Pound Sterling Hits Four-month High Against Euro on PMI Beat

- Written by: Gary Howes

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

The British Pound was higher against the Euro, Dollar and other major currencies after it was reported the UK economy was firmly in growth territory in January.

The S&P Global PMI survey reported the economy's dominant services sector expanded with a reading of 53.8, up from December's 53.4 and ahead of expectations for 53.2.

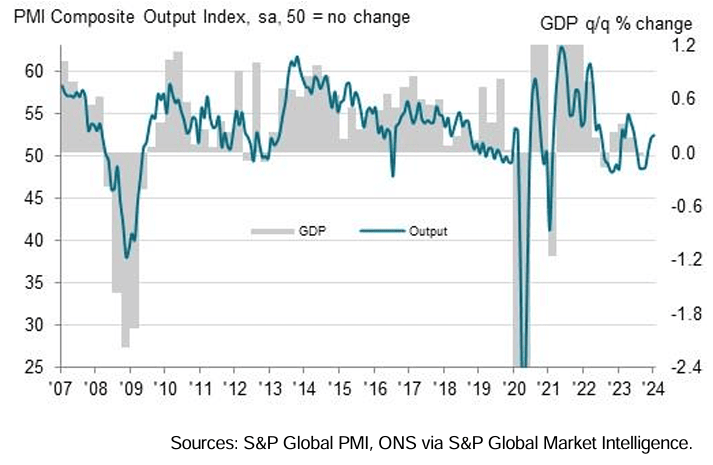

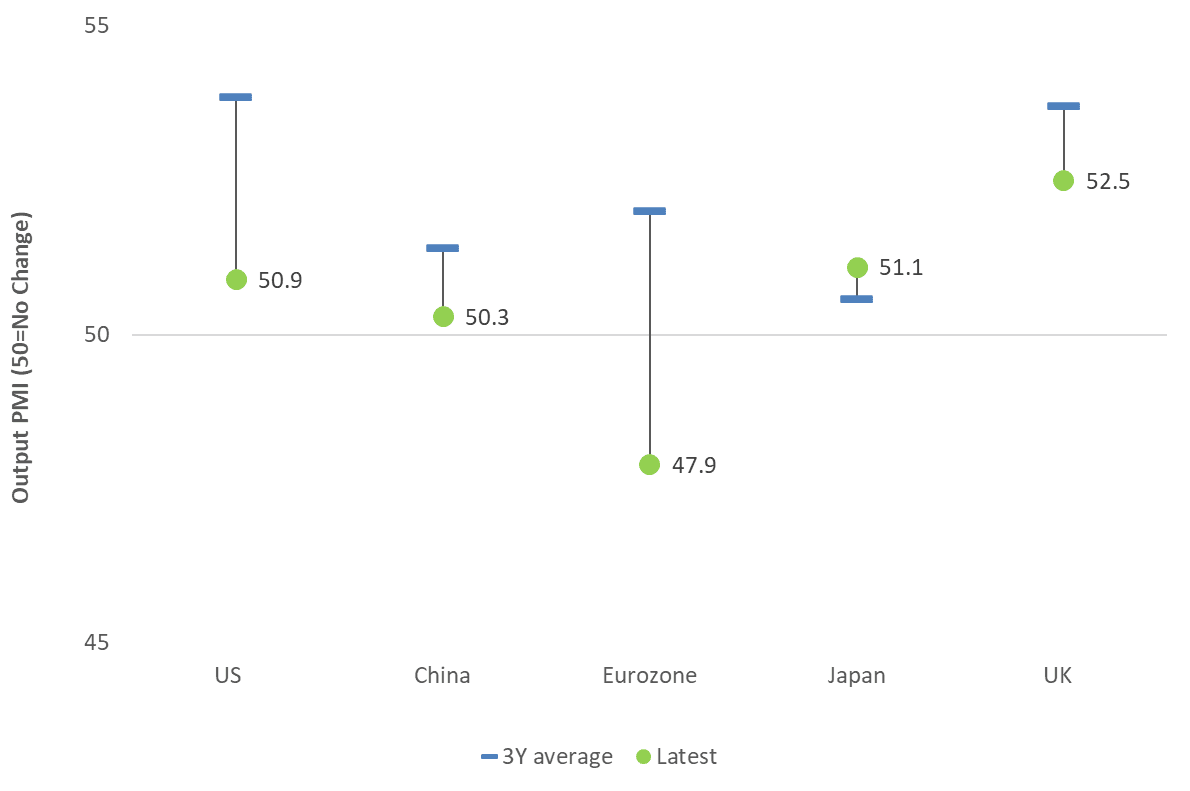

The manufacturing PMI printed at 47.3, which is still consistent with shrinkage, but was above December's 46.2 and the consensus expectation for 46.7. The composite PMI, which balances the findings to give a more representative view of the broader economy, read at 52.5, which was up on December's 52.1 and above the consensus of 52.2.

A clean sweep of consensus-busting numbers helped the Pound to Euro exchange rate to its highest level in four months at 1.1715. The exchange rate was aided by the Eurozone PMI readings which undershot expectations and printed at levels consistent with economic contraction.

The Pound to Dollar exchange rate was quoted half a per cent higher at 1.2755.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"January’s S&P Global/CIPS PMI suggests that the economy is quickly escaping the mild recession that it went into in the second half of last year," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The findings suggest the UK economy is firmly in expansionary territory, lessening the need for the Bank of England to provide support via interest rate cuts.

"The PMI data remain consistent with the MPC being able to cut interest rates this year, but at a more gradual pace than investors currently expect. We still look for a 75bp reduction in Bank Rate this year, slightly less than the 100bp implied by OIS rates," says Tombs.

The prospect of UK rate staying higher for longer supports UK yields while underpinning demand for the Pound.

"We still hold to a mild upward trajectory for GBP as BoE is likely to keep rates restrictive for a little longer," says Christopher Wong, an analyst at OCBC Bank.

S&P Global reports the rise in service sector activity was the fastest since last May, although manufacturing production decreased to the greatest extent for three months.

The survey also provides early evidence that it would be rash for the Bank of England to signal a turn in policy as there were widespread reports of higher freight costs in the wake of the Red Sea disruptions. Worryingly, the survey also tells of private sector firms recording the steepest rise in input costs since August 2023.

Above: "7-month high in UK composite PMI for January keeps the UK at the top of this league table at the start of 2024. The spread between weak manufacturing & strong services activity is something of a chasm but also a global trend" - Simon French, Panmure Gordon.

Also likely keeping domestic inflationary pressures robust are firms reporting improving demand conditions and higher levels of optimism towards the business outlook.

Resilient demand will underpin employment, wages and inflation.

"A number of firms suggested that improving optimism with regards to the UK economic outlook had helped to support business and consumer spending, despite constraints on budgets from elevated inflationary pressures," says S&P Global.

January data also signalled a modest rise in private sector employment, which ended a four-month period of job shedding. Higher staffing levels reflected a rebound in service sector recruitment which survey respondents linked to new project starts and anticipated demand growth.

UK businesses were more upbeat about the growth outlook for the next 12 months with the degree of confidence highest since May 2023.

"The ongoing rebound in real household disposable income, supported by declining CPI inflation and tax cuts, also is helping demand to recover. As a result, we continue to think that GDP will rise by around 0.3% quarter-on-quarter in Q1," says Tombs.