Pound Sterling Dumped in Wake of Bank of England Rate Hike

- Written by: Gary Howes

- BoE hikes

- GBP falls sharply

- As investors bet fewer rate hikes lie ahead

- BoE to rely on 'demand destruction' to control inflation

Image © Adobe Stock

The British Pound fell sharply in reaction to a Bank of England decision to raise interest rates at a third consecutive policy meeting.

The Monetary Policy Committee (MPC) voted by 8-1 to hike rates by 25 basis points, with one member (Jon Cunliffe) opting for no hike.

The Pound dropped sharply in the wake of the news, almost certainly a mechanical response to the revelation only one member voted for 50 basis points of hikes.

An initial assessment would be that the MPC has reversed some of the hawkishness it displayed at the February meeting when it was a mere vote away from delivering a 50 basis point hike.

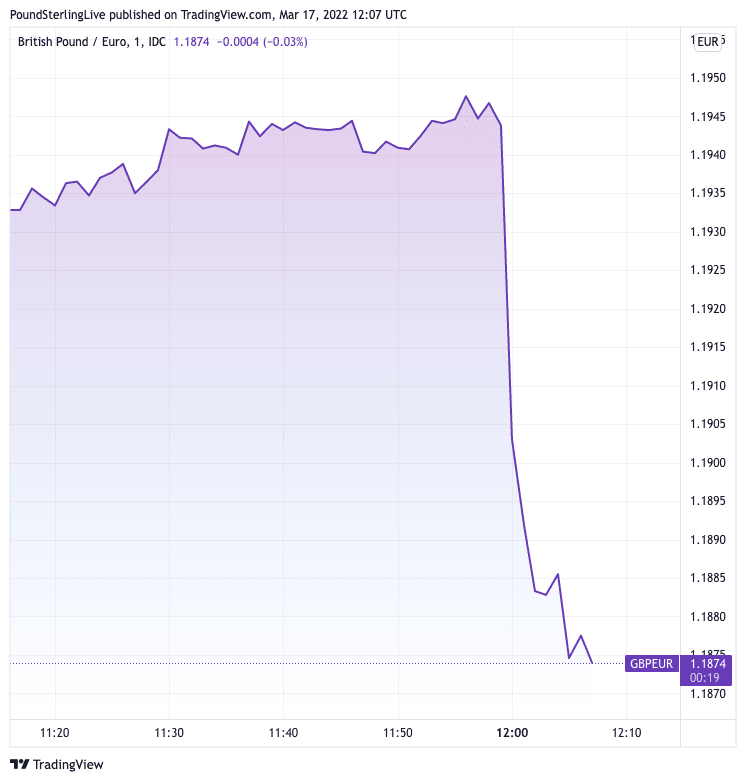

The British Pound rose steadily into the rate hike, hinting at a 'hit and run' job by speculators and algorithms.

It is typical to see elevated volatility heading into, and following, such decisions and we will only be able to draw strong conclusions when we see the day's closing levels.

The Pound to Euro exchange rate was at 1.1950 in the minutes ahead of the news, but immediately fell below 1.19 and is at 1.1878 at the time of writing.

The Pound to Dollar exchange rate was as high as 1.3210 ahead of the decision but was back at 1.3188 in the immediate wake.

- Reference rates at article's last update:

GBP/EUR: 1.1828 \ GBP/USD: 1.3162 - High street bank rates (indicative): 1.1500 \ 1.2790

- Payment specialist rates (indicative): 1.1745 \ 1.3090

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

The Bank said it was now concerned that the war in Ukraine would slow UK economic growth and push inflation even higher than their previous assumptions.

"Developments since the February Report are likely to accentuate both the peak in inflation and the adverse impact on activity by intensifying the squeeze on household incomes," read a statement.

Inflation is expected to increase further in coming months, to around 8% in the second quarter, "and perhaps even higher later this year" said the Bank.

"Even as the BoE continues on a hiking path, we see more downside risks for GBP on the back of the ongoing geopolitical conflict, multi-decades high inflation, and a continued surge in oil prices fuelling stagflationary fears. The risk/reward is admittedly less attractive at these levels after the recent move lower, but we are not ready to call time yet," says Matthew Hornbach, Global Head of Macro Strategy at Morgan Stanley.

But the Bank acknowledged the UK economy remains in a solid position heading into its next shock, with the labour market proving tight amidst continuing signs of robust domestic cost and price pressures. Economists at the Bank now expected GDP to increase by around 0.75% in the first quarter of 2022, stronger than the February Report projection for a flat quarterly outturn.

The MPC said some further modest tightening in monetary policy may be appropriate in the coming months, consistent with the view further hikes are coming.

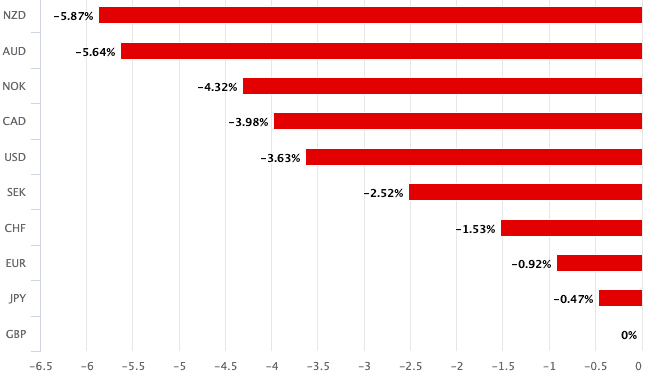

Above: GBP has lost ground to all major currencies over the course of the past month.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

But it appears that the Bank now expects inflation to suppress consumer demand in the future to such a degree that it will slow the economy, which will in turn suppress inflation further out.

"Inflation was expected to fall back materially, and possibly to a greater extent than had been expected in the February Report, as energy prices stopped rising and as the squeeze on real incomes and demand put significant downward pressure on domestically generated inflation," said the Bank.

In short, the Bank is now relying on demand destruction to do its job.

This is in itself a dovish assessment that signals the Bank does not see itself as having the capabilities nor reason to suppress inflation over the medium-term as this will ultimately be a function of energy prices.

In an ironic assessment the Bank now believes inflation will kill itself.

Thus, there is reason to keep interest rate hikes from rising too high in the future.

And what matters for the Pound is how high the terminal rate at the Bank of England will be relative to other central banks.

If the market judges it will be lower than previously assumed then the Pound's upside potential is crimped.

Morgan Stanley economists expect the Bank to deliver just one more hike this year in May, with a possibility of another move in either June or August, before a slowdown in growth pauses the tightening cycle.

As such, "Faced with a negative growth effect from the Russia-Ukraine crisis in 2H22, we think that market pricing for policy tightening from the BoE further out in the year has to come down," says Hornbach.

Morgan Stanley says the slowdown in growth, coupled with a continued rise in inflation expectations, will weigh on UK real yields further and widen the UK-US 10-year real yield differential, which peaked at the end of last year.

"This is a key driver of GBP/USD in our GBP framework, and the fall in real yield differentials is likely to put downward pressure on GBP," says Hornbach.

Morgan Stanley are tactically bearish on Sterling and prefer to express their bearish view against the Norwegian Krone, with a target of 11.30 for GBP/NOK.