GBP/EUR Week Ahead Forecast: Heavy Resistance, Bank of England and Eurozone Inflation Dominate

- Written by: Gary Howes

- GBPEUR retains bearish setup near-term

- But also well supported in the low 1.14s

- Eurozone inflation is highlight of 1st half of week

- Bank of England interest rate decision is main event

Image © Adobe Images

Pound Sterling looks set to remain under pressure against the Euro over the coming days and will require a sharp downturn in Eurozone inflation to be reported Tuesday and/or an unexpectedly 'hawkish' Bank of England guidance on Thursday.

The Pound to Euro exchange rate has been under pressure since late August when investors started cutting their expectations for the scale of interest rate hike to come from the Bank of England and there is little to suggest a material turn higher is close at hand.

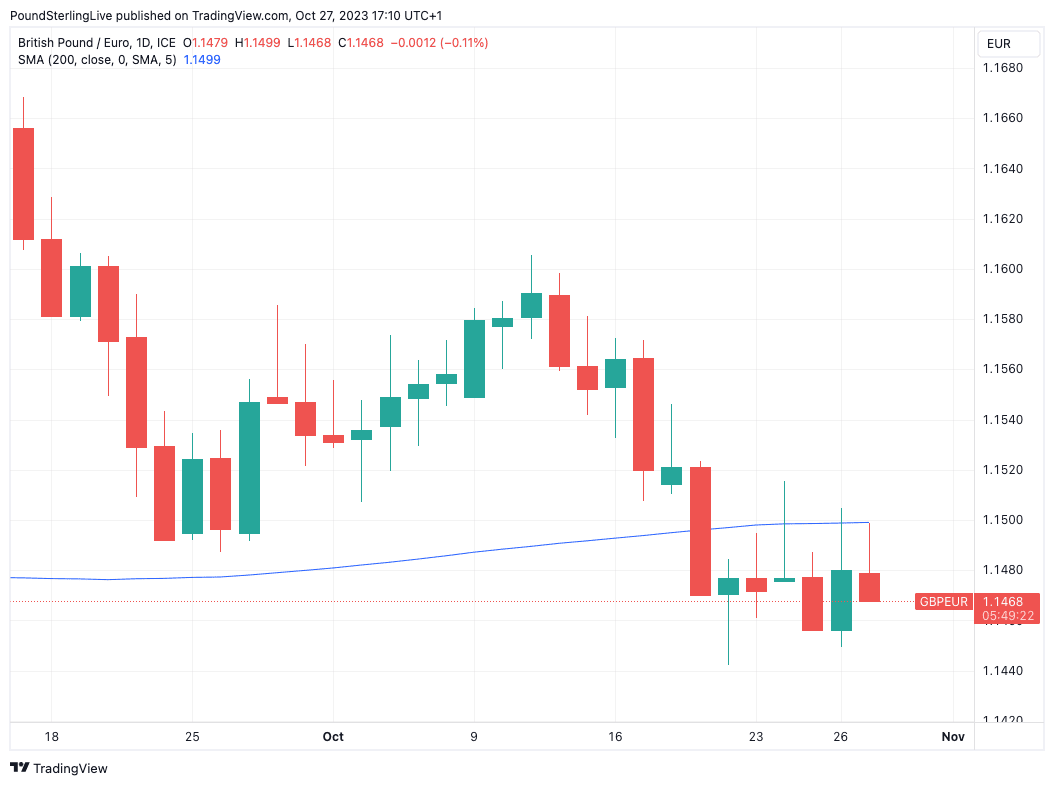

Any GBPEUR appears to run into significant selling interest whenever it attempts to breach the 200-day moving average, as shown in the below:

Above: GBPEUR at daily intervals showing the 200-day MA, which is acting as a source of resistance. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Strength is likely to be short-lived, based on the above technical setup, but should the pair break above the 200 DMA, then perhaps the outlook is brightening, at least from a technical perspective.

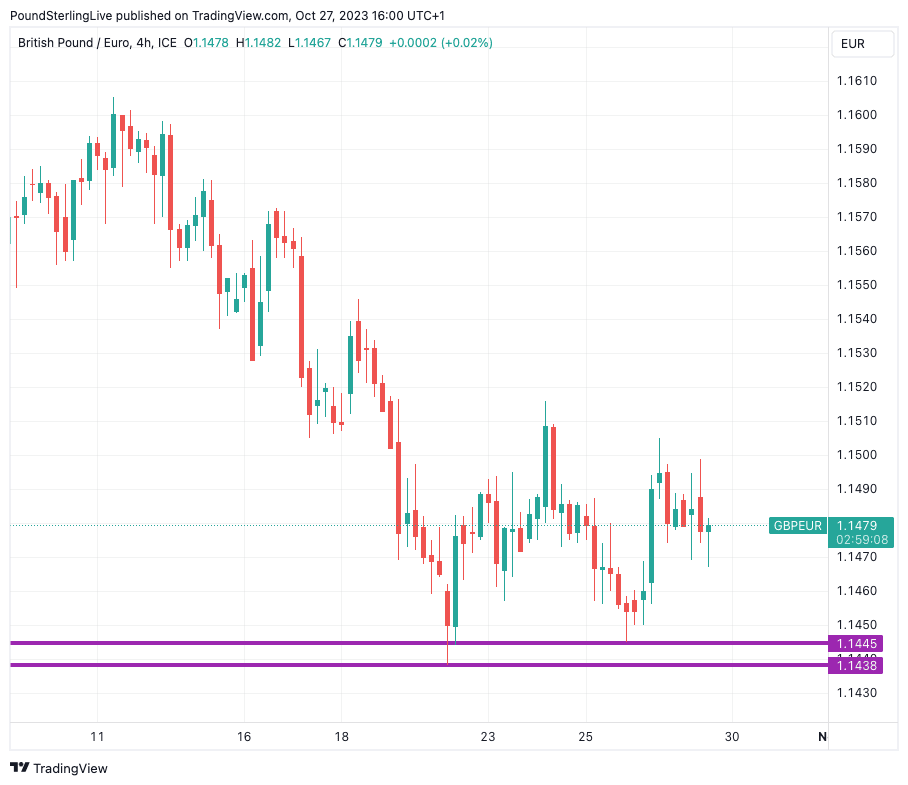

Despite an inability to rally, GBPEUR is also looking relatively well supported on forays below 1.1450, which suggests weakness is also likely to be limited.

The near-term setup is, therefore, one that suggests a tight range will be respected.

Above: GBPEUR at four-hour intervals showing a potential area of support.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

It falls to incoming data and guidance from the Bank of England to break the deadlock in GBPEUR and push it decisively lower to fresh multi-month lows or prompt a rebound higher into the well defined range the pair has respected through the summer months.

The Bank of England forms the highlight of the coming week for the British Pound and the risks associated with the event will likely cap any strength in the currency.

Investors could opt to lower exposure to the Pound in the lead-up to Thursday's decision which is likely to see interest rates left unchanged at 5.25%.

On balance, the Bank of England's policy decisions have tended to undermine the Pound in the current hiking cycle, as policymakers have tended to err on the cautious side.

This cautious reaction function could result in the Bank inadvertently giving a green light to market participants to bring forward rate cut expectations, which can weigh on the Pound.

The Bank will be keen to stress interest rates must stay at current levels for an extended period, particularly given wage rises are elevated and could contribute to inflation remaining above target for a long period.

"With the GBP already weighed down by weak data, the currency could benefit from confirmation of the BoE's 'higher for longer' outlook," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

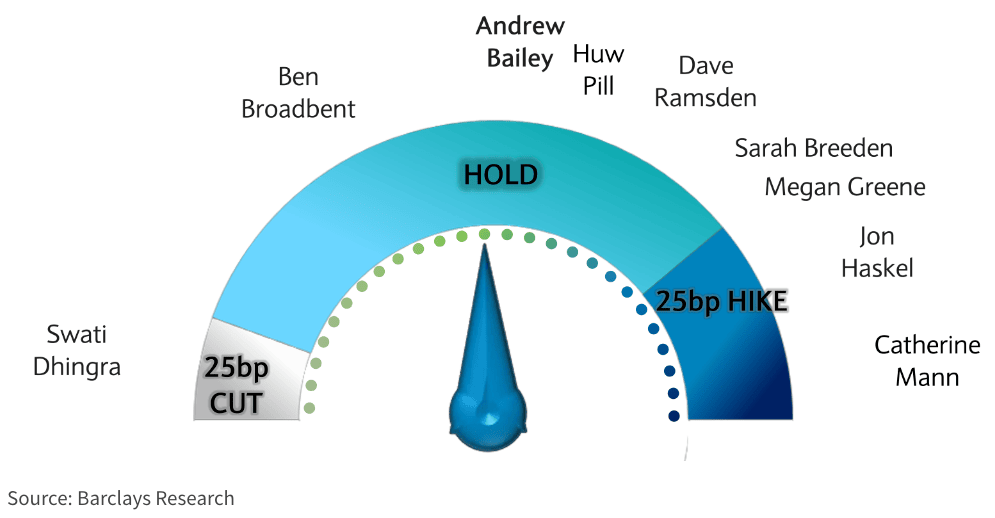

But the 'higher for longer' message could be undermined by how the Monetary Policy Committee (MPC) votes.

In particular, we are wary that Swati Dhingra, the most 'dovish' member of the MPC, will vote for a rate cut.

Economists at Barclays expect Dhingra to vote for a cut on Thursday, saying in a research note: "We expect the MPC to hold Bank Rate at 5.25% at the 2 November meeting, with a base case of a split vote of 1-6-2, reflecting the finely balanced nature of the decision and plausible arguments on both sides (Dhingra to vote for cut and Mann and Haskel to vote for hike)."

Should Dhingra vote for a cut, the MPC will be signalling rate cuts are actively being discussed, making the Bank of England the first to communicate that an easing of policy is now on the horizon.

Therefore, this single vote and its necessary acknowledgement in the accompanying minutes, risks undermining any unity on a 'higher for longer' message the Bank is trying to convey.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Money markets will likely bring forward expectations for rate cuts in 2024, pressuring UK bond yields relative to those of the Eurozone and U.S.

The mechanical transfer of these expectations to foreign exchange markets would imply a weaker Pound.

However, any downside risks from the vote composition could be countered by an uplift in the Bank's economic forecasts.

"Updated economic projections should provide some food for thought," says Nikesh Sawjani, Senior UK Economist at Lloyds Bank. "The BoE’s forecasts will be conditioned on a market-implied path for Bank Rate that will be around 75bp below where it was for the August."

Expectations for lower rates in the future "imply a less tight policy stance and lift the Bank of England’s projected level of GDP and CPI projections across the forecast horizon," says Sawjani.

Lifting inflation and growth projections could limit the 'dovish' tendencies of the MPC and afford the Pound some downside protection.

Euro Week Ahead: Inflation Data Dominates

The highlight for the Euro in the coming week is the release of Eurozone inflation figures for October, which could help the market firm expectations for the increasingly important December 14 European Central Bank (ECB) interest rate decision.

Ahead of the all-Eurozone numbers on Tuesday come the regional releases, with Germany's North Rhine Westphalia releasing its number at 07:30 GMT on Monday.

Often this can elicit a reaction as it gives a sense of where Germany's nation figure - due at 14:00 GMT - will land.

Watch Spanish CPI inflation due at 09:00 as this is oftentimes considered a leading indicator for Eurozone inflation in the next one to two months owing to Spain's rapid price passthrough rate. Markets will be looking for a further decline from September's 3.5%.

Tuesday's Eurozone PMI is expected at 11:00 GMT on Tuesday, with the headline rate seen at 3.4% year-on-year, down from 4.3% previously. The all-important core CPI is expected to come in at 4.2%, down from 4.5%.

The rule of thumb is that a strong set of inflation figures raises the odds of the ECB striking a 'hawkish' tone in December, which is supportive of the Euro.

But faster-than-expected declines could well see the ECB highlight relief that prices are comfortably on course to fall back to target.

This would raise the odds of a rate cut in H1 2024, in turn potentially weighing on the Euro.

Also due for release alongside the inflation figures on Tuesday are preliminary Eurozone GDP numbers for the third quarter, where markets look for a 0.2% increase year-on-year in the second quarter.

The quarter-on-quarter figure is expected at -0.1%, and the Euro would likely find some support on any reading that comes in higher.

Expect softness if the data disappoints, as this would only further bolster the case for a 'dovish' December ECB.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes