 'buy line' located near 1.1650 EUR, a level that has defended the 2024 range and has proven remarkably predictable. This suggests the market is still too nervous to aggressively push GBP/EUR in either direction and it will take an unambiguously 'dovish' turn from the Bank of England on Thursday to push it to the April lows.

Above: GBP/EUR is bouncing off the lower bound of the 2024 range.

"The pound is susceptible to BOE risks into the May 9 meeting," says a note from the foreign exchange strategy team at Barclays. "The MPC is gradually pivoting more dovish, as evidenced by Ramsden's recent speech but also more measured statements by Governor Bailey at the IMF meetings."

A clearly 'dovish' outcome for the Pound would involve the Bank pointing to a June rate cut, as this would involve a significant amount of repricing in financial markets. Such pointers could come in the form of more than one vote on the MPC for an immediate rate cut. The statement could also signal such intentions, as would a downgrade in the Bank's inflation forecasts.

Under such a scenario we would anticipate Pound-Euro to test April's low at 1.1567, but we would be surprised if the pair closed the week below 1.16.

Track GBP/EUR with your own custom rate alerts. Set Up Here

This is clearly a rangebound exchange rate, and if the Pound continues to weaken on Monday, Tuesday and Wednesday, then the odds of it bouncing back in a relief rally on Thursday and Friday increase. (Sell the expectation, buy the fact).

When we consider an upside scenario for Sterling, we imagine it would involve the Bank being at pains to signal that nothing much has changed and that while it is pleased with progress on inflation it remains guarded.

This could solidify expectations for an August rate cut. Here we would imagine the Pound recovers, with the scale of any recovery depending on how deep this current immediate-term selloff extends.

Any outcome that the market considers 'hawkish' could allow Pound-Euro a shot at retesting the upside of the range at 1.1720. We would not expect much progress beyond here.

This is because we don't see too much divergence potential between the UK and Eurozone at the current point in time, meaning weakness and strength will be faded in either direction.

"Our broad disposition to the pound remains constructive, particularly versus the EUR. This is because spill-overs from a dovish BOE repricing tend to be limited (per the round-trip in EURGBP following Ramsden's speech)," says Barclays.