GBP/EUR Week Ahead Forecast: Downside Likely Limited

- Written by: Gary Howes

Image © Bank of England

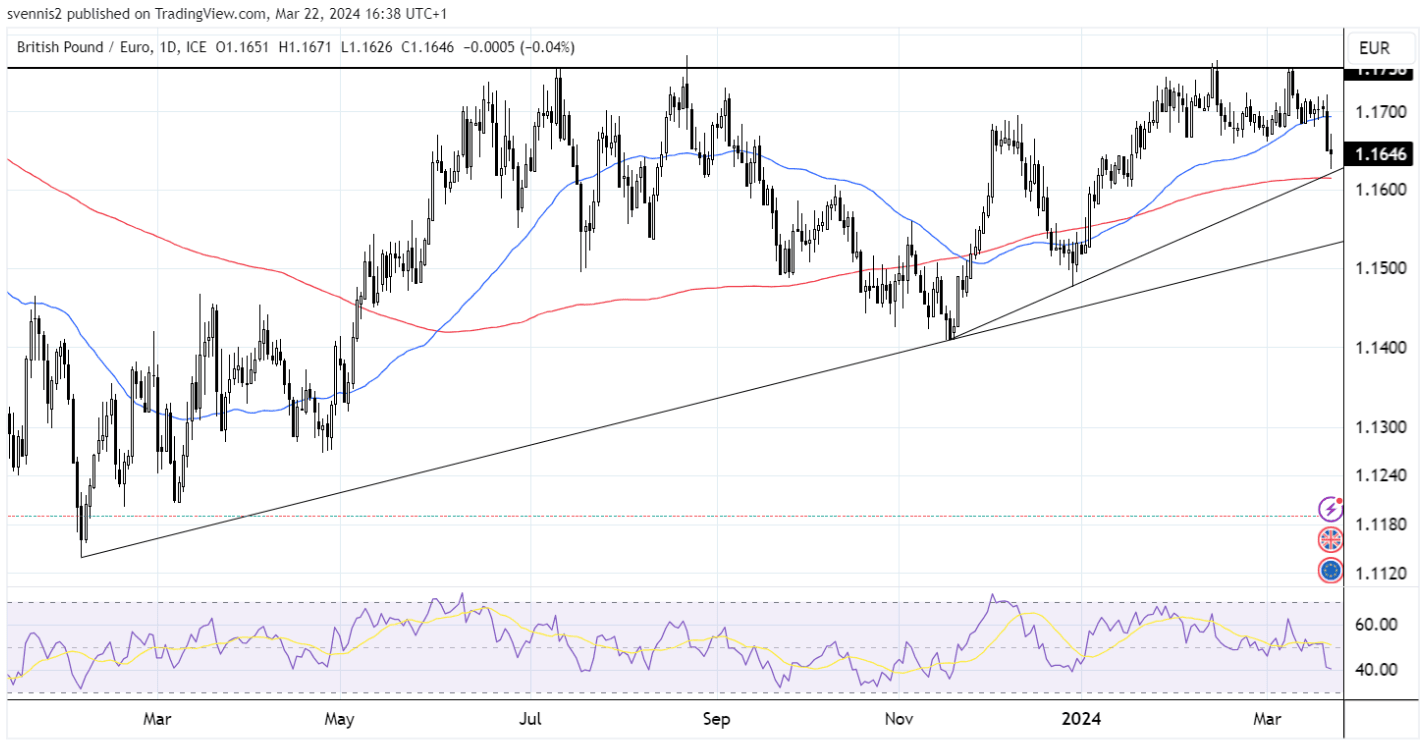

Pound Sterling has endured two successive weeks of decline against the Euro, but the prospect of technical support around current levels and an expected synchronisation in Eurozone and UK rate cutting cycles will limit weakness.

After posting an intermediate low of 1.1507 on December 28, the Pound to Euro exchange rate began the year on the front foot, embarking on a rally that lifted it up to an eighteen-month high of 1.1758.

Since then, it has been caught in a range, with seemingly solid support at 1.1668. Prior to last week's slide, it hadn’t closed below its 50-day moving average since January 2.

Thursday saw the exchange rate make a decisive close below the 50-day moving average, signalling a period of resilience had come to an end and that lower levels than we have been used to of late are in prospect.

"The relatively dovish noises that emerged from the latest meeting of the Bank of England’s Monetary Policy Committee prompted a 0.46% drop relative to the single currency – its largest one-day decline in three months – and that took it through the bottom of its range and to a nine-week low," says Bill McNamara, head of analysis at The Technical Trader.

The market raised the odds of a June rate cut last Thursday after two members of the MPC dropped their votes for a hike while the Bank said in guidance that modest rate cuts would not risk boosting inflation.

Note that if the Bank were to cut in June, it would do so alongside the European Central Bank, which suggests limited divergence potential in terms of interest rate policy.

This should contain the Pound's losses, and a return into the January-March range is possible over the coming days and weeks.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Given that it already looks short-term oversold – the 40.4% reading on its 14-day RSI is a new low for the year - the scope for further weakness might be limited at this point, and support is possible at 1.161 or so, which is where its 200-day MA now stands," says McNamara.

He adds that should this give way, the next level would be at 1.159 or so.

Looking at this week's schedule, a speech by Catherine Mann on Monday will be interesting, given she was one of those Monetary Policy Members who voted for the Bank of England to maintain rates at 5.25%, having voted for a hike in February.

The market considered her vote switch and that of Jonothan Haskel a clear signal the Bank is closing in on a rate cut. Her justifications should shed some light on how fast and far the upcoming cycle will proceed, which could have a bearing on FX.

Track GBP/EUR with your own custom rate alerts. Set Up Here

In the Eurozone, Spain will release inflation figures on Wednesday.

Spanish inflation tends to lead that of the Eurozone due to fast pass-through effects and could offer a clue as to whether the disinflation trend across the broader Eurozone is still intact.

"We continue to think that the GBP would do relatively better vs the EUR that could remain vulnerable to any potential downside inflation surprises in coming days," says Valentin Marinov, Head of FX Research at Crédit Agricole.

The Eurozone-wide inflation figures would also be released this week were it not for the Easter holidays and they will be released early the following week.

"The inflation data in particular will be closely scrutinised by FX investors as it could be instrumental for the outcome of the 11 April ECB policy meeting. In that, any downside surprises could corroborate the market expectation that the Governing Council would start preparing the ground for a potential rate cut as soon as the June policy meeting. In turn, the build-up of market ECB rate cut expectations could intensify and once again worsen the EUR’s rate disadvantage," says Marinov.