Truss Crisis Levels Await GBP/EUR Rate in 2024, Says Deutsche Bank

- Written by: Gary Howes

Image © Gov.uk. Picture by Simon Dawson / No 10 Downing Street.

The British Pound will fall to levels last seen against the Euro during the crisis sparked by former Prime Minister Liz Truss when she introduced her controversial budget in September 2022.

This is according to analysis from Deutsche Bank, where a slowing UK economy is expected to prompt the Bank of England into a May interest rate cut, resulting in a decline in Pound Sterling's value.

Deutsche Bank analyst George Saravelos explains, "the timing and speed of the adjustment from hiking to cutting for individual central banks will be a dominant influence for each currency in 2024."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

On this count, the Pound will be penalised by the Bank of England, which Deutsche Bank expects to cut Bank Rate in May, ahead of the U.S. Federal Reserve and European Central Bank, both of which are seen cutting in mid-year.

"Past monetary policy tightening is clearly starting to feed through the economy," says Saravelos. "House prices have started their correction, but likely have further to fall. This sharp slowing in housing activity is also yet to feed through to the labour market, which in any case is finally showing signs of cooling fairly quickly."

Deutsche Bank's base case is that the Bank of England will start cutting rates in May next year. It looks for both the Federal Reserve and ECB easing cycles to start mid-year.

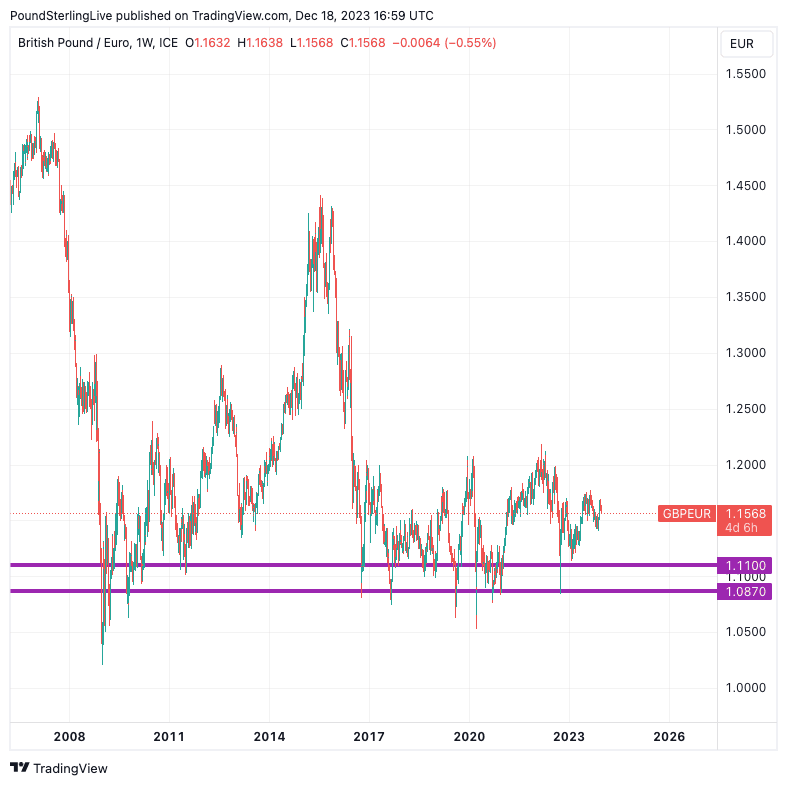

Above: It is back to levels associated with recent crises for Pound-Euro says Deutsche Bank. (Purple lines show forecast levels at mid-year and year-end).

In addition, analysts say the UK’s external accounts remain in a poor place, with the broad basic balance turning negative again.

"For EURGBP meanwhile, we think a move north of 0.90 (which we assess to be fair value across DBeer and PPP models) is likely, and fair value in the cross will continue to drift higher as long as UK inflation remains stickier," says Saravelos.

The Euro to Pound exchange rate is forecast to rise to 0.90 by mid-year 2024, ahead of 0.92 by year-end.

This gives a Pound to Euro exchange rate of 1.11 and 1.0870.

Track GBPEUR with your own custom rate alerts. Set Up Here.

The exchange rate was last this low when former Prime Minister Liz Truss announced an unfunded budget that caused financial markets to panic.

In fact, forays below 1.10 have only ever been associated with crises, including the coronavirus outbreak of 2020, post-2016 Brexit negotiation anxieties and the 2008 financial crisis.

So, it is crisis-era levels for a currency that is not expected to experience a crisis.

Yet, Deutsche Bank expects politics to be a benign factor over the coming months.

"We don’t see the next general election – due by January 2025 - as a major risk event for the pound. Current polls suggest the Labour party will win a majority, but for now there aren’t many large differences between the fiscal and Brexit stances across the major parties," says Saravelos.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes