Pound-Euro Struggles after Retail Sales Disappoint and Eurozone PMIs Surge

- Written by: Gary Howes

- UK retail sales disappoint

- On the same day Eurozone PMI data impresses

- GBP/EUR edging back towards 1.13

Image © Adobe Images

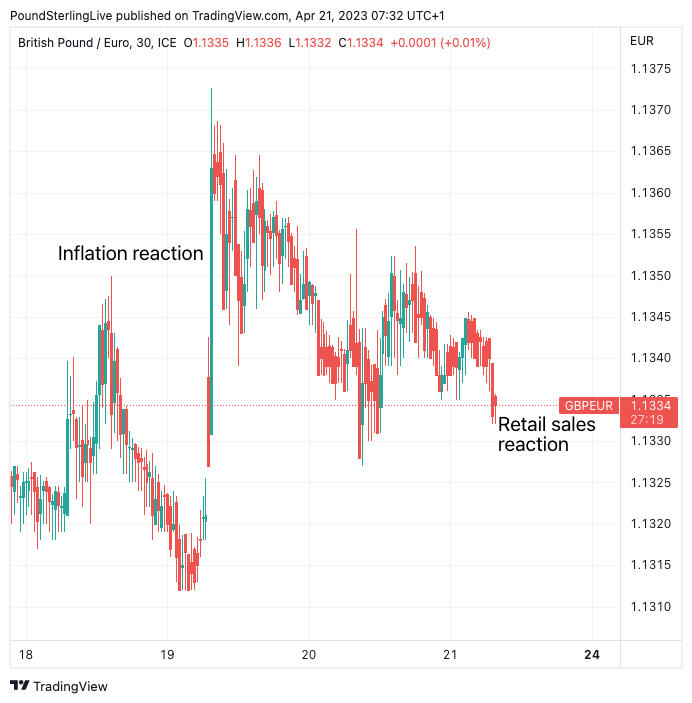

The Pound to Euro exchange rate could struggle to hold a small weekly advance after UK retail sales figures disappointed at the same time Eurozone PMI figures revealed the bloc's economy grew impressively in April.

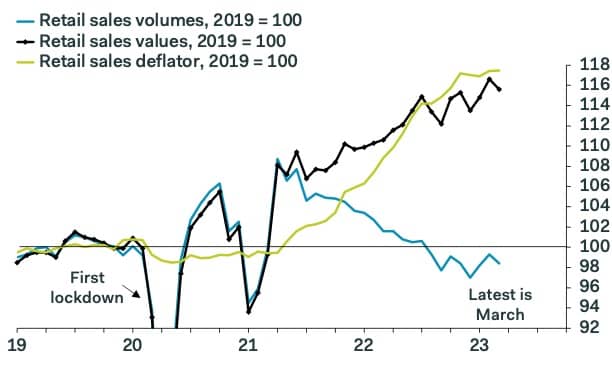

Sales in the UK fell 0.9% month-on-month in March after they rose 1.1% in February says the ONS, disappointing against analyst expectations for a reading of -0.5%.

The year-on-year change stood at -3.1%, in line with expectations, and is an improvement on February's -3.3%.

It appears food store sales were a key drag on the headline numbers as volumes fell by 0.7% in March 2023, following a rise of 0.6% in February 2023.

"Inflation continued to eat into the UK’s consumer spending, notably even volumes at food stores went down. The consumer is likely worried too that when the full impact of rate hikes is felt later this year, there could be an increase in unemployment," says Emma Mogford, fund manager at Premier Miton Investors.

Above: Retail sales volumes struggle amidst higher prices. Image courtesy of Pantheon Macroeconomics.

"The renewed decline in retail sales in March proves the recovery in January and February was a false dawn and suggests that consumers still are grappling with very high CPI inflation and mortgage rates," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics.

The soft retail sales data is however unlikely to dissuade the Bank of England from raising interest rates again in May as it follows wage and inflation figures that beat estimates. Therefore the impact on the Pound is unlikely to be a significant one as this could be considered a lower-tier event.

"The recent activity data is of little consequence for the Bank of England which remains squarely focused on inflation. And after this week’s hotter-than-expected wage and CPI data, it looks like the Bank is heading for one more 25 basis-point rate hike next month," says James Smith, Developed Markets Economist at ING.

The Pound to Euro rate is holding a 0.40% advance for this week as it trades near 1.1340 in the wake of the release. However, whether this advance builds or evaporates will ultimately rest on the outcome of the PMI survey release due at 09:30 on Friday.

Above: GBP/EUR at 30-minute intervals.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But ING's Smith says the worst is now behind the UK high street.

"Pressure on real wages is set to ease over coming months and consumer confidence has risen from its lows. That suggests the worst is behind us for the UK high street, despite a fall in March sales," he says.

ING says real wage growth is currently around -4% on a year-on-year basis, but this measure of real wages is set to turn slightly positive by year-end.

Eurozone PMIs Impress

The message from the April PMIs is clear: the Eurozone economy is rallying back in a strong fashion thanks to a rebound in the bloc's services sector.

The Euro rose against all peers after the headline Eurozone composite PMI read at 54.4 in April, breezing past expectations for 53.7 and representing an improvement on the previous month's reading of 53.7.

According to S&P Global, compilers of the PMI series, Eurozone business activity growth accelerated to an 11-month high in April.

The services PMI registered a blow-out 56.6, exceeding estimates for 54.5 and accelerating on March's 55.

This leaves little doubt that the European Central Bank will hike interest rates in May and potentially again at subsequent meetings.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

Calling Time on the Pound's Rally

The Pound is one of 2023's top-performing currencies as it has benefited from a run of better-than-expected data outturns that point to the economy being in a position to avoid recession.

Sentiment heading into 2023 was resolutely downbeat as major institutions such as the Bank of England, OBR and IMF pencilled in a multi-quarter recession extending from end-2022 to end-2023.

However, the retail sales disappointment will serve as a reminder that the economy faces significant headwinds and the kind of upside surprises required to drive further Pound outperformance might no longer be forthcoming.

If so, the Pound could struggle to extend its winning streak.

"This may be as good as it gets," says Kamal Sharma, FX Strategist at Bank of America. "The best of UK data surprises may be behind us and there is little encouragement that international investors are returning to UK asset markets - a necessary condition for medium-term optimism."

The Bank of America analyst says May and June have historically been weak months for the Pound which has fallen in every Q2 since 2016.

"This feeds into the narrative that strong April seasonality will eventually give way to fading the GBP rally," says Sharma.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes