GBP/EUR Week Ahead Forecast: Big Data Releases and Autumn Statement Beckon

- Written by: Gary Howes

- GBP/EUR struggling to hold gains

- Suggesting downside potential for coming days

- Tuesday sees UK jobs data

- Wednesday sees inflation data

- And Thursday sees the Autumn Statement

Above: Chancellor Jeremy Hunt. Image: Gov.uk.

Pound Sterling will take direction this week from several key domestic data releases as well as Thursday's Autumn Statement, where the government will spell out just how severe the spending cuts and tax hikes planned for coming years will be.

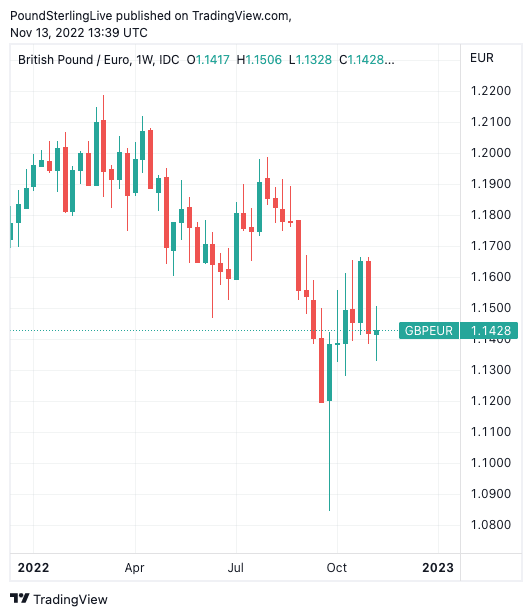

The Pound to Euro exchange rate (GBP/EUR) enters these busy few days having recently lost the clear upside momentum that characterised October, and the longer-term downtrend that has been in place since March therefore still looks to be intact.

While GBP/EUR last week took advantage of a remarkable market rally following the release of U.S. inflation data, it was unable to make these gains stick.

This could indicate that, although global market conditions are important for this pair, and have been favourable over recent days, domestic considerations are still holding it back.

Above: GBP/EUR at weekly intervals, showing the generalised trend of weakness that has characterised 2022. To better time your payment requirements, consider setting a free FX rate alert here.

Investors are particularly concerned about the UK's economic outlook while at the same time they judge the outlook for the Eurozone as improving amidst falling gas prices.

On Monday it was reported Eurozone industrial production rose 0.9% in September and 4.9% year-on-year. The figures are much better than the expected +0.1% m/m and 2.8% y/y, pushing out further the prospect of a recession.

"In absolute terms, the Eurozone recession may not be as deep as feared a few months ago, despite high energy costs and a sharp rise in the ECB rate," says Alex Kuptsikevich, FxPro's senior market analyst.

"We note that commodity prices have fallen significantly in recent months. A relatively strong economy by the start of the extreme hike cycle forms more room for an ECB rate hike, which is suitable for the euro," he adds.

This economic divergence theme - that favours the Euro - could persist over the coming days if key UK data releases disappoint and the government imposes a round of stinging fiscal austerity in order to try and convince investors the UK's books will remain balanced.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Tuesday sees the release of wage and employment data, with the market consensus looking for the Average Earnings Index, with bonuses included, to rise 6.0% in September.

The unemployment rate is expected to remain unchanged at 3.5% but job losses of 155K are expected to be reported for the three months to September.

Should the data disappoint, then the Pound would be expected to fall. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

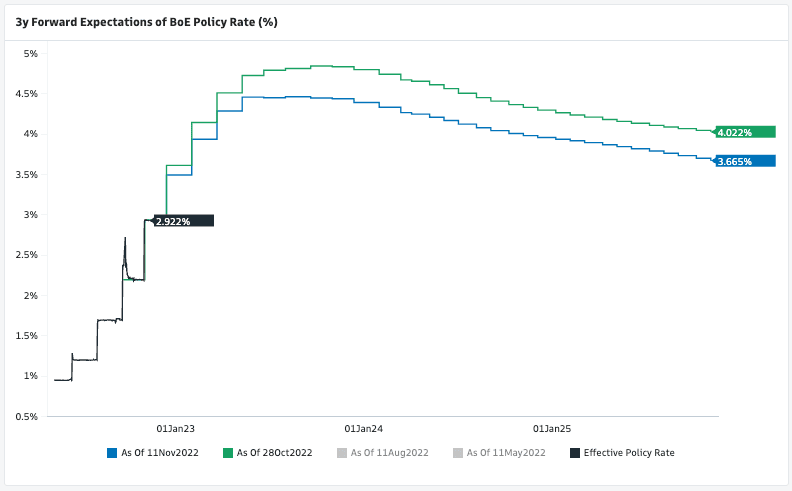

Wednesday's CPI inflation is however expected to be of greater importance for the Pound, given it has a direct bearing on the future of Bank of England interest rate decision-making.

Headline CPI inflation is forecast to report at 10.6% year-on-year for October, up on September's 10.1%.

The core CPI reading is seen at 6.4%, well ahead of the Bank of England's 2.0% target and consistent with further interest rate rises.

The reaction of the Pound to this data is hard to predict: does it rally on a weaker inflation print, as this suggests the economic pain wrought by inflation will be less severe?

Or does it fall as a weaker inflation print implies that the Bank of England can end its rate hiking cycle soon?

Above: Market implied expectations for the number of BoE rate hikes continue to fall from the post-mini budget highs.

The uncertainty comes as the Pound's relationship to interest rate expectations has shifted through 2022, courtesy of the ructions that followed the ill-fated budget of Liz Truss and Kwasi Kwarteng.

At the time, rising Bank of England rate hike expectations was consistent with a weaker Pound, whereas the longer-term rule is that higher rate expectations support a currency.

This breakdown in the relationship between the Pound and rates reflected the risks investors saw in the UK outlook owing to Truss' unfunded tax cuts.

This week's reaction to the inflation data will therefore be important as it should signal what matters for the Pound again, and whether or not the Truss-Kwarteng risk premium has disappeared.

The big event for the Pound comes on Thursday when Chancellor Jeremy Hunt lays out his tax and spending plans for the coming months and years as he endeavours to regain the market's confidence and convince investors the UK's debt position remains sustainable.

Media reports suggest he is seeking to fill a 'black hole' of around £55BN and will do so by cutting spending and raising taxes.

However, the cost of Hunt's plans will be lower economic growth, which is a natural headwind to Pound Sterling's appreciation potential.

"Attention turns to the UK with the budget announcement on 17th November. We continue to expect GBP under-performance against most of the non-USD G10 currencies going forward," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

"Tightening fiscal policy into a recession to weigh on GBP," he adds.

Some of the potential fiscal changes to look out for on Thursday include:

- Changes to capital gains tax

- Changes to the dividend allowance

- Changes to the top rate of income tax and lowering the top rate of tax threshold

- Freezing income tax thresholds

- Freezing inheritance tax thresholds

- Scrapping social care cap

- Freezing the lifetime allowance

- Scrapping the pensions triple lock

- Changing pensions tax relief

- Changing the rules around the Money Purchase Annual Allowance (MPAA)

Oxford Economics, the research provider and consultancy, says next week's Autumn Statement could signal a dramatic swing in UK fiscal policy from too loose to too tight.

"In our view, shifting to overly tight policy would deepen the recession that the UK is likely to endure in 2023," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

The call comes on the day the ONS reported the UK economy shrunk 0.6% in September.

The data confirm a potentially protracted slowdown is now underway; the Bank of England warned in October this decline could last for up to eight quarters.

Most economists we follow are also forecasting a UK recession in 2023.

"A consolidation of £55BN, or 1.8% of 2027-2028 GDP, is large in the context of an economy with low trend growth of less than 1.5% a year," says Goodwin.

"The current global environment may make executing a successful fiscal adjustment even harder," he adds.

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, says the policies due to be announced by Hunt could help restore the fiscal credibility of the government, safeguard financial stability in the

UK and boost the Pound's long-term investment appeal.

"In the near term, however, the prospect for a sharp economic downturn could mean that the BoE would disappoint the still relatively hawkish market rate hike expectations. We therefore maintain a cautious outlook on the GBP," says Marinov.

The outlook for GBP/EUR remains soft and strength is likely to be sold into.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes